Image Credit: Natasha Chabanoo (Pexels)

Phase I Research Findings on a US Central Bank Digital Currency Released by Federal Reserve

The Federal Reserve Bank of Boston and the Digital Currency Initiative at the Massachusetts Institute of Technology have released the findings of their initial technological research into a central bank digital currency, or CBDC. The published research describes a theoretical high-performance and resilient transaction processor for a CBDC that was developed using open-source research software, OpenCBDC. This collaborative effort, known as Project Hamilton, focuses on technological experimentation and does not aim to create a usable CBDC for the United States. The research is separate from the Federal Reserve’s Board’s evaluation of the pros and cons of a CBDC.

“It is critical to understand how emerging technologies could support a CBDC and what challenges remain,” said Boston Fed Executive Vice President and Interim Chief Operating Officer Jim Cunha. “This collaboration between MIT and our technologists has created a scalable CBDC research model that allows us to learn more about these technologies and the choices that should be considered when designing a CBDC.”

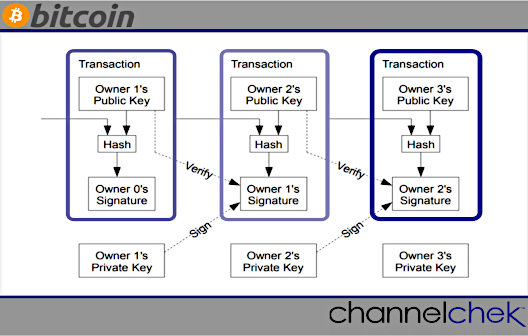

The whitepaper released today details findings from the first research phase. In this phase, researchers selected concepts from cryptography, distributed systems, and blockchain technology to build and test platforms that would give policymakers substantial flexibility in the potential creation of a CBDC. The paper describes the following findings:

- The team met its goal of creating a core processing engine for a hypothetical general purpose CBDC and explored it in two architectures.

- The work produced one code base capable of handling 1.7 million transactions per second.

- The vast majority of transactions reached settlement finality in under two seconds within architectures that support secure, resilient performance and offer the significant technological flexibility required to adjust to future policy direction.

Researchers with MIT and the Boston Fed released the code for Project Hamilton, OpenCBDC, in github for contributions.

“There are still many remaining challenges in determining whether or how to adopt a central bank payment system for the United States,” said Neha Narula, director of the Digital Currency Initiative at MIT. “What is clear is that open-source software provides an important way to collaborate, experiment, and implement. In addition to supporting collaboration, monetary systems benefit from transparency and verifiability, which open-source offers.”

About Project Hamilton

Project Hamilton is a multi-year collaboration between the Boston Fed and MIT’s Digital Currency Initiative that was announced in 2020. The project explores the use of existing and new technologies to build and test a hypothetical digital currency platform. The project’s first phase produced the research and code released today for a high-performance transaction processor. The code is the first contribution to OpenCBDC, a project maintained by MIT which will serve as a platform for further CBDC research. Project Hamilton aims to inform future contributions to the code and inform policy discussions about CBDC.

In the coming years, the second phase of this partnership will allow Project Hamilton to explore alternative technical designs to improve the already robust privacy, resiliency, and functionality of the technology outlined in the first phase.

The Federal Reserve Bank of Boston serves the First Federal Reserve District, which includes all of New England except Fairfield County, Connecticut. Within the district, the Bank monitors local economic conditions to aid in the formulation of monetary policy; engages in outreach to promote economic growth, community revitalization, and economic and financial education; supervises banks and bank holding companies; and provides financial services to facilitate banking operations.

|

The above report was released by the Federal Reserve Bank of Boston on February 3, 2022 under the title: “The Federal Reserve Bank of Boston and Massachusetts Institute of Technology release technological research on a central bank digital currency”. All links throughout the report are provided by the authors. |

Suggested Reading

Cryptocurrencies in 2022, a View from Academics

|

Blockchain 2022 – What’s Next?

|

Has Bitcoin Lived Up to the Original Vision

|

How Close is the U.S. to Having a Digital Currency?

|

Source

https://www.bostonfed.org/news-and-events/press-releases/2022/frbb-and-mit-open-cbdc-phase-one.aspx

Stay up to date. Follow us:

|