Image Credit: Ken Teegardin

Belt Tightening Not Necessary as Top Strategist Sees No Long-Term Economic Malaise

The possible long-term economic decline that the market fears may be unwarranted, says a top strategist at JPMorgan Chase. Most importantly, he backs his case up with compelling data. This comes just before the economy has 21 days to prove it is not in a recession. As a reminder, the textbook definition of a recession is two consecutive quarters of economic growth as measured by GDP. The GDP growth rate for the first quarter of 2022 is reported to have shrunk by 1.5%. As we approach the end of the second quarter, the economy seems to continue to fade. Since investors, workers, and business owners all have a stake in the economy’s overall health, they may take comfort in the projection of Mike Bell, a global market strategist at JPMorgan Asset Management, on the future of the U.S. economy.

What He Said with Context

“Our base case is not that we get a recession in the US in the near term,” Mike Bell, the global market strategist at JPMAM said at a conference on Wednesday. Bell explained the key economic ingredient that reduces the chance of prolonged decline in the US economy is that Americans are harboring higher than usual amounts in savings. This level of savings grew during the pandemic-economy. The post-pandemic economy, Bell believes, will also benefit as this will help prevent price shocks with high inflation.

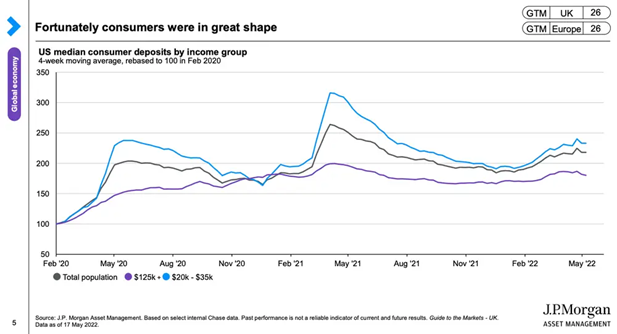

The global market strategist backed up his argument, using a Chase Bank homegrown chart showing deposits. JPMorgan Chase is the world’s sixth-largest bank, and the largest in the U.S.

Consumer Savings Increase

Internal JPMorgan data demonstrates Americans have built up a cushion of savings. The statistics show that households have double the amount of savings they had at the start of the pandemic (using February 2020 as base). Discussing the above chart, Bell pointed out, “See in the U.S. how much the stimulus checks boosted savings, particularly for the lower income group,” and continued, “Part of the reason we had a lot of booming economic growth and inflation over the last year was that some of that got spent. But they’re still sat, on average, on somewhere like double the amount of savings they had at the beginning of the pandemic.” He believes the consumer will continue to consume and not retrench to a level tha causes severe economic impact.

However, Bell said there’s still a chance the Federal Reserve raises interest rates so far it would trigger a recession. And he said central bankers and finance ministers face a trade-off. If there’s no recession, then inflation is likely to stay above the central banks’ 2% target for a lengthy period.

Take Away

Economics is not an exact science. Most economists are accused of saying, “on the one hand this, on the other hand, that…” There are so many inputs, that predicting a month out is far more difficult than predicting the weather a month out. And no one expects any weatherman to be correct.

The global strategist at JPMorgan Chase is using insight that is different than those clamoring about inflation, a tight job market, or interest rates. Investors may benefit from understanding the more positive data and crossing that with everything else they are digesting. In this case, the thought is that the consumer won’t retrench because they do not have to. Their savings is above previous periods.

Managing Editor, Channelchek

Suggested Content

Why Good Economic Numbers Can Cause a Selloff

|

How PPI Impacts CPI Numbers

|

Michael Burry Uses Burgernomic’s logic to Evaluate the US Dollar

|

Inflation Sticker Shock to be on Powell Says President

|

Sources

https://www.doughroller.net/banking/largest-banks-in-the-world/

Stay up to date. Follow us:

|