The Sources of Deflationary Pressure According to Cathie Wood

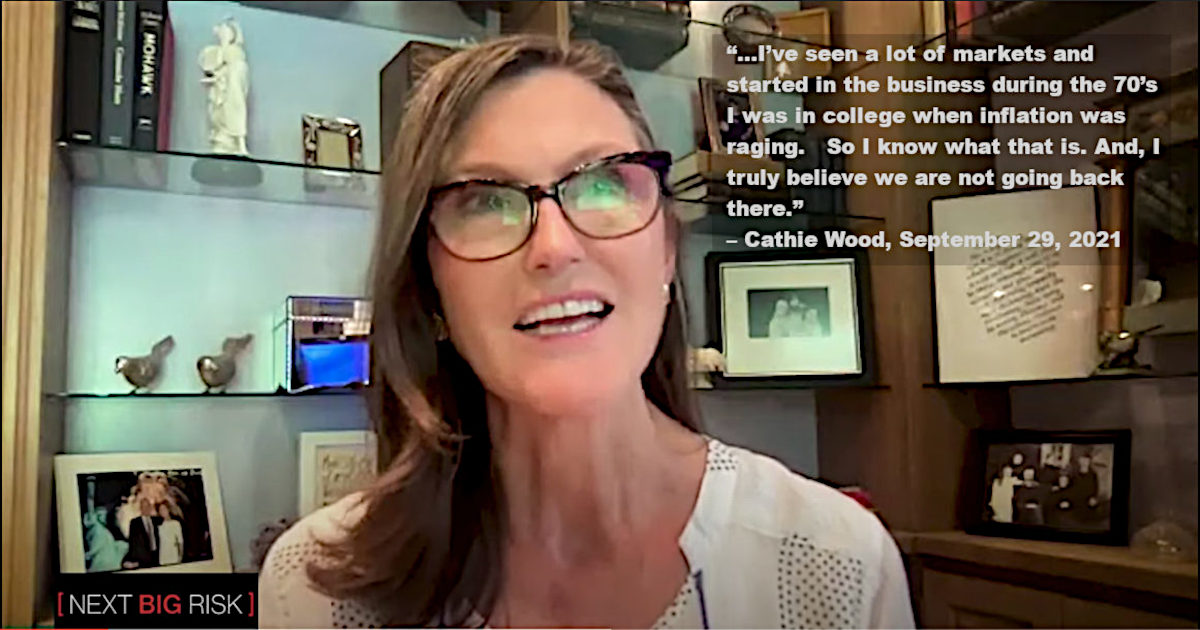

Cathie Wood, the founder and Chief Investment Officer of ARK Invest, says she leans more toward the thinking that the risk is deflation, not inflation which she believes “investors prematurely baked into the cake.” Along this same line of thinking, she said, “anyone planning for it [inflation] is probably going to be making some mistakes.

In a televised interview with Bloomberg’s Sonali Basak on Thursday, Wood expressed that her biggest concern for the markets is a “deflationary boom.” She outlined her firm’s less mainstream position with the factors she believes are feeding deflation.

Deflation Pressures

High on her list of inputs that would cause downward pressure on prices are innovation and technology “We are in a period like we have never, never been. You’d have to go back to telephone, electricity, and automobile to see three major technologically enabled sources of innovation evolving at the same time. Today we have five.” She said with conviction. She explained these are DNA sequencing, robotics, energy storage, artificial intelligence, and blockchain technology. All of which, she explains, are extremely deflationary. As far as an additional deflationary input, she believes that there are many old-economy companies that have tried to satisfy shareholders short term wants by adding an extra few cents each quarter. By being short-sighted, not forward-looking, they have made miss-steps like taking on large amounts of debt. She believes that in order to service their debt, they’ll have to cut prices to move goods and services that will have fallen out of favor with consumers. Wood expects there to be a lot of confusion as this plays out. Many, she suspects, don’t keep their eye on the “innovation ball.” In her firm’s analysis, they conclude it’s innovation that will balance out the inflationary pressures not brought about by the supply chain issues we see now.

Stocks Not in Any Index

Her expectations also lead to the conclusion that we will begin to feel scarce growth and see very low GDP numbers at first. She further expressed that tomorrow’s companies aren’t in any index right now so a lot of public market investors aren’t exposed to them – and there will be many more opportunities to discover tomorrow’s leaders that are now excluded by many from consideration.

Job Displacement

She went on to describe the job displacement she believes the current state of technology sets up. Automation replacing workers has been a talked about fear since she began her firm in 2014. Some of that fear was brought on by an Oxford University piece that suggested that 47% of all jobs would be lost to automation by 2035. She said the University piece did not follow with what would happen next. In the interview, she “finishes the story” by explaining “automation and artificial intelligence productivity is going to go up dramatically. We think more than it ever has, certainly in modern times. And, with productivity increases comes more wealth creation.” Wood writes the chapter following where Oxford left off by saying that according to her firm’s estimates, in the year 2035, AI and automation would push GDP in the U.S. to $40 trillion. This contrasts with a $28 trillion forecast if you just calculated linear growth. Investors like herself are in the position where they need to figure out where the extra $12 trillion will come from.

Outside of investing, she believes it’s important to help parents decide how to educate their children, so they know what they should be prepared for.

Take-Away

The highly recognized, highly successful fund manager finished by saying, if you are on the “right side of change, there will be many exciting opportunities.” Markets are made by differing opinions. Cathie Wood is an outlier in her belief that any upward inflationary pressures will be more than offset by the supply side of the price equation. The supply, in her mind, will come from efficiencies created through technological innovation and as old industries firesale their products or services as they become less desirable. She also believes that there are many companies leading these changes; most are not currently in any index.

Managing Editor, Channelchek

Suggested Reading:

Michael Burry’s Tweet and Delete

|

Why Michael Burry has Better Opportunity Than Cathie Wood

|

Index Funds Still May Fall Apart over Time

|

Canadian Bitcoin ETFs May Be Cathie Wood’s Solution

|

Sources:

https://www.youtube.com/watch?v=7MVxrtg28Eo

Stay up to date. Follow us:

|