Image credit: Diverse Stock Photos (Flickr)

Inflation and Stock and Bond Markets Provides Good Movement for Trading

Buy the rumor, sell the fact is advice often quoted by stock traders. It has at its roots contrarian investing. The positioning leading up to this mornings CPI report, may have been the perfect example of how this works.

In anticipation of an inflation report expected to be as high as 8.4%, both the bond market and stock market sold off significantly. The actual print on 4/12/22 at 8:30am ET was worse. The 8.5% consumer inflation rate showed gas prices for the period had risen 18.3%, food, fuel and housing were up 1.5% on the month, and all-in-all the worst CPI report since January 1982.

So what happened immediately after in the markets? The expectation of travesty unwound as often happens when events become known. Stock futures jumped from negative to positive, the bond market rallied, and many who sold into the number wish they had not.

While no Wall Street axiom is perfect, and even contrarians inflict wounds on themselves, it is worth considering the “buy the rumor, sell the fact” – or in this case “sell the rumor, buy the fact” contrarian position when an event is already priced to worst/best.

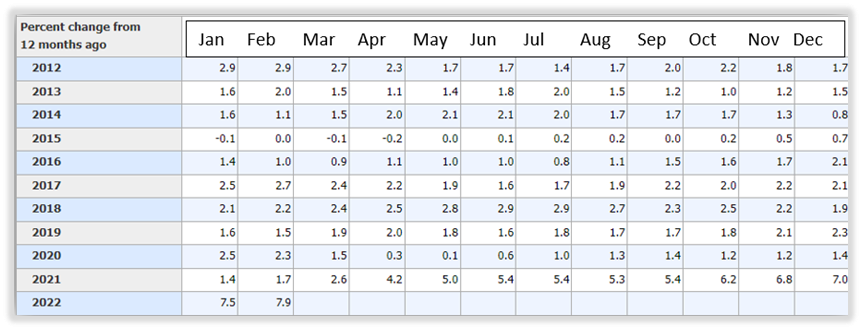

Above is a ten year history of monthly YOY CPI reports. The March 2022 box should now read 8.5%. This is a number that was unfathomable three years ago when deflation was a concern. The stock market is considered a natural hedge against price increases. The main concern however, is rising interest rates and investors finding higher returns in fixed income.

Managing Editor, Channelchek

Stay up to date. Follow us:

|