Image Credit: Nenad Stojkovic (Flickr)

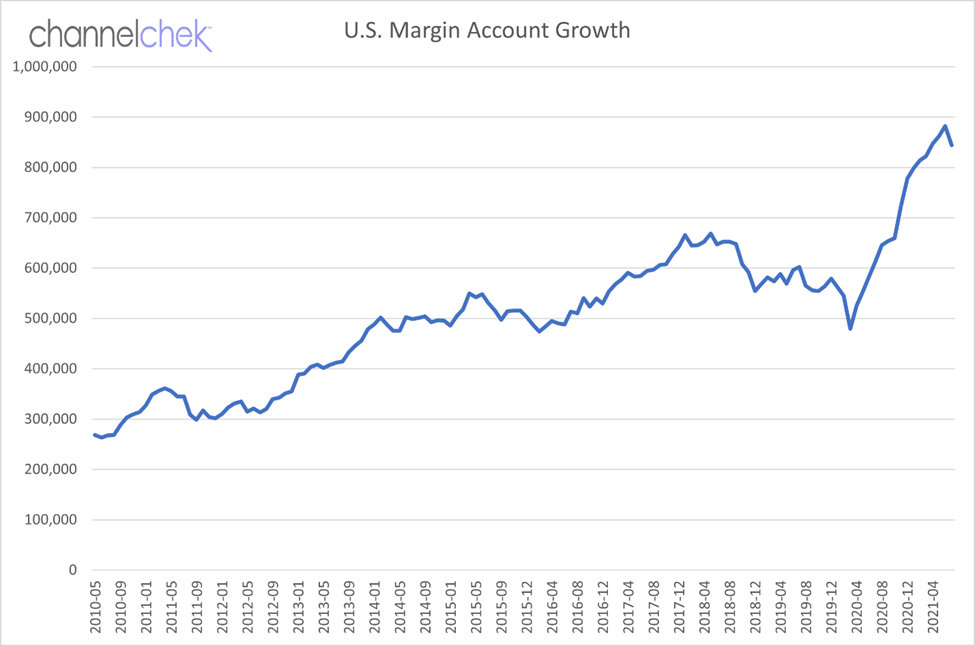

After Screaming Higher, Leverage Suddenly Came Down $38 Billion

Margin debt fell by $38 billion from its historic high in June. This is the first dip since March 2020, and this move may have implications for the market. The data, which is released monthly by FINRA, is the only official measure of leverage available to investors. So, these are the only stats available from which to draw any conclusion. There are, of course, other non-broker forms of leverage. These include borrowing against an asset (i.e.: home equity) or personal credit (i.e.: opening an account with a Visa card) to security purchases.

The FINRA statistics are collected as per FINRA Rule 4521(d). They are numbers provided by the member firms that offer margin accounts for customers. The report includes the total of all debit balances in securities margin accounts, and the total of all free credit balances in cash accounts and all securities margin accounts.

The Numbers

From an all-time high in June, margin debt fell $38 billion. This took it back down to a level it had attained after March 2021, but before the end of April. For 15 months through the month of June, leverage in securities portfolios overall was climbing at an excessive pace (84%). The rise in market prices is likely to have been largely fueled during this period by the growth in debt-financed purchases.

Data Source: FINRA

Increasing leverage has turned out to have not been a bad move for account holders, the markets are up significantly since March 2020. During the period, the Fed’s policies of interest rate suppression and yield curve control helped to reduce the cost of money and held it low. Investors, some for the first time, waved in as much stock as they could, enjoyed the results, and then added even more to their holdings. The nature of additional margin buying is that it helps drives up prices. Higher prices give account holders more collateral that can then be leveraged further. It’s a known accelerator of price movement. It also drives up risks — long periods of dropping margin debt can be associated with sell-offs as accounts unwind stocks held with borrowed money.

Should Investors be Cautious?

One might suggest investors always exercise prudence and caution; however, one data point is not a trend. Investors should check back on margin debt when the August numbers are released in mid-September. If a trend is developing, it may alter the strength of the market. The decline may very well be a summer pause in trading activity and a one-off number to ignore.

Take-Away

Easy money and available leverage help to finance higher asset prices. This includes everything from stocks, to real estate, and to some extent even used cars.

Should money become much tighter, or the market falter, the same forces that assisted higher market prices, could reverse themselves. This is just one input into what drives the overall equity markets, investors would be wise to follow any larger trend.

Registering for daily emails from Channelchek is one way investors follow news and research not found on other sites — Register free now.

Managing Editor, Channelchek

Suggested Reading:

Margin Debt Increases are Eye-Popping

|

The Beginning of the Road for Gold?

|

COLA Increases for Seniors in 2022 Will Likely Top $68 Billion

|

Why the Smart Money is the Individual Investor in 2021

|

Sources:

https://www.finra.org/investors/learn-to-invest/advanced-investing/margin-statistics

Stay up to date. Follow us:

|