Image Credit: Ron Frazer (Flickr)

Future for Lithium Prices Looks Strong Due to Expected Demand Growth for EVs

The electric vehicle (EV) and li-ion battery materials sectors are moving through what may become reminiscent of the decades of growing demand we’ve experienced for chips and computers. The current surge in EV sales has helped push lithium prices to their highest level in three years. Investors taking positions in battery materials, rather than the result of the technology, can avoid trying to pick specific winners if the entire li-ion EV sector grows. Here are a few basics to be aware of if you’re looking at lithium.

Lithium-ion batteries are a key component of electric vehicles. According to an article in Reuters, lithium prices have risen to their highest in more than three years due to a surge in electric vehicle sales and depleting stocks of the battery metal in China. Year-to-date, lithium carbonate prices in China have risen significantly, with futures prices for lithium carbonate 99% Min China up from CNY$48,500 (US$7,498) per tonne at the end of 2020 to CNY$148,000 (US$22,881) per tonne on September 17. Lithium carbonate 99.5% Min China rose from CNY$52,500 (USD$8,117) at the end of 2020 to CNY$153,000 (US$23,654) on September 17. Since June 30, the prices of each have risen 85% and 76%, respectively. Equities have followed and we note that companies like Piedmont Lithium, Cypress Development, and Albemarle are up 87%, 62%, and 49% in price, respectively, on a year-to-date basis through September 17.

A Few Terms to Keep in Mind

Electric vehicle batteries use lithium carbonate or lithium hydroxide, but the industry typically cites volumes in terms of lithium carbonate equivalent. Lithium is sourced from lithium clays, metallic brines stored in man-made ponds predominantly in the desert regions of South America, and spodumene ore via hard rock mining. Producing lithium carbonate or spodumene concentrate entails different processes and cost structures. Some take it a step further by producing lithium hydroxide, which generally sells at a higher price than lithium carbonate and is preferred by some EV battery manufacturers because it increases the performance of the battery. Cypress Development Corp. provides several informative slides in their corporate presentation summarizing lithium deposit types and current lithium demand, sourced from Benchmark Mineral Intelligence.

|

Pictured Above: Automobili Estrema (Italian) is a marque soon to become known for extreme technology and performance in the hypercar universe. The Fulminea is the first automobile to use a new hybrid battery pack of lithium-ion cells with solid-state electrolyte and ultracapacitors that power 4 motors with a total output of 2,040 hp. The Fulminea will supposedly reach 200 mph in less than 10 seconds. It will be priced for the European market at the equivalent of $2.38 million |

More Investment Needed

More investment in lithium production is needed to meet future needs of the electric supply chain and to avoid production disruptions like have recently been experienced due to chip shortages. Given the opportunity set, there will likely be new entrants in the lithium space in addition to mergers and joint ventures. On September 16, Sibanye Stillwater Limited announced a joint venture with Ioneer Limited where Sibanye would contribute US$490 million for a 50% interest in Ioneer’s Rhyolite Ridge Lithium-Boron project in Nevada. The joint venture represents Sibanye Stillwater’s third announced transaction in the battery materials sector which it views as a vehicle for value creation and growth in the U.S. battery metals supply chain.

Take-Away:

It is still early days in the electric vehicle and battery materials sectors. Much like the demand for chips and computers did for Silicon Valley, companies that participate in and form the supply chain for electric vehicles could be winners much like Intel, Microsoft, and Apple were in the 1970s and 1980s. For that matter, the same could be said for innovative companies that lead the way to a low carbon future.

Suggested Reading:

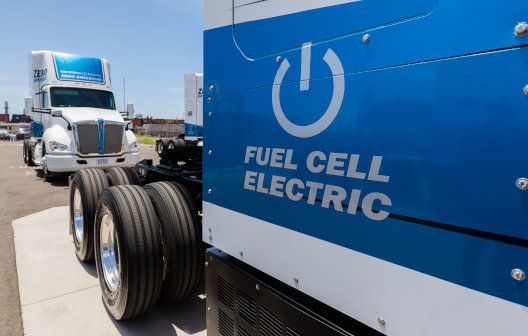

Lithium Batteries vs Hydrogen Fuel Cells

|

The High Growth of ESG Investing can Reduce Adherence to Principles

|

Clean vs Dirty Electrons on Power Grid

|

The Increasing Popularity of Uranium Investments

|

Sources:

Surge

in Electric Vehicle Sales Power Lithium Prices as Shortages Loom, Reuters, Zandi Shabalala, September 13, 2021.

Lithium

Price Rally Accelerates in September, Mining.com, Staff Writer, September 17, 2021.

All Lithium Is Not Created Equal. Hydroxide vs. Carbonate, Lithium 101, Piedmontlithium.com, Piedmont Lithium Inc.

What

is the Difference Between Lithium Carbonate & Lithium Hydroxide, FAQs, Bisley International, February 14, 2021.

Building

batteries: Why Lithium and Why Lithium Hydroxide, Innovation News Network, February 4, 2021.

Clayton

Valley Project, Nevada, An Advanced Stage LITHIUM Company, Corporate Presentation, Cypress Development Corp., September 2021.

Sibanye-Stillwater

and Ioneer to establish a 50:50 joint venture with respect to Ioneer’s US-based

Rhyolite Ridge Lithium-Boron project, Press Release, Sibanye Stillwater Limited, September 16, 2021.

Stay up to date. Follow us:

|