Image Credit: Alexandra Maria

Are Consumer Price Increases Negatively Correlated to Stock Market Price Levels?

Does inflation lift stock prices? It has been long thought that stocks are a better hedge against inflation than cash, which loses purchasing power with rising prices, or even bonds, which lose value when inflation leads to higher interest rates. Excessive consumer price increases (defined as over 2% CPI YoY) come from either hypergrowth where demand outstrips supply or reduced supply while demand has changed little. The current inflation spike appears to be a mix of both supply issues from disruptions during the pandemic and demand issues from a dramatic increase in the money supply.

What Does Inflation Do to the Stock Market?

The answer is not straightforward as it depends on all of the contributing factors. If those factors can be easily modified, the markets are likely to react, in advance, to what it will be that changes them. If monetary policy is expected to be tightened, this can slow economic growth and weigh on equity prices as capital will not be as free-flowing. If it is because there is a shortage of supply, the market is likely to react to how quickly the condition will resolve itself. A shortage of supply could come from short-duration events like weather that impacts agriculture, or shipping, which is usually short-lived – also resource shortages result from a supplier not being available. This could be related to embargos, logistics, etc. Price increases from an imposition of tariffs are one-time additions to prices and don’t lead to prolonged inflation.

Stock market participants are forward-looking. On an ongoing basis, they monitor current and expected conditions and react to how they will impact company earnings. The sweet spot is when inflation has no risk of dropping below zero and is stable within a percentage point of 2%.

Sources: NYU.edu (Stocks), BLS.gov (Consumer Prices)

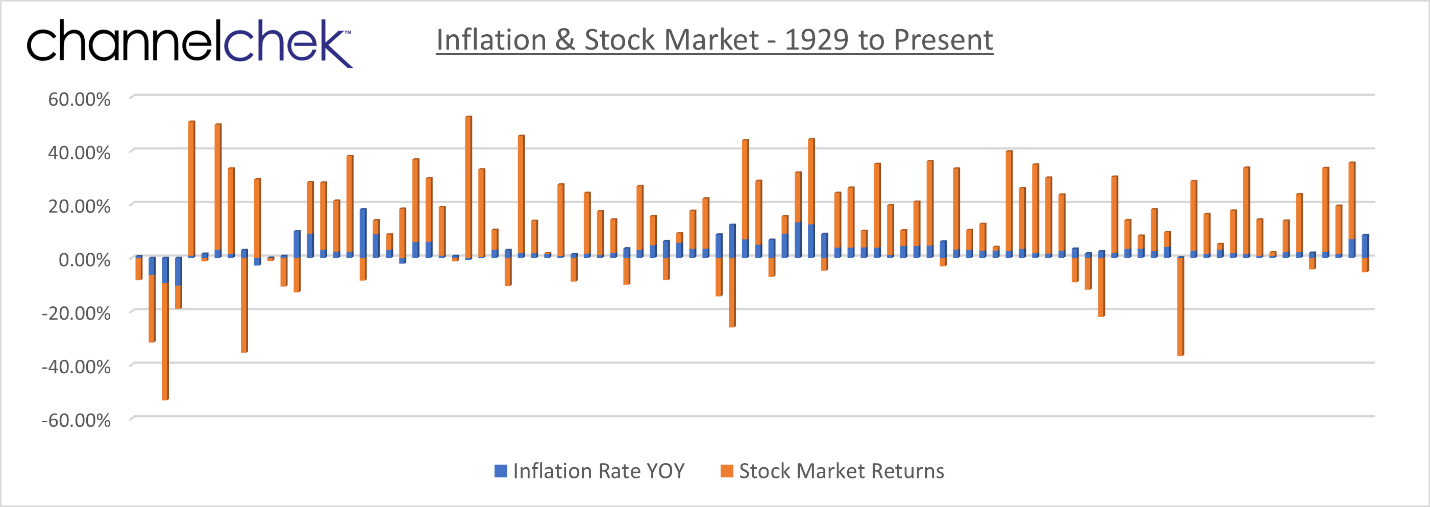

The markets clearly dislike deflation or negative price growth. The chart above demonstrates that each time inflation went negative that same year or the following year, stocks dropped. So deflation has a positive correlation to stock index levels (decreasing inflation = decreasing stocks). From the chart, we also see when inflation approached or breached 10%, the markets also gave up ground that year or the following year.

A healthy market comes from a healthy economy; a healthy economy is one where supply is meeting demand. This makes growth more predictable, and the markets enjoy predictability. A lack of being able to assess what the future is likely to bring issues in periods of volatility where bulls and bears are most at odds. The 40-plus year high in CPI has ushered-in the kind of whipsaw volatility that can hurt active investors and traders.

Some investors may seek stock ownership as a hedge against inflation. Companies that own assets that are rising in value help offset the erosion of the native currency. Alternatively, some investors may also find that fixed return investments like those that pay a known interest rate compete much better than the uncertain returns in stocks. Dividend stocks like utilities are often held by income investors like retirees. These stocks are particularly vulnerable should lower-risk bonds offer the same or higher yield than the expected dividends.

Take Away

Markets react to future earnings expectations. If the demand for a company’s product is little changed as prices increase, its earnings should stay relatively stable (food, medicine, government contractors, other non-discretionary). If the product or service will see reduced demand as prices increase, the company is likely to see reduced earnings and lower stock valuations.

Markets also react to expectations of future conditions. If it is expected that whatever the cause of inflation is, is transitory, market participants may look past current conditions. If instead, the expectations are that an aggressive and prolonged tightening stance will shrink the entire economy, then the markets are likely to respond negatively.

The high inflation the U.S. has experienced over the past year has resulted from both supply and demand-related factors. The supply issues are out of the Fed’s control, but it is presumed that these are transitory and related to the pandemic and war in Europe. Current price increases are also the result of trillions of dollars pumped into the economy over a short period of time. The Fed does have more control over this. If they act with aggressive monetary policy, the markets may initially pull back, if it appears the Fed is winning the battle, markets may become more bullish.

Managing Editor, Channelchek

Suggested Content

Labor Market Statistics are Pointing to Lower Wage Inflation

|

Republicans Likely to Have the Majority in the House – Investors May Want to Pivot Early

|

Earnings Season Results for Small Caps May Indicate a Rosier Economy

|

There’s Still a Swift Current Helping Some Infrastructure Related Companies

|

Sources

https://pages.stern.nyu.edu/~adamodar/New_Home_Page/datafile/histretSP.html

https://www.usinflationcalculator.com/inflation/historical-inflation-rates/

https://investorplace.com/2022/06/what-does-inflation-do-to-the-stock-market/?utm_source=Nasdaq&utm_medium=referral

Stay up to date. Follow us:

|