Image Credit: Forextime (Flickr)

The Battle Between Bull and Bear Has Become Intense

A bull facing off with a bear is among the most entrenched icons and lore in stock market trading. Bull vs. bear icons can be found in almost any office that is involved in the stock market. Long ago, people came to use the terms “bullish” and “bearish” to reflect their thoughts on market direction, and the meanings are universally understood. In 2022 the memes of bulls and bears struggling with each other have reached a crescendo. After an incredibly long and strong market from Spring 2020 until year-end 2021, there has been no question we were in a bull market. As we entered 2022, the sentiment which drives markets has been less confident and decidedly more negative.

The terms are based on direction and overall sentiment, but over time, analysts have attempted to define what a bear market is. In recent years, a bear market has been defined as having fallen 20% or more from recent highs.

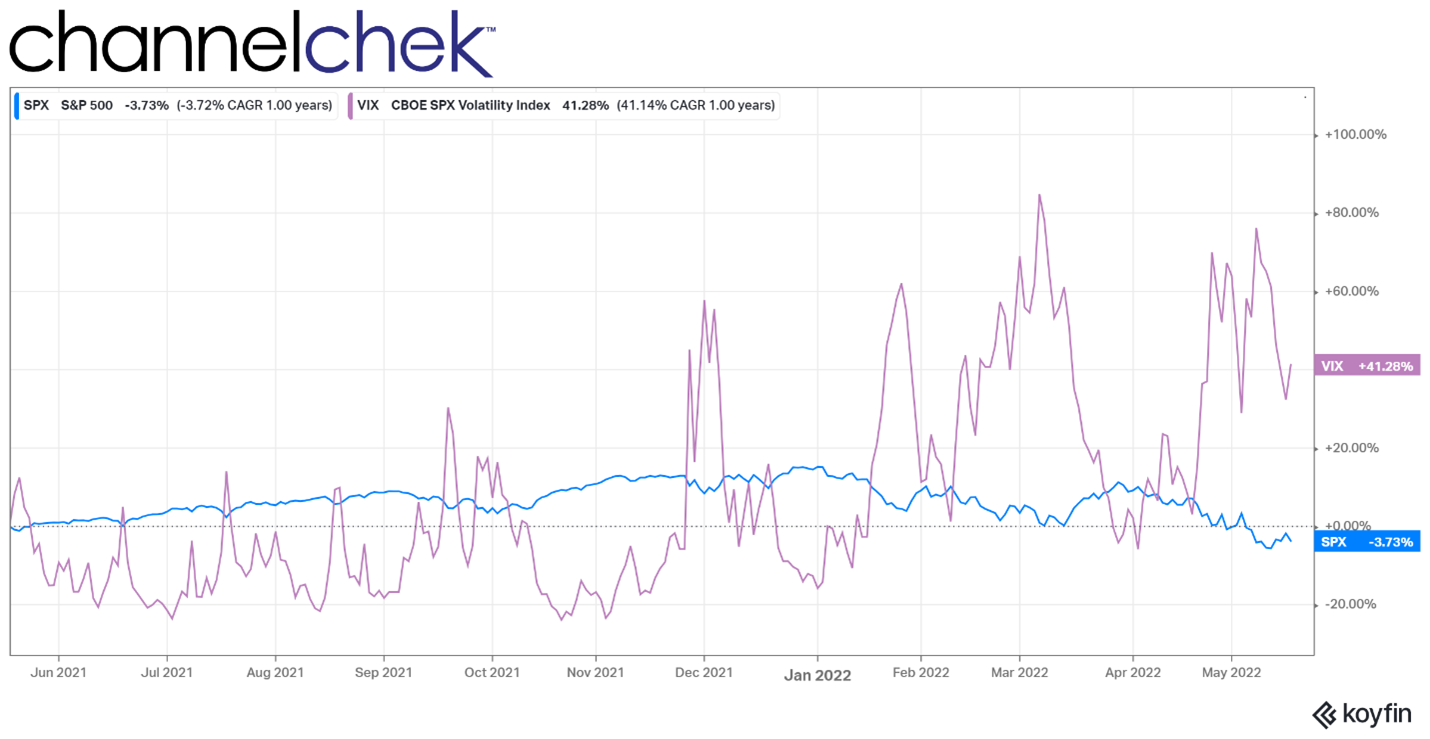

Source: Koyfin

The chart above shows the volatility index (%) against

the S&P 500 index (%). Since December 2021, the index has hit higher highs

and higher lows as the markets are wrestling with more negativity than prior

periods.

Bull and Bear Facing Off

In a bear market, share prices are on average dropping each week. This results in a downward trend that investors believe will continue; the belief, in turn, snowballs into an entrenched downward trend.

To date (May 18), none of the major indices have fallen 20% or more from their high. But for many in the markets, it feels as though they have. Investors had been velocitized by the swift gains over the prior years, so even sideways movement for a period would feel negative. The current 16% decline of the S&P 500 feels much steeper than it is. It has been held up by many strong up days showing there are still plenty of bottom-fishing bulls. This is the essence of the bull and bear facing off.

Bullish Position

The economy may seem to have the ingredients for a reduction in growth that could lead to a reduction in corporate earnings, but the most followed measurement, employment, isn’t showing signs of faltering. Confidence is created by knowing if one wants a job, they can get a job. Job growth and wages have been marching higher through most of 2022. So much so, that wage inflation is becoming a concern.

There is still ample stimulus in the system as a result of quantitative easing and low-interest rates. The Fed has discontinued adding stimulus in the form of bond purchases and has begun raising rates, but real rates are still negative, and the mopping up of money injected into the system is scheduled and will follow a slow timeline.

Consumers are still spending. Retail sales for April rose a seasonally adjusted 0.9% in April. Demand is strong for most goods and services, especially those involving leisure activities. With the consumer still looking to spend, the markets may hold up well.

Bearish Position

Fed Chair Jerome Powell gave a talk yesterday at the Wall

Street Journal’s Future of Everything Festival. During his talk, he discussed his resolve to bring down the 40-year high inflation rate and bring it in line with their 2% target range. He admitted that the landing might be bumpy, but he believes it can be done without causing a recession. A recession is generally defined as two consecutive quarters of negative growth (GDP). We are now halfway through the second quarter of the year. The first quarter, which came off a very strong 4th quarter, showed the economy had negative growth of 1.6%. So we may already be in a recession. If job growth falters, it will become a problem.

The Fed is raising rates and draining stimulus with an eventual target of 2% inflation. This would seem to argue for aggressively applying of the economic brake pedal.

Higher rates increase costs for businesses that borrow money and slow down purchases for households that were planning on making a purchase on credit. For businesses, higher rates could cut into profits, and households may decide to curtail purchases because of the high cost of money (borrowing costs).

Take-Away

By definition, it is premature to call this market a bear market, yet it has ceased to be a bull market. On up days, the bulls come out in force and have driven the markets up by 2% or more in a trading session. This shows that there are many positive participants buying in at these lower prices. The bearish sentiment is in large part based on future expectations, not economic reports. The feeling is based on previous Fed tightenings and the heightened probability of entering a recession.

This market has continued to surprise over the previous decade, and the future won’t be any different. In addition to overall growth or recession, there is the potential for a rolling recession. This could play out where it affects companies that rely on low interest rates such as housing, while at the same time those that still prosper while the job market is good and continues to grow. Examples of this are sectors where people spend disposable income on things such as leisure, entertaining, or clothing. In the meantime, the bulls and bears are thrashing to determine how 2022 will play out in the markets.

Managing Editor, Channelchek

Suggested Content

Protecting Portfolios from Losses While Capturing Gains

|

Finding Tomorrow’s Best Stocks Beneath a Cloak of Invisibility

|

Where are Consumers Most Likely to Spend Their Leisure Budget?

|

Asset Classes that Perform Best and Worst with Negative Real Interest Rates

|

Sources

https://www.bea.gov/data/gdp/gross-domestic-product

Stay up to date. Follow us:

|