Image Credit: Kishjar (Flickr)

OPEC Sees a Better Balance of Supply and Demand in New Forecast

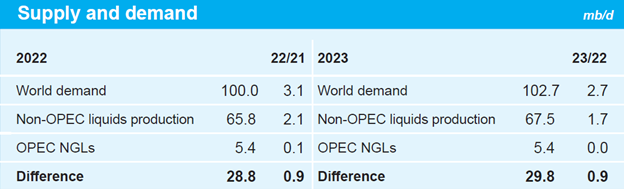

The Organization of Petroleum Exporting Nations (OPEC) released a 92-page report dated August 11, 2022, on the state of the global oil market. The topics include expected supply and demand balance shifts, global demand expectations, world economy expectations, and physical versus futures prices. The OPEC Monthly Oil Market Report suggests the cartel is not expecting to increase output.

Supply

The global oil supply has risen steadily over the past several months. This includes OPEC coordination with countries participating in the Declaration of Cooperation (DoC). However, ongoing low overall investment is limiting non-OPEC oil supply growth. Signs of slowing growth in the world economy and oil demand have been causing a better balance of output and consumption.

The oil market since the beginning of 2022 has been riddled with price volatility, this became much more pronounced after February 2022. The late winter imbalances were triggered by concerns in Eastern Europe. Sanctions on Russian oil by some major oil importing nations served to increase the premium that was built into crude prices. The sanctions led to significant changes to inter-regional trade flows. This raised supply concerns heading into the summer travel season.

The early summer was characterized by increased pressure on prices in most regions and soaring prices. This created a situation that resulted in crude differentials rising to record-high levels in 2Q22, along with steepening backwardation, a situation where physical oil is priced higher than futures contracts.

Demand

The OPEC report shows fundamentals in the physical oil market remain heightened, and volatility in the futures markets is reacting to expectations of lower GDP growth. Lower growth expectations are fed by rising worldwide inflation and the central banks’ reaction to slow economies.

Another factor impacting world demand is the US dollar’s value which strengthened further against major currencies. Oil is priced in US Dollars. Moreover, market price volatility contributed to reduced market liquidity, as seen in declining futures and options open interest in ICE Brent and NYMEX WTI dropped in July 2022 to the lowest since June 2015.

Source: OPEC Monthly Oil Market Report (August 2022)

Prices

Fuel prices surged in the first half of the year due to lower supplies amid refinery closures and a busy refinery turnaround season. The summer also ushered in stronger fuel consumption as pandemic-related travel restrictions were lifted in most regions. Adjustments to flow tied to the war in Eastern Europe further produced tightness. Combined, this all worked to push oil prices to record highs in June.

Jet fuel became the second strongest performer in the US product market. The product saw its price benefit from growing international air travel.

Prices peaked in June, with US gasoline reaching $193.06/b, up by $97.79/b, or 103%, y-o-y.

In July, rising refinery run rates reduced some of the tightness, mostly in US Gulf Coast (USGC), where product prices declined by $26.83/b, on average. In Europe, average prices declined the least, $20.24/b, m-o-m.

Looking Ahead

Refined product markets in the coming months are expected to experience seasonal support from transport fuels, while fuel sales could increase from the trend of moderating product prices.

Available refinery capacity will be helped by the operational ramp-up of at least two large capacity additions last year. These include the Middle East. The countries participating in the DoC will continue to monitor market developments and seek investment to help ensure adequate levels of capacity and bolster their efforts to maintain a stable oil market balance which is perceived to be in the interest of producers and consumers alike.

Managing Editor, Channelchek

Suggested Content

Who Benefits if Oil Price Increases are Not Transitory?

|

Why Natural Gas Opportunities Should Not Always be Lumped in With the Oil Sector

|

U.S. Petroleum Producers’ Future Becomes Brighter with White House Proposal

|

Energy Industry Report – The Outlook for Energy Stocks Remains Favorable

|

Sources

https://momr.opec.org/pdf-download/

https://www.investopedia.com/terms/b/backwardation.asp#:~:text=Key%20Takeaways,months%20through%20the%20futures%20market.

Stay up to date. Follow us:

|