Image Credit: Bruce Fingerhood (Flickr)

While Many Investors are Shunning Coal as Yesterday’s Energy, the Industry May Have Just Entered a Supercycle

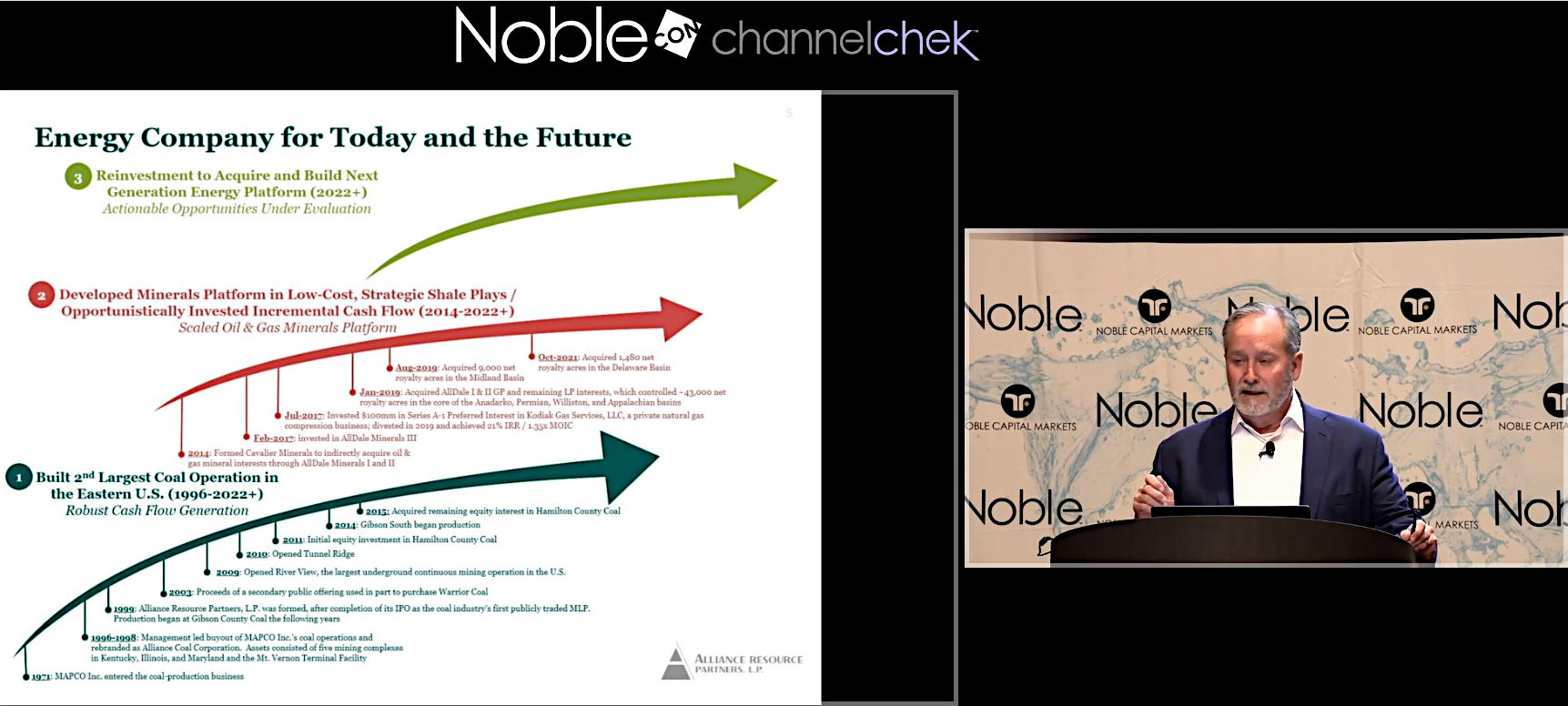

Investor conferences are full of companies helping investors better understand newer industries and then showcasing individual company business models and “value propositions.” The annual NobleCon Investor conference showcases growth companies, arguably, better than any other event. While attending this year’s NobleCon, I sat in on a presentation by a company up 277% YoY and trending higher. The industry dates back to the 1700s in the US, and the product had recently been rumored to have outlived its usefulness. Yet scheduled in between small companies doing groundbreaking work in life sciences, electronic games, and high-tech trading systems was a company still breaking ground mining coal and extracting other fossil fuels. The company’s stock market returns are staggering, and the presentation (video

available here) pointed to a positive outlook both for the company and the industry.

Image: Brian Cantrell, SVP and CFO of Alliance Resource Partners, discusses the future of his company at NobleCon18

About the Company and Fossil Fuels

Alliance Resource Partners (ticker: ARLP), is the second-largest coal producer in the eastern US. Alliance markets its coal production to major domestic and international utilities and industrial users. The company derives income from coal production and oil & gas mineral interests located in seven strategic mining bases across the eastern states. The company has a market cap of $1,953m and is trading at $15.36 (April 26) up from $5.48 one year earlier.

Brian Cantrell, the CFO of ARLP, led the investor-facing presentation that highlighted his company’s challenges through the pandemic and the current stature and strength since mid-2021. The CFO explained that the price for natural gas began to rise last year, which fueled demand for less expensive coal. This was followed by what he called the “unfortunate situation in Ukraine” which is benefitting the price of fossil fuels as international consumers are weaning themselves off Russian natural gas. It’s far cheaper now to power from coal than natural gas.

Feeding into this perfect storm for coal prices has been an unwillingness of capital to support any fossil fuel projects. This has slowed any recovery from the supply shock. Also feeding into longer-term elevated prices is that fuel stockpiles had been very low where needed. There was a presumption that production could automatically respond, Cantrell explained that while it varies by unit and utility, end-users like to have 45 days’ worth on hand as a buffer to manage demand.

Today the fossil fuel industry has its own version of supply chain problems as fuel buyers are having difficulty finding producers with enough capacity to refill their buffer, which has in many cases been critically shortened. Internationally the US has been the swing producer, filling gaps outside of North America when needed with short-term, vessel-by-vessel, or quarter-by-quarter contracts. This demand has stressed the capacity to produce. Alliance has introduced artificial intelligence into its operation to create efficiencies for mining and extraction and to improve safety and productivity.

The

Future of the Industry

During the Alliance Resource Partners presentation, it was asked if current supply/demand fundamentals, because of lack of capital support, are forcing companies to live within their cash flows? Increased output may not come quick within the industry as it’s not in a position to leverage up while prices are under upward pressure; the presenter pointed out that ESG pressures are real. This could place this sector within a new supercycle.

Take-Away

Investment ideas are not limited to whatever the latest invention is. Often there is so much buzz around the “hot” “disruptive” industry that other opportunities have the potential to be overlooked.

Coal producers may be worth paying attention to for some time. Alliance’s CFO mentioned that he believes coal will continue to be an important part of power generation in the US and internationally.

Managing Editor, Channelchek

Suggested Reading

No Punches Pulled at NobleCon18 Panel Discussion

|

EV Inflation Outpacing Traditional Cars

|

Evaluating Gold Royalty Companies to Gain Exposure to Precious Metals

|

Metals & Mining First Quarter 2022 Review and Outlook

|

Sources

NobleCon18 Investor Presentation,

Alliance Resources (Replay Video)

https://www.arlp.com/investor-relations/investor-overview/corporate-profile/default.aspx

Stay up to date. Follow us:

|