Image Credit: Marco Verch (Flickr)

Biotech Earnings Reports and M&A Activity Contribute to Sector Strength

Biotech stocks that were on life support during the beginning of 2022 are now revived and not slowing down. Since mid-June, when many sectors turned around, the beaten-up biotechs became impressive outperformers. And, for good reasons. While they may have overshot on the high side during the pandemic, the post-pandemic selling may have also gone too far, currently, they are priced at levels that has generated a lot of interest among investors, both small and large.

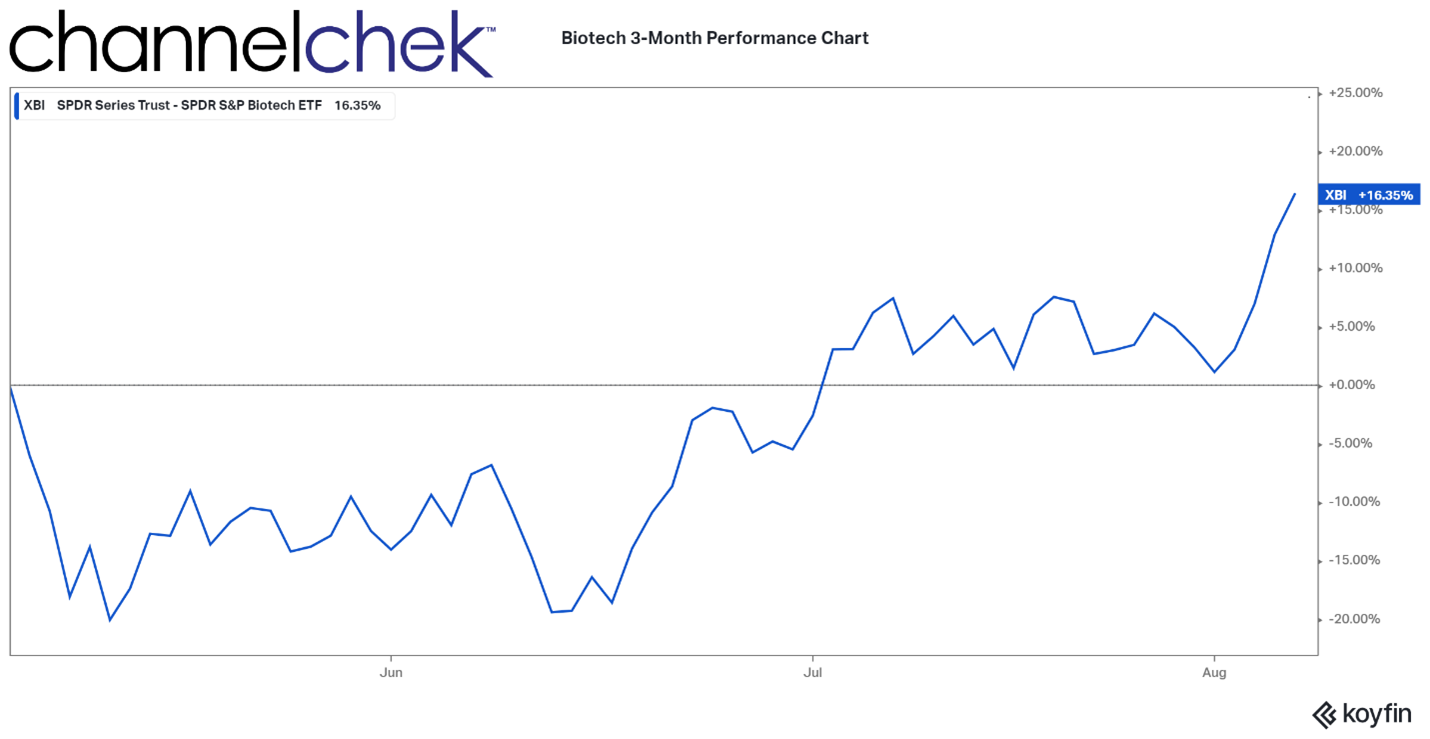

The SPDR S&P Biotech ETF (XBI), which tracks the sector, is up 16.35% over the past three months and 45.14%% since the markets closed on June 14. XBI had fallen from the $110 range to the $60 range earlier this year, it is now around $92. Whether or not this represents a continued direction for the biotech sector remains to be seen, but the positive buzz and news stories surrounding biotech seem to be increasing.

Right Mixture

Merck (MRK) has been in the news as they’re in negotiations to acquire Seagen (SGEN). This has been a reminder that big pharma is flush with cash, so much that attractive small and mid-cap biotech companies can easily be purchased without a financial blink from the acquirer. These smaller companies are also finding it easier to develop financial and R&D partnerships with big companies. The financial strength of big pharma has been further highlighted in recent weeks as stock buybacks among large firms and merger activity seem to be growing. Market-moving drug-testing results are also being reported as the FDA is less distracted than it has been in years. Taken together, all of these factors would seem to be the right treatment to continue to heal and strengthen a depressed sector.

Source: Koyfin

The market is also being reminded of the potential profitability of the sector during this earnings

season. Companies like Regeneron Pharmaceuticals (REGN) climbed almost 6% after reporting earnings this week, and Gilead Sciences (GILD) financial reporting had a similar impact on its stock price. But these didn’t even come close to Moderna (MRNA) which gained 16% after reporting its earnings.

As for the smaller biotech names, both public and private are also deals being made. Gilead announced an agreement on Thursday to pick up a private U.K.-based biotech called MiroBio for $405 million in cash.

The sector has gained much of its strength of the sector in recent months from mid-caps that were weaker than their larger counterparts early in the year. Names like Therapeutics (BEAM), which started the year off poorly but is now up 104% since mid-June. Fate Therapeutics (FATE) is another mid cap that has been flying since mid-June and is currently up 77% during that period.

Take Away

Markets are cyclical, and the biotech sector, which was at the height of its cycle earlier this decade, may have recently passed the bottom of its cycle. Smaller names are now at attractive levels for cash-rich larger pharmaceutical companies to scoop up companies that operate in areas they are looking to strengthen their pipeline or offerings.

A great place to find and explore small biotechs is Channelchek. Simply click on Company

Data at the upper left of your screen, then healthcare, which leads you to a drop-down menu with biotech as one of the categories. Sign up for research on small and microcap companies from top-ranked analysts in biotech and other industries, delivered to your inbox each morning.

Managing Editor, Channelchek

Suggested Content

Is Biotech’s Outperformance Reaching a New Stage of Development?

|

What Investors Haven’t Yet Noticed About the Value in Some Biotechs

|

Energy and Global Fundamentals Make a Good Case for Owning Western Uranium

|

Science Fiction Becoming Medicines Future

|

Sources

https://www.barrons.com/articles/biotech-stocks-rally-bear-market-51657551507

https://www.barrons.com/articles/bull-market-biotech-stocks-51659620438?mod=hp_LEAD_2_B_2

Stay up to date. Follow us:

|