Image Credit: Ivan Radic (Flickr)

The New Coinbase Insider Trading Case May Finally Define Crypto Tokens

Whether cryptocurrency tokens are securities or should be treated as securities by regulators is being tested yet again. This time a Coinbase (COIN) employee and two others are being charged with insider trading by the Securities and Exchange Commission (SEC). The outcome of this legal disagreement could have industry-changing ramifications for the crypto industry.

Details

of Case

In a press release last week, the SEC alleged that, while employed at Coinbase, Ishan Wahi helped to coordinate the platform’s public listing announcements that included what crypto assets or tokens would be made available for trading. According to the SEC’s complaint, Coinbase treated such information as confidential and warned its employees not to trade on the basis of, or tip others with, that information. However, from at least June 2021 to April 2022, in breach of his duties, Ishan repeatedly tipped off the timing and content of upcoming listing announcements to his brother, Nikhil Wahi, and his friend, Sameer Ramani. Ahead of those announcements, this usually resulted in an increase in the assets’ prices. Nikhil Wahi and Ramani allegedly purchased at least 25 crypto assets, at least nine of which were “securities,” and then typically sold them shortly after the announcements for a profit. The long-running insider trading scheme generated profits totaling more than $1.1 million.

The tokens in question would be considered outside of the Securities and Exchange Commission’s jurisdiction if they are not securities. The SEC alleges that they fall within that classification.

The chief legal officer at Coinbase, Paul Grewal, issued a statement in response where he said, “Seven of the nine assets included in the SEC’s charges are listed on Coinbase’s platform. None of these assets are securities. Coinbase has a rigorous process to analyze and review each digital asset before making it available on our exchange — a process that the SEC itself has reviewed. This process includes an analysis of whether the asset could be considered to be a security and also considers regulatory compliance and information security aspects of the asset. To be explicit, the majority of assets that we review are not ultimately listed on Coinbase.”

Grewal’s statement says these charges put a “spotlight on an important problem: the US doesn’t have a clear or workable regulatory framework for digital asset securities.” He continued, “And instead of crafting tailored rules in an inclusive and transparent way, the SEC is relying on these types of one-off enforcement actions to try to bring all digital assets into its jurisdiction, even those assets that are not securities.”

“Coinbase does not list securities. End of story” wrote the chief legal officer.

Struggle to Define

The question of whether tokens should be classified as currencies, commodities, or securities has created a cloud of uncertainty over the industry. According to the SEC, some tokens most likely meet the definition of a security.

One legal battle involving the SEC is the payments network Ripple’s token (XRP.X). According to the SEC, the payments token is a security. Ripple Labs and the Commission are engaged in a legal battle over the distinction.

Bitcoin (BTC.X), according to SEC Chairman Gensler, is a commodity.

The definitions help compartmentalize the assets. If the crypto tokens are not securities, then the SEC isn’t likely under its current mandates to have much jurisdiction over exchanges like Coinbase – then it wouldn’t be in a position to regulate the listing and trading of tokens.

Image: Tweet from Coinbase co-founder and CEO.

Coinbase does not support wrongdoing; according to management, however, they want a clear set of legal guidelines for their industry.

As part of a string of Twitter posts, CEO Brian Armstrong wrote, “we actively monitor for illegal activity and investigate any alleged misconduct.” The company launched an investigation in April after being tipped off about possible frontrunning, Armstrong said the company provided the names of three individuals to law enforcement and terminated an employee.

However, Coinbase intends to strongly dispute the SEC’s premise that some tokens on its platform are securities.

The SEC’s insider-trading case also seems to be at conflict with the beliefs of other regulators. CFTC Commissioner Caroline Pham said that the SEC’s move was an example of “regulation by enforcement.” The SEC’s allegations “could have broad implications beyond this single case,” she called on regulators to work more closely.

Take Away

On the road to defining and classifying digital tokens, the industry is likely to experience higher levels of regulatory scrutiny. The Department of Justice is beginning to get more involved in prosecuting crypto crime; the DOJ filed criminal charges in the Coinbase case, and it has filed insider trading charges against a former employee of the largest NFT platform, Opensea.

The SEC has said it aims to beef up its crypto

enforcement. The Commission added 20 positions to its crypto asset and cyber unit in May, bringing its dedicated headcount to 50.

The outcome of defining the asset class and proper jurisdiction and rules surrounding cryptocurrency is a process. During the early stages of this process, investors in tokens tolerate an added level of uncertainty surrounding the outcomes.

Managing Editor, Channelchek

Suggested Content

SEC Announces Crypto Assets and Cyber Unit Will Double in Size

|

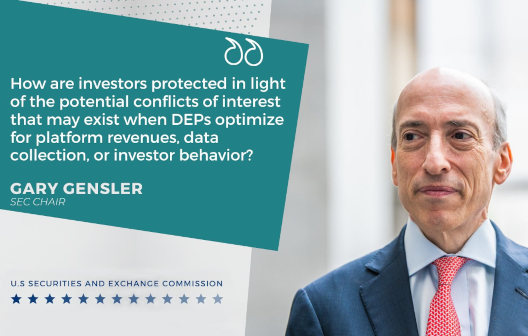

SEC Investigates Digital Engagement Practices in Broker Apps

|

Has the Crypto Crunch Accelerated SEC Plans to Regulate the Market?

|

What Might be in a Portfolio Allocated for a Republican Majority in the House?

|

Sources

https://www.sec.gov/news/press-release/2022-127

https://blog.coinbase.com/coinbase-does-not-list-securities-end-of-story-e58dc873be79

https://twitter.com/CarolineDPham/status/1550159347984044033/photo/1

https://www.breakingviews.com/considered-view/bidens-sec-pick-is-ominous-sign-for-wall-st/

https://www.reuters.com/legal/government/gary-gensler-has-set-sec-perilous-path-2022-07-22/

Stay up to date. Follow us:

|