Image Credit: Jonathan Peterson (Pexels)

Oil and Gas Prices May Continue to Bedevil Drivers and Please Investors

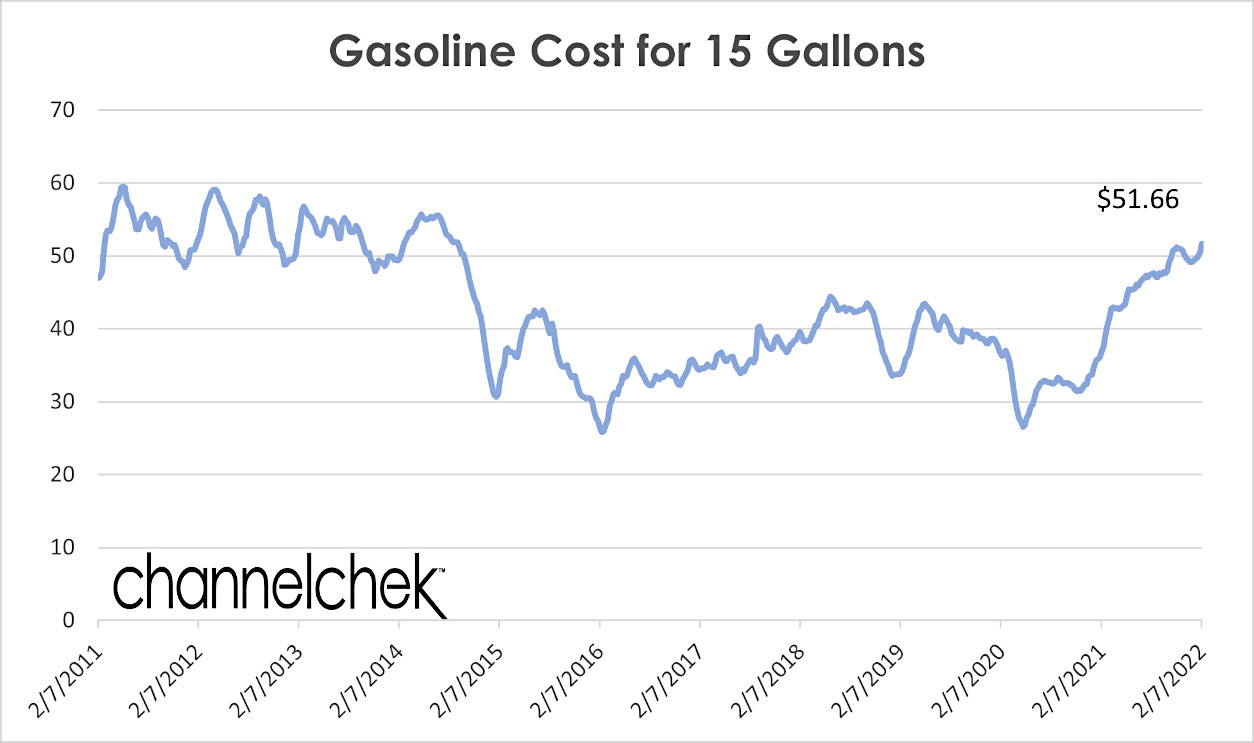

Drivers in the U.S. are paying on average 43% more for gasoline than they were one year ago. And near double what they paid in late April 2020. The reasons for the cost increase are more than changes in demand; during the height of pandemic fears, producers made changes that impacted the supply side of cost dynamics. When petroleum-based products become more expensive, their impact can be felt in almost all other products. Understanding the dynamics that impact the finances of most businesses and households helps one understand when prices may ease or if they may progress higher. Meanwhile, investors in this sector are also likely to ask whether they should take some profits or if higher prices are likely.

Fuel costs more than it did a year or two ago, and since the economic pace has been rising, the amount of fuel being consumed has also risen. So not only are consumers and businesses paying more to keep vehicles on the road, but the increased cost per mile is part of the inflated prices on most other goods. Oil prices are a factor in the 40-year highs we’re seeing in consumer prices.

Data Source: U.S. Energy Information Administration

Background

Over the past year, the unexpected sharp run-up in gasoline prices was propelled by a unique set of market imbalances. These imbalances brought about by the pandemic initially drove the “cost” of a barrel of oil on the futures market below $0.00 per barrel. This is because the pace of production was outstripping the ability to use or store what was being pumped. Remember, at this time, across the developed world, planes stopped flying, fewer people were going to their workplace, and manufacturing slowed significantly. This absence of demand created an excessive inventory glut. For a brief period, storage facilities were near their maximum, some “buyers” were actually paid to contractually agree to own more. This shook a lot of people in the business and investors who never could have imagined this set of circumstances. Managers of some Oil ETFs were scurrying to rewrite prospectuses so they wouldn’t be required to meet outflows by selling at such unfortunate prices. Producers shut a large percentage of their rigs and other production in order to halt the supply problem. Country after country was instituting lockdowns in reaction to the novel coronavirus, and there was no sign that demand would resume soon.

Then demand quickly bounced back. This flipped the imbalance and lack of supply became the driver of prices. With demand far outstripping supply, petroleum prices rose to their highest levels in years.

Where

is the Road Taking Us?

There is a consensus among industry analysts that crude prices could

reach $100 a barrel this year, Bank of America estimates crude prices may rise as high as $120 per barrel from the current price of about $90. This will create more costs for shippers, drivers, airlines, and throughout the economy.

The primary reason for the estimates of higher prices is production hasn’t kept up with the rebound in demand. Despite increased consumption and lower inventories, producers have not fully opened the spigots to the levels they were at only a couple of years ago.

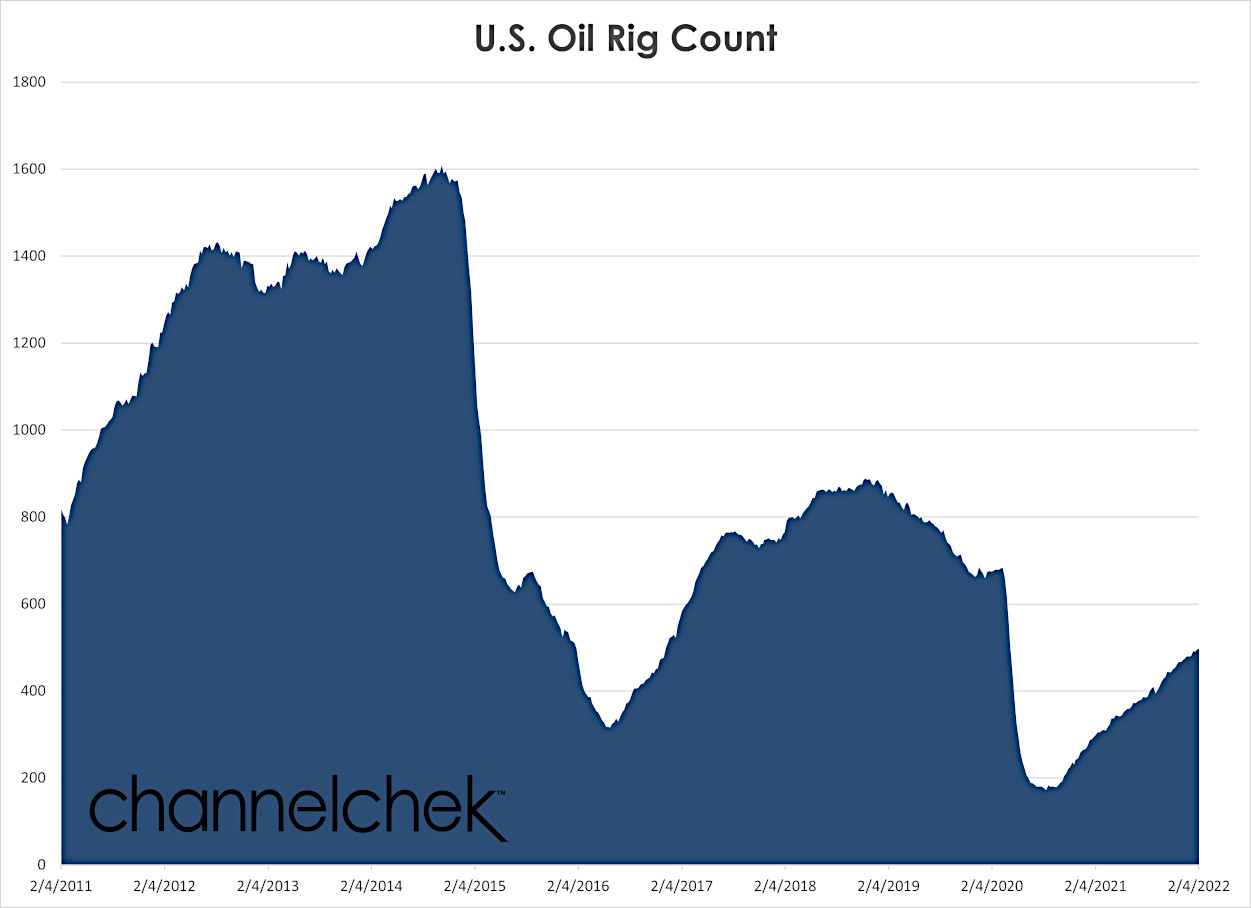

Spending on exploration and production is low, and the number of U.S. rigs active in North America has shrunk considerably. As indicated in the chart below, producing rigs in the U.S. have been increasing steadily for over a year however, the number of active rigs is about 75% of what it was two years ago.

Source: Baker Hughes (rig count)

The economy has bounced back significantly. Assuming there are no further negative pandemic surprises, there is still a great deal of pent-up economic demand which is expected to pressure prices upward. The unusually cold of the 2021/2022 winter has also added to unexpected consumption.

Take-Away

The International Energy Agency (IEA) and even OPEC find the unexpected demand for oil will likely outstrip production into the summer months. The IEA forecast is for global demand for oil to exceed pre-Covid19 restrictions.

While this may not bode well for many businesses or individual households, it may provide investment opportunities in the energy producers sector for investors or those that are involved directly in commodities futures.

Managing Editor, Channelchek

Suggested Reading

Will Crude Break $100?

|

Energy: Fourth Quarter 2021 Review and Outlook

|

Uranium and Natural Gas Investments Turn Green in 2023

|

Contango, ETFs, and Alligators (April 2020)

|

Sources

https://www.eia.gov/dnav/pet/pet_pri_gnd_dcus_nus_w.htm

https://rigcount.bakerhughes.com/na-rig-count

Stay up to date. Follow us:

|