The Hottest Stock Sectors and Segments

May’s stock market performance will hinge on a number of questions investors may get answers to during the month. What they’re waiting to learn is: Will we see a tick up in inflation? If the 2% inflation target set by the Fed is exceeded, will they act and begin to throw cold water on the strong stock market rally? Will there be a reduction in lockdowns throughout the world? How will the pandemic linger through 2021? Will tax increases, including a capital gains tax, impact stocks? Will inflation take root and begin to force the Fed to choose between subdued growth or higher prices (both negative)?

The fear-of-missing-out (FOMO) investors were rewarded in April. There has been a bit of shift in which sectors are showing strength year-to-date as larger companies have not performed at the levels they had relative to smaller capitalized companies that took the stage. The shift in emphasis on smaller companies and recovery industries makes sense coming off a year where mega-cap stocks and covid-19 related companies reigned

Looking Back

April had investors eyeballing two competing market movers; the first was the sign of a substantial economic rebound in the U.S. and elsewhere, the second was worsening Covid-19 cases outside of the U.S. that lessen the chance of global recovery. Strong corporate earnings helped improve major indexes propelling them higher during the first full month of Q2.

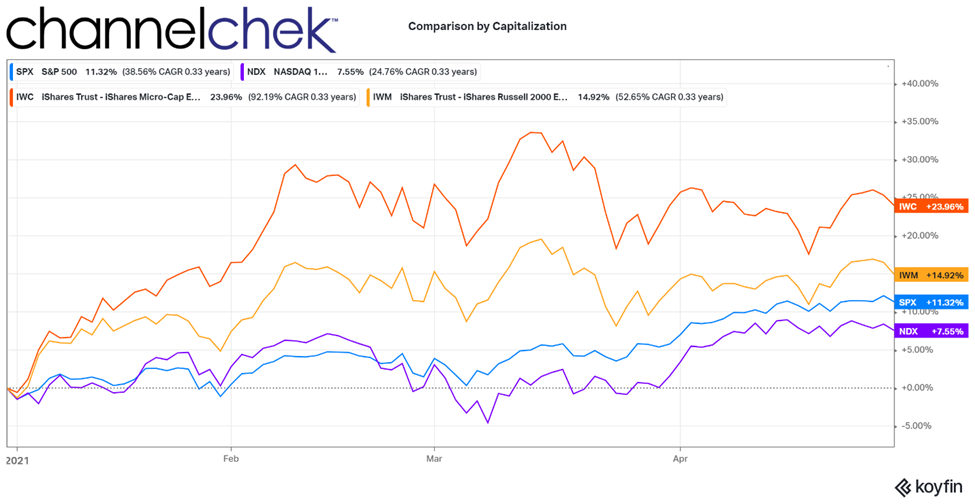

So far in 2021, the Nasdaq 100 has increased by 7.55%, which is nothing to sneeze at, but it has been outdone by the S&P 500, which grew by 11.32%, the small-cap Russell 2000, which has returned 14.92%, and the microcap Russell 1000 which has returned 23.96% beating the indexes of larger stocks.

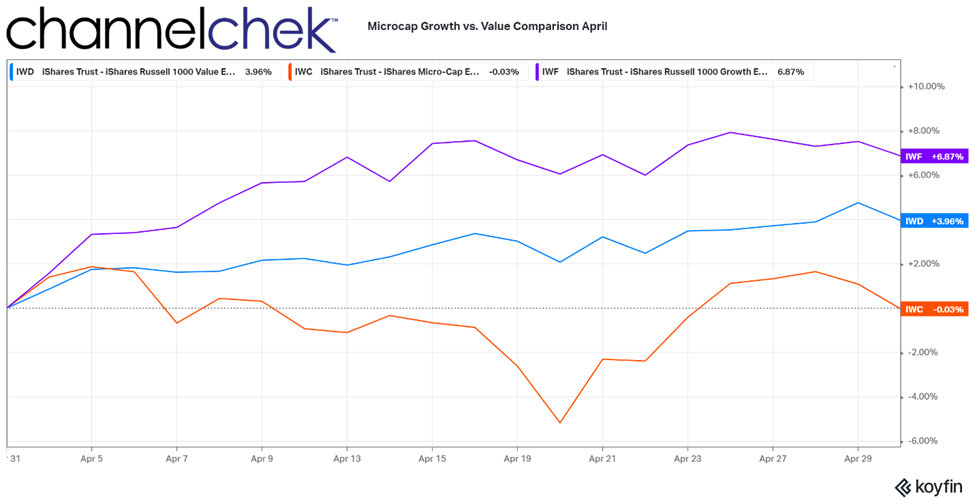

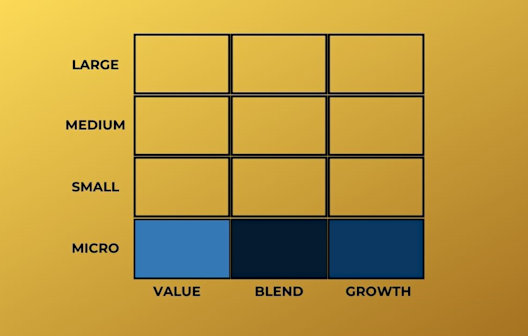

Within 2021’s strongest sector by market cap, microcap growth stocks in April returned 6.87%, outperforming the overall microcap sector as measured against the Russell 1000 which returned 3.96%, and microcap value experienced a decline of .03%.

Take-Away

The market is nervous. The large and mega-cap sectors, although in or near record territory are not seeing the same momentum. Interest rates are on everyone’s mind despite the Fed being adamant about their resolve to keep levels low. There is some fear that holding rates below where they may naturally want to trade is setting us up for a bubble situation where all assets become less in favor as money becomes more expensive. There is no clear sign of a complete global economic reopening, India has backtracked and even the Biden administration has extended rules on masks into the Summer.

The world is now fully into the second year of managing a pandemic, we experience new situations every week and are beginning to find ourselves in a period where yesterday’s stocks to avoid are today’s stocks to buy and visa versa. There is a long list of stocks that were beaten up during the pandemic and those businesses that flourished during the height. Looking at further reversals in this list may be a good place to start to project the next winners and losers as we steer out of the state of emergency we placed ourselves into.

Suggested Reading

|

|

Why Elevated Employment Isn’t Hurting Stocks

|

What Stocks do You Buy When the Dollar Goes Down?

|

|

|

Managing Investment Portfolio Risk

|

The Asset Allocation Role of Microcap Stocks

|

Photo Credit: Marco Verch

Stay up to date. Follow us:

|

|

|

|

|

|

Stay up to date. Follow us:

|

|

|

|

|

|