CanAlaska Deals Manibridge Nickel Project in Thompson Nickel Belt Manitoba

D Block Discoveries has Staged Option to Earn up to 100% Interest; CanAlaska to be Initial Project Operator

Focus on Advancing High-Grade Sulphide Nickel Discovery

Vancouver, Canada, March 30, 2021 – CanAlaska Uranium Ltd. (TSX-V: CVV; OTCQB: CVVUF; Frankfurt: DH7N) (“CanAlaska” or the “Company”) is pleased to announce that it has entered into a Letter of Intent (“LOI”) with D Block Discoveries Inc. (“DBD”), a private company wholly owned by Ore Group Inc., to allow DBD to earn up to 100% interest in CanAlaska’s 100%-owned 4,368 hectare Manibridge Nickel Project in Manitoba, Canada (the “Project”) (Figure 1).

DBD may earn up to a 100% interest in the Project by undertaking work and payments in three defined earn-in stages. DBD may earn an initial 49% interest (“Stage 1”) in the Project by paying the Company $30,000 cash, issue $275,000 worth of common shares and incur $500,000 in exploration expenditures on the Project within 12 months of TSX Venture Exchange approval date. DBD may earn an additional 21% interest (“Stage 2”) in the Project by paying to the Company a further $50,000 cash, issue a further 1,500,000 common shares in DBD, and incur an additional $1,500,000 in exploration expenditures on the Project within 12 months of entering the Stage 2 option. DBD may earn an additional 30% interest (“Stage 3”) in the Project by paying to the Company a further $100,000 cash, issue a further 5,000,000 common shares in DBD, and incur an additional $2,000,000 in exploration expenditures on the Project within 24 months of entering the Stage 3 option.

After successful completion of either of Stage 1 or Stage 2 of the option agreement, and if DBD elects to not enter the final stage, a joint venture will be formed and the parties will either co-contribute on a simple pro-rata basis or dilute on a pre-defined straight-line dilution formula. A summary of the various stages is contained in Table 1.

During Stage 1 and Stage 2 of the option agreement, CanAlaska will be operator of the Project. DBD will have sole voting rights on exploration programs while sole funding at the various option stages and will have the right to assume operatorship after successfully earning 70% interest in the Project (Stage 2).

As part of completing the Stage 1 option, DBD will grant to CVV a 1% Net Smelter Return (NSR) royalty on claims P1271F and P1272F, and a 2% NSR royalty on all other claims.

Table 1: Summary of Option Stages

| Option Stage | DBD Interest Earned (%) |

Cash Payment ($) |

DBD Shares Issued |

Exploration Expenditure ($) |

Timeline (months) |

| On signing | 15,000 | ||||

| On CPC merger | 15,000 | $100,000 eq. | On TSX Approval | ||

| Stage 1 | 49 | $175,000 eq. | 500,000 | 12 | |

| Stage 2 | 21 | 50,000 | 1,500,000 | 1,500,000 | 12 |

| Stage 3 | 30 | 100,000 | 5,000,000 | 2,000,000 | 24 |

| Totals | 100 | 180,000 | 6,500,000* | 4,000,000 | 36 |

*Does not include the $275,000 worth of share issuance

Manibridge Nickel Project

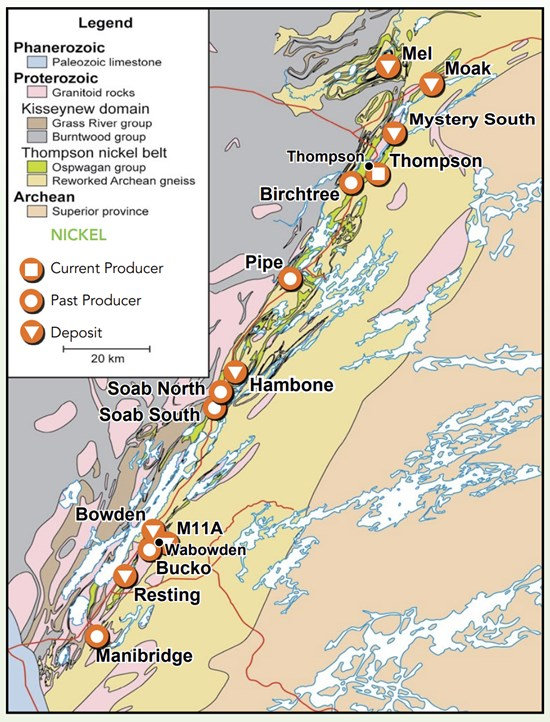

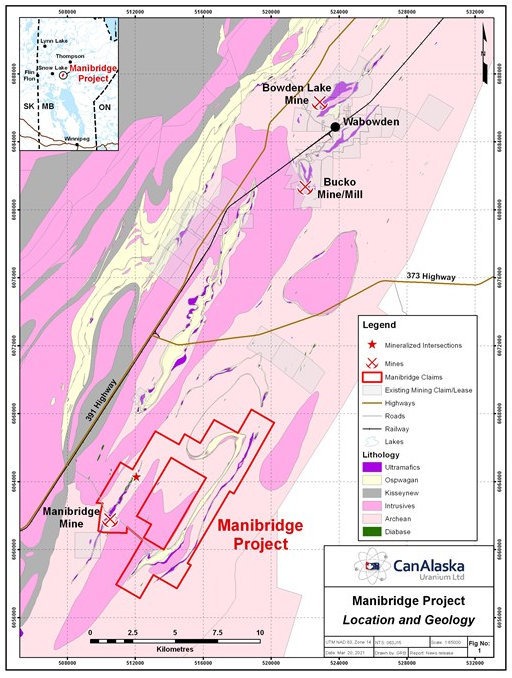

The Manibridge nickel deposit was discovered in 1963 by Falconbridge (as Glencore was then named) following up on coincident magnetic and electromagnetic anomalies that were thought to be caused by an ultramafic body. The second hole of the program intersected the fringes of what would become the Manibridge Mine. Sulphide nickel mineralization is hosted within an elongate, folded ultramafic body that extends for at least 3.2 kilometres with nickel-bearing sulphide mineralization throughout (Figure 1). The Manibridge nickel deposit is located within the core of a major fold axis with up to ten sulphide lenses that conform to the fold pattern and plunge to depths in excess of 380 metres.

A production decision was made in 1969 on an initial mineral inventory of 1,409,000 tons (including 15% dilution) at an average grade of 2.25% nickel and 0.27% copper to a depth of 380 metres. The mine was operational from 1971 to 1977 with concentrate shipped to both Sudbury, Ontario and Thompson, Manitoba. Mining occurred to a depth of 300 metres and the mine infrastructure has since been reclaimed.

Manibridge Project – Location and Geology Map

In 2007, Crowflight Minerals Inc. and Pure Nickel formed a 50-50% joint venture to explore the Manibridge claims. The 2008 exploration program intersected two new zones of nickel mineralization within 400 metres of the Manibridge deposit. Further drilling confirmed the extension of the mineralization below the mine workings. The most significant results from drill holes MN08-01, MN08-02 and MN08-04 respectively include: 16.75 metres (55 feet) @ 1.38% Ni; 5.45 metres (17.9 feet) @ 1.18% Ni; and 6.3 metres (20.7 feet) @ 1.37% Ni.

In 2019 a 800 metre drill program completed by CanAlaska 2.5 kilometres north along the mine trend intersected a broad fold structure that included multiple high-grade nickel assays up to 12.06% nickel,

CanAlaska President, Peter Dasler, comments, “CanAlaska is pleased to be able to work with D-Block’s entrepreneurial group, and management is looking forward to operating the next exploration programs and new discoveries at Manibridge, as well as being exposed to the new company’s other exploration interests.”

About D Block Discoveries

D Block Discoveries Inc. is privately held wholly owned private company controlled by Ore Group Inc. DBD controls the Strange Nickel Project, an 11,000-hectare, drill permitted nickel, copper, PGE exploration property west of Thunder Bay, Ontario. DBD is planning its going public process for listing on the TSX Venture Exchange in the near term. Further information can be found at DBD’s website.

Other News

CanAlaska is currently conducting drilling at its 100% owned Waterbury Uranium project in the Athabasca Basin near the Cigar Lake uranium mine. The Company is also awaiting drill results from its Mouse Mountain copper property in British Columbia, and drilling permits for the Strong nickel project in Manitoba.

About CanAlaska Uranium

CanAlaska Uranium Ltd. (TSX-V: CVV; OTCQB: CVVUF; Frankfurt: DH7N) holds interests in approximately 214,000 hectares (530,000 acres), in Canada’s Athabasca Basin – the “Saudi Arabia of Uranium.” CanAlaska’s strategic holdings have attracted major international mining companies. CanAlaska is currently working with Cameco and Denison at two of the Company’s properties in the Eastern Athabasca Basin. CanAlaska is a project generator positioned for discovery success in the world’s richest uranium district. The Company also holds properties prospective for nickel, copper, gold and diamonds. For further information visit www.canalaska.com.

The qualified technical person for this news release is Dr Karl Schimann, P. Geo, CanAlaska director and VP Exploration.

On behalf of the Board of Directors

“Peter Dasler”

Peter Dasler, M.Sc., P.Geo.

President & CEO

CanAlaska Uranium Ltd.

Contacts:

Peter Dasler, President

Tel: +1.604.688.3211 x 138

Email: [email protected]

Cory Belyk, COO

Tel: +1.604.688.3211 x 138

Email: [email protected]

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-looking information

All statements included in this press release that address activities, events or developments that the Company expects, believes or anticipates will or may occur in the future are forward-looking statements. These forward-looking statements involve numerous assumptions made by the Company based on its experience, perception of historical trends, current conditions, expected future developments and other factors it believes are appropriate in the circumstances. In addition, these statements involve substantial known and unknown risks and uncertainties that contribute to the possibility that the predictions, forecasts, projections and other forward-looking statements will prove inaccurate, certain of which are beyond the Company’s control. Readers should not place undue reliance on forward-looking statements. Except as required by law, the Company does not intend to revise or update these forward-looking statements after the date hereof or revise them to reflect the occurrence of future unanticipated events.