Image Credit: Marco Verch (Flickr)

Michael Burry’s Recent Fed Tweet Has Implications for Most Investors

The Federal Reserve receives splashy headlines when they up the overnight lending rate that banks charge one another. But Federal Reserve Chair Jerome Powell had laid out a schedule for something that is arguably more significant than a Fed Funds adjusted target – the schedule massively and methodically shrinks the Fed’s balance

sheet. Michael Burry noticed that the Fed has quickly veered from its quantitative tightening plans. He took to Twitter to let those of us in the markets know about it. The information he shared in a Tweet is important

to investors of stocks, bonds, and even real estate. What did Michael Burry’s 36 words say, and what else do investors need to know?

About Burry’s Tweet

The hedge-fund manager that became world-renowned after being portrayed in the movie “The Big Short,” compared the Federal Reserve’s unresolved, high level of economic stimulus to the difficulties of drug addiction. He tweeted: “Drugs are hard to kick. Fed was supposed to sell $30B Treasuries and $17.5B Mortgage-Backed Securities per month starting June 1. Q.T.” He continued, “During June, MBS holdings rose almost $3B. Treasury holdings fell less than $10B.”

Source: @BurryArchive (Twitter)

Burry’s tweet refers to the Fed’s plan to reduce U.S. Treasury holdings by $30 billion for the months of June, July, and August and by $17.5 billion in mortgage-backed securities during these same months. This would effectively pull $47.5 billion in cash from the U.S. economy and would cause the new issuance replacing (actually funding) this maturing debt to need to find new buyers. New buyers are attracted when Treasury auctions to replace the maturing debt reach a high enough interest rate bid to sell every last penny. The Fed’s guidance meant that, at least for Treasuries, $30 billion non-Fed dollars would need to be attracted at Treasury auctions.

Is It True?

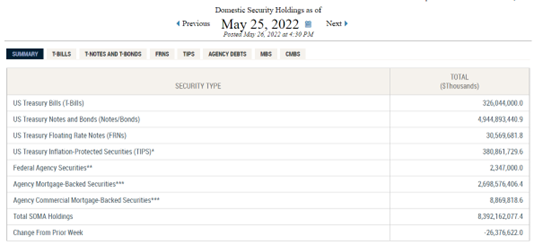

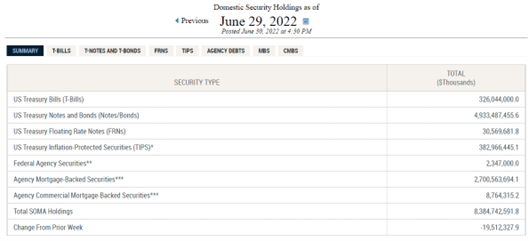

The holdings of domestic securities by the Fed are reported each week on the New York Fed website. Using the last week in May, and the last week in June, it would seem the Fed has only reduced its holdings by $7,419,485,200 overall. This is a $40 billion miss from Fed guidance given as recently as May.

The math can be refined using the website by drilling down into the holdings more, but Michael Burry’s tweet asserts that they added $3 billion in MBS, and Treasury holdings are only down by $10 billion. The $7 billion roughly equates to netting the difference between the two SOMA holdings; this is the total difference between the Fed’s two statements, four weeks apart.

What Does it Mean for Investors?

If, as an investor, you determine your positions by connecting “economic dots,” and you’re told by the Fed that they are transparent and that this is what you can expect from us if nothing changes, you align your positions according. That’s a fairly substantial “dot.” For Michael Burry, there is nothing I can see on his company, Scion Capital Management’s, most recent SEC

13-F filing that would indicate he specifically used the Fed’s guidance, however, this 13-F is from May 16.

Investors inclined to trade on money supply, or interest rates, may have taken positions based on the Fed’s advertised transparency and guidance for the few months forward. One could imagine a scenario where investors would see the Fed’s activity serving to steepen the yield curve. This could have caused investment in stocks of some banks. Banks with a substantial portion of their earnings made from lending would benefit from a curve where the longer rates increase faster than shorter rates. A natural result if the Fed followed its plan.

The promised decrease in mortgage-backed securities could cause some real estate investors to pull back substantially, or at least more than they would have if they had known the Fed would actually increase its position.

Michael Burry is best known for his ability to spot what to short and how to short it. The Fed guidance would indicate that rates on longer-term Treasuries would rise with the $30 billion per month reduced holdings by the Fed. This would mathematically drive prices down with each uptick in rates. The actual number for June was closer to $10 billion. Not only would this lack of Fed follow-through in June mess with investor positions, it leaves in question whether Powell will be equally cavalier about promised future reductions. The Fed laid out a schedule where it would increase its reductions beginning in September. Investors, presumably Michael Burry among them, now don’t know what to think.

Managing Editor, Channelchek

Suggested Content

Michael Burry is Predicting More Red

|

Can the Fed Successfully do What Has Never Been Done Before?

|

The FOMC Decision on Rates

|

he Detrimental Impact of Fed Policy on Savers

|

Sources

https://www.newyorkfed.org/markets/soma-holdings

Stay up to date. Follow us:

|