Image Credit: Patrick Feller (Flickr)

Michael Burry’s Investments in Health, Bombs, and Bars

Michael Burry’s investing genius was brought to the world’s attention in the movie The Big Short. When the hedge fund manager’s insight and brilliance became known, investors made a practice of checking the latest transactions from his company, Scion Capital Management, on its 13F quarterly filing. His latest filing shows that he scaled down his stock holdings considerably. In fact, when compared to the previous quarter, Burry’s holdings of public companies went from 22 to just 6.

It’s safe to say Burry’s investment universe is broader than the average self-directed investor and even deeper than the average hedge fund manager. With this in mind, out of the entire universe of publicly held corporations he could hold, there are only six that Burry’s portfolio owned at the end of the third quarter. Of the six, two are large-cap household names, and the others have smaller market-caps and are far less known. It’s on the lesser-known opportunities that we’ll focus.

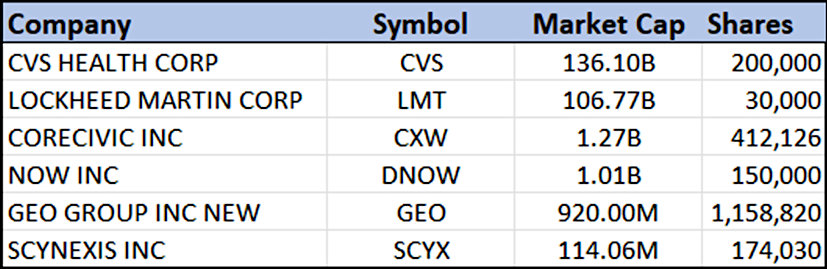

SCION ASSET MANAGEMENT, LLC – Q3 2021 (per 13F filing)

Sources: Whale Wisdom / Channelchek

The two large-cap names, CVS Health (CVS) and Lockheed Martin (LMT) shouldn’t need an introduction. CVS operates retail and mail-order pharmacies. Lockheed Martin is a defense contractor that builds military satellites, missile control systems, mission systems, and aeronautics. As for the four smaller companies, there are two prison systems, a health care company, and a distributor of oil and gas services. These are the four out of the thousands of publicly traded stocks available to Dr. Michael Burry that we will explore further.

Burry’s Small-Cap and Microcap Holdings

CoreCivic (CXW) is a company that owns and manages private prisons and detention centers along with related concessions. CoreCivic is a publicly owned prison system that was trading as a REIT up until January 2021, it now trades as a Regular C-Corporation.

In a research report dated January 11, 2022, titled A

Significant Win Noble Capital Markets Senior Research Analyst, Joe Gomes we learn that CoreCivic is one of the largest private owners of real estate used by U.S. government agencies. The Company owns 15 properties representing nearly 2.7 million square feet of real estate, all used by government agencies.

Shortly after being inaugurated, President Biden signed an executive order directing the attorney general to not renew Justice Department contracts with privately operated criminal detention facilities. The company has been proactive in pivoting to adjust to the changing operating landscape. The company’s initial steps are discussed in an exclusive Channelchek

Virtual Roadshow.

CoreCivic’s 52-week price range is $5.92-$12.35.

NOW Inc. (DNOW) is a global distributor to the oil and gas markets. It does business under the brands DistributionNOW and DNOW. The Company operates approximately 130 locations in the U.S., and 40 locations in Canada, plus nearly 20 other countries. NOW’s energy product offerings are used in the oil and gas industry, including upstream drilling and completion, exploration and production, midstream infrastructure development, and downstream petroleum refining. They also operate in related industries such as chemical processing, power generation, and industrial manufacturing operations. NOW provides supply chain management to drilling contractors, E&P operators, midstream operators, downstream energy, and industrial manufacturing companies.

DNOW’s 52-week price range is $6.83-$11.98.

GEOGroup (GEO) is another correctional facility play that specializes in the ownership, leasing, and management of correctional, detention, and reentry facilities as well as community-based services and youth services in the United States, Australia, South Africa and the United Kingdom. The Company owns, leases and operates a range of secure facilities, including maximum, medium, and minimum-security facilities, processing centers, as well as community-based reentry facilities. It also offers delivery of offender rehabilitation services under its GEO Continuum of Care platform.

In a research report dated January 11, 2022, titled What Do The

Debt Negotiations Reveal?, Noble Capital Markets Senior Research Analyst Joe Gomes updates investors on the company including a section on GEO’s monitoring business called BI. The analysts calls BI “a hidden gem.” Gomes explains GEO is a market leader in the monitoring business with over 2,000 active contracts and a 98% customer retention rate. He presents the value this way, “BI is the largest producer of electronic monitoring devices and has developed an unrivaled platform of monitoring, case management, and supervisory services. Since 2015, BI has generated a 12% CAGR in revenue and should end 2021 with about $260 million of revenue. With many clients seeking an alternative to detention for low-risk offenders, we believe there remains substantial growth potential in this business.”

GEO’s 52-week price range is $4.96-$11.

SCYNEXIS Inc. (SCYX) is a drug development company focusing on the commercialization of novel anti-infectives to address what they see as a significant amount of unmet therapeutic needs. The company engages in developing a lead product candidate, SCY-078, which is a novel oral and intravenous (IV) drug for the treatment of several fungal infections, including serious and life-threatening invasive fungal infections. According to information found under the company ticker on Channelchek, it is a structurally distinct triterpenoid glucan synthase inhibitor that is effective in vitro and in vivo against a broad range of Candida and Aspergillus species, including drug-resistant strains.

SCYNEXIS’ 52-week price range is $4.21-$10.25.

Take-Away

Dr. Burry has an excellent record of spotting investment opportunities before the rest of the market catches up. His picks are as disparate as the mortgage market in 2008 and GameStop (GME) in 2020. Burry will typically see what others are not looking at. One-third of his public company holdings are prison and detention center related. Does he believe the industry is beaten up and will rise, does he think the real estate or other assets owned are valuable beyond the stock price, perhaps something else? The research reports for both CXW and GEO may provide more insight.

One of his other two small company holdings, DNOW, is an oil and gas distributor. This is another industry that would appear to have substantial government policy headwinds. The last, SCYX, develops drugs to fight off fungus infections. It is a microcap company that is the smallest of the six that Burry committed capital to.

Managing Editor, Channelchek

Suggested Content

CoreCivic C-Suite Interview (Video)

|

Biden Signs Executive Order to End Use of Private Prisons by BoP

|

Michael Burry vs Cathie Wood is Not an Even Competition

|

Is the Index Bubble Michael Burry Warned About Still Looming?

|

Sources

https://whalewisdom.com/filer/scion-asset-management-llc#

https://www.youtube.com/watch?v=URBOifP8EDY

Stay up to date. Follow us:

|