September 11, a Retrospective Account of Investment Fallout and Recovery

I wasn’t in New York City on September 11, 2001. Just prior to 911, I had taken a position as CIO for a major Wall Street firm headquartered in lower Manhattan; however, the trading floor I was responsible for was about 50 miles east of ground zero. I took the position outside NYC to be closer to my home and family – the benefit of my decision became apparent all at once, at 8:45 am that Tuesday morning, then reinforced 18 minutes later.

Twenty-one years have passed since then, the children of the deceased are now adults, and financial activity is spread much further than one small area in lower Manhattan. Although much has changed, it’s important to look back and recognize how the investment markets handle devastation and, at the same time, recognize how humans here and around the world will band together when others need help.

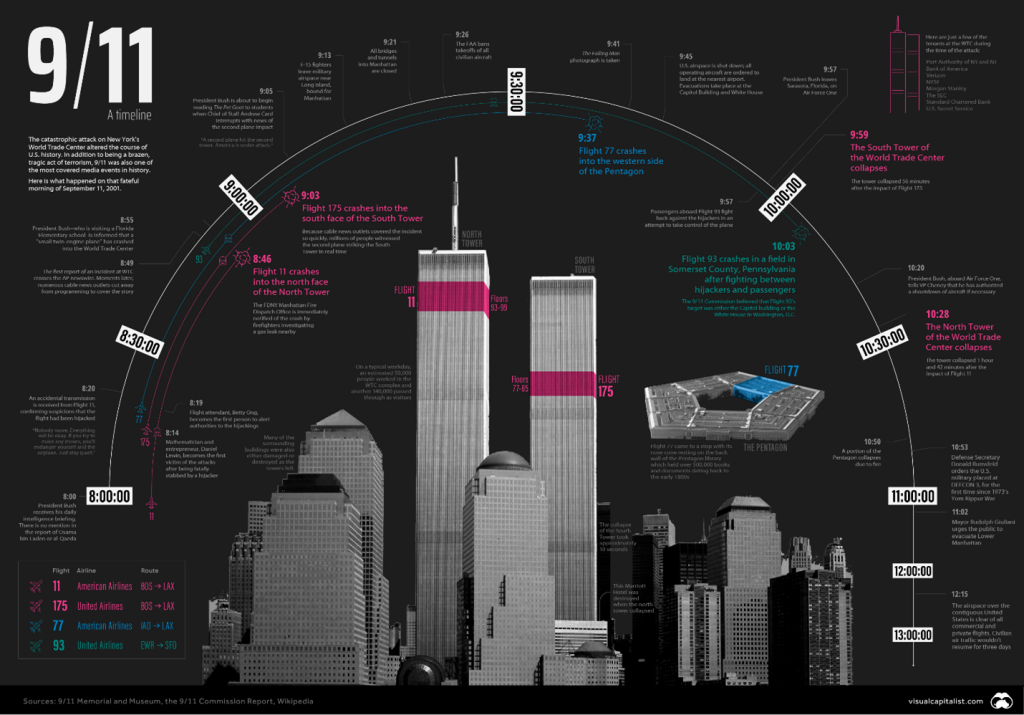

September 11, 2001

The opening bells at the New York Stock Exchange (NYSE) and Nasdaq were silent at 9:30 that morning. They remained silent until September 17, as traders and investors feared what their positions would be worth upon the reopening of the financial markets after the longest close on record.

Once reopened, the Dow Jones fell 7.1% or 684 points, setting a record at the time for the highest one-day loss in the exchange’s history. By Friday, the NYSE had experienced the greatest one-week decline in its history. The Dow 30 was down more than 14%, the S&P 500 plunged 11.6%, and the Nasdaq dropped 16%. In all, about $1.4 trillion in wealth disappeared during the five trading days. Since then, this record has only been surpassed once at the early stages of the pandemic.

In hindsight, the industries most negatively impacted make sense. Airlines and the insurance sectors lost tremendous value. A flight to quality made gold popular as the price per ounce leaped 6% to $287.

Gas and oil prices quickly rose as fears that oil imports from the Middle East would be slowed or stopped altogether. Those fears lasted about a week; then, after no new attacks and a clearer understanding of the intentions of government officials, index levels returned to near their pre-911 levels.

The sectors that experienced major gains after the attacks include technology companies and certainly defense and weapons contractors. Investors anticipated a huge increase in government borrowing and spending as the country prepared to root out terror around the world. Stock prices also spiked for communications and pharmaceutical companies.

On the U.S. options exchanges, volatility in the markets caused put and call volume to increase. Put options, designed to allow an investor to profit if a specific stock declines in price, were purchased in large numbers on airline, banking, and publicly traded insurance companies. Call options, designed to allow an investor to profit from stocks that go up in price, were purchased on defense and military-related companies. Short-term profits were made by investors who were quick to execute.

The terrorism of September 11 will, doubtless, have significant effects on the U.S. economy over the short term. An enormous effort will be required on the part of many to cope with the human and physical destruction. But as we struggle to make sense of our profound loss and its immediate consequences for the economy, we must not lose sight of our longer-run prospects, which have not been significantly diminished by these terrible events. – Fed Chairman Alan Greenspan, September 20, 2001

Since September 11

Over the following 21 years, the major U.S. stock exchanges have taken steps to make physical disruption of trading more difficult. This includes dramatically increasing the percentage of trading that is electronic. While this has made the U.S. markets less vulnerable to physical attacks, it is feared that there is increased potential for cyberattacks. “As we have digitized our lives, which has generally been a great blessing, we have sown the seeds for even greater destruction in terms of the ability to hack into our systems,” said former Securities and Exchange Commission Chairman Harvey Pitt, who led the agency on Sept. 11, 2001. “That is today’s equivalent of a 9/11 attack. There is a potential ‘black swan’ event every single day.”

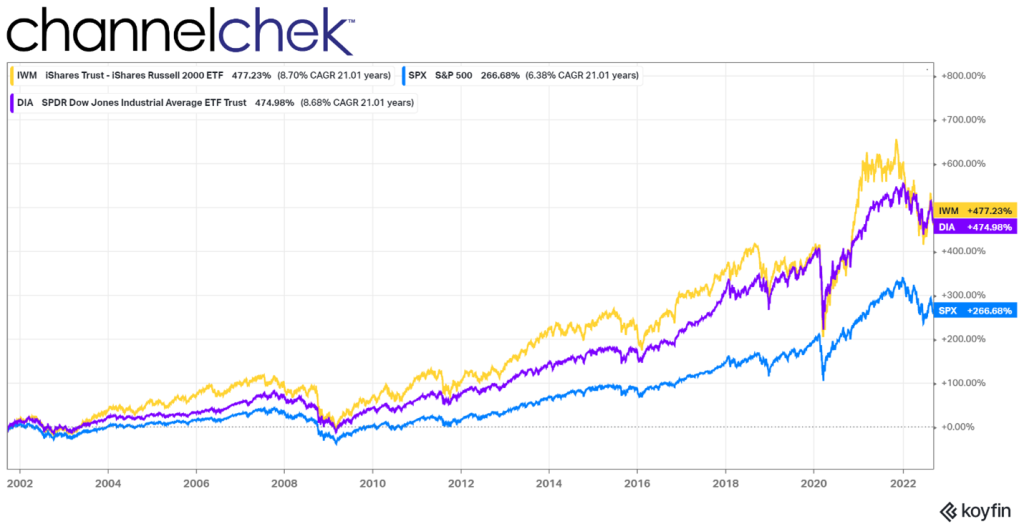

The investment markets have enjoyed above-average upward movement, despite the negative short-term impact of the black swan event. In the nearly 20 years since Sept. 11, the S&P 500, Nasdaq 100, and Russell 2000 Small-Cap index has risen more than four-fold. The bond market has also been strong (persistent low rates) despite increased borrowing to fund defense operations to finance America’s 911 response.

The U.S. economy itself has had long periods of expansion since 2021, even with the mortgage market crisis from December 2007 to June 2009, and the economic challenges from the response to the COVID-19 pandemic.

The costs, however, are likely to continue to be borne by taxpayers for generations. Interest-related costs alone on debt which financed military operations, including the long Afghanistan war, which was resolved last year when the U.S. withdrew after 20 years, and the protracted conflict in Iraq from 2003 to 2011, are high. The economic drag of these costs, while not fully measurable, are real.

The U.S. government financed the wars with debt, not taxes. Interest rates have been low, but taxpayers have already helped pay approximately $1 trillion in interest costs on the debt incurred to finance the two wars. These interest costs are expected to balloon to $2 trillion by 2030 and to $6.5 trillion by 2050 (according to the Watson Institute at Brown University). This places upward pressure on interest rates and places downward pressure on economic activity. One reason is that taxes used to fund interest costs take money from the economy without providing any stimulus or new material benefit.

Off Wall Street

September 11 radically changed the national mood and political environment. Polls and surveys taken just before the 911 attacks found Americans growing less certain about the direction of the country as a recession began to weigh down the ability to be optimistic. A full 44 percent of the country thought it was headed in on the wrong direction, according to the August 29-30, 2001 New Models survey.

Logic might suggest that after a successful attack, people’s attitudes toward the direction of the country would trend toward a worse future. Reporters, politicians, and spokespeople all predicted a terrible economic shock; their forecast seemed supported by the first week’s plunge in markets. But the events of that day seemed to give citizens purpose. In fact, statistics that indicated the “direction of the country” showed that optimism surged. An October 25-28 CBS/NY Times survey reported that people felt the country was headed in the right direction by a two-to-one margin. A sense of pride in who we are as a country and as individuals overcame negative economic news in an unprecedented way.

Take Away

It has been over two decades since what many of us think of as recent. The truth is, children born on September 11, 2021 or before are now of drinking age. But history can prepare us for new events. The market’s first reaction to tragic news is always down; when proven temporary, bargain hunters come in, then the market has always resumed its historical growth trend upward.

The markets now trade more digitally with almost no need for runners in lower Manhattan and far less open-outcry and paper jockeying by masses of people working for companies in one small section of Manhattan island. But the new threats are also real, a cyber attack on electronic records or transactions could be devastating in its own way.

Challenges even those caused by tragedy provide opportunity and even purpose. September 11, and its aftermath are proof of this.

Managing Editor, Channelchek

Sources

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=803387

https://www.weforum.org/agenda/2021/09/9-11-timeline-visualized-america-september-terror-attacks/

https://www.federalreserve.gov/boarddocs/speeches/2002/20020111/default.htm

https://www.brookings.edu/articles/flying-colors-americans-face-the-test-of-september-11/