FenixOro Commences Drilling on Highly Prospective Southeast Block

Research, News, and Market Data on FenixOro Gold

TORONTO, Jan. 19, 2022 (GLOBE NEWSWIRE) — FenixOro Gold Corp (CSE:FENX, OTCQB:FDVXF, Frankfurt:8FD) is pleased to announce that a second drill has been mobilized to begin exploration drilling on the highly prospective southeast block.

- The southeast block has a principal significant soil anomaly that is 600 m long of greater than 1 g/t gold-in-soils. In drilling to date, soil anomalies have been an excellent indicator of the presence of high-grade gold bearing structures where there are no visible outcrops on surface.

- The southeast block hosts the highest-grade channel sample on the entire project, 146 g/t gold taken from inside an historic artisanal mine

- Veins in the Southeast block are exposed at an elevation of nearly 2800 m, adding at least 400 m of additional vertical potential to the scale of the deposit

- Veins in the southeast have a significantly higher silver content than in the northern block, adding another potentially interesting element

- Specific targets in the southeast license include a series of northwest and east-west trending gold bearing veins that appear similar in scale to those in the north

FenixOro VP Exploration Stuart Moller stated: “We are very excited to be back in pure exploration mode in the southern block on some of the most highly prospective locations at Abriaqui. Preliminary exploration data is extremely promising and has generated very large target areas which we know have historically produced high grade gold. With two drills now operating, both the rate of drilling and the frequency of assay results will be increasing. We certainly have a very busy and exciting first half of the year in front of us.”

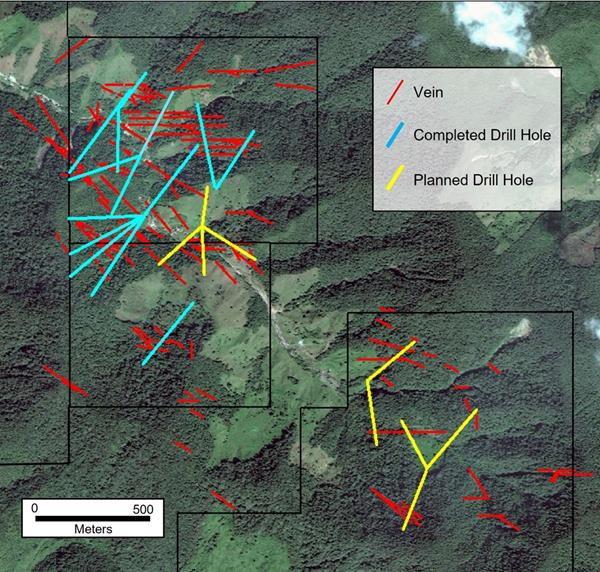

This next phase of drilling will focus on reconnaissance scale drilling of all new targets. As shown in Figure 1, a pattern of four holes will test a series of NW and E-W trending veins near the currently drilled area. Several of these veins have 20+ g/t gold assays in shallow mine workings. A second pattern of holes one kilometer to the southeast will provide the first drill test of a second group of highly prospective veins. Soil sampling indicates that there may be significantly more veins in the area than are shown on the figure and that the largest may be more than 600 meters in strike length. The veins are exposed at a higher elevation than those to the northwest (an average of 2500 meters vs. 2100 meters) giving them a minimum one vertical kilometer of mineralization potential. The geochemical signature in the area is different with the equally high grade gold being accompanied by significantly higher silver (silver/gold ratio of 16 vs. 1.5) with higher copper and lead.

Figure 1. Currently completed 7000+ meters of drilling (blue) and planned early 2022 drill plan (yellow).

To date, the 15 holes totaling more than 7000 meters of drilling at Abriaqui have focused on evaluation of the dozens of veins in the northwestern part of the property (Figure 1). Two main corridors of northwest and east-west trending veins have been delineated by mapping, soil sampling, ground magnetics, and diamond drilling. The most significant veins in the northwest corridor appear to have continuous gold mineralization along 500–800 meters of strike and a minimum of 700 vertical meters and all veins are open at depth. Thickness in these principal veins ranges up to 15-20 meters and gold grades range from 2-20+ g/t with a silver/gold ratio of about 1.5/1. These main families of veins in the northwest have been drilled at an average 200 meter spacing along strike and their geometry is fairly well understood.

Technical Information

Stuart Moller, Vice President Exploration and Director of the Company and a Qualified Person for the purposes of NI 43-101 (P.Geo, British Colombia), has prepared or supervised the preparation of the technical information contained in this press release. Mr. Moller has more than 40 years of experience in exploration for precious and other metals including ten in Colombia and is a Fellow of the Society of Economic Geologists.

Drill core sampling is done in accordance with industry standards. The HQ and NQ diameter core is sawed, and half core samples are submitted to the laboratory. The other half core along with laboratory coarse reject material and sample pulps are stored in secure facilities on site and/or in the sample prep lab. Following strict chain of custody protocols, the samples are driven to the ISO 17025:2017 certified ALS Laboratory sample preparation facility in Medellin and ALS ships the prepared pulps to their assay laboratory in Lima, Peru. Blanks, duplicates, and certified reference standards totaling 15% of the total samples are inserted into the sample stream. To date, no material quality control issues have been detected. Gold is analyzed by fire assay with 50 gram charges for grades in excess of 10 grams per tonne and the additional elements are analyzed by ICP with appropriate follow-up for over-limits.

Reported grade intervals are calculated using uncut gold values. Maximum sample length is one meter. Intervals which include multiple samples are calculated using the full geologic interval of mineralization and are not subject to specific rules for cutoff grades and internal low grade. As such, quoted thickness and grade of these intervals do not necessarily represent optimized economic intervals in a potential future mine. Reported sample and interval widths are based on lengths of individual samples in core and do not necessarily represent true widths of mineralization. True widths will sometimes be less than the quoted interval lengths.

There are currently no NI 43-101 compliant resources or reserves in the project area. The analysis of drill results is intended to estimate the potential for future resources which will require significant additional drilling to define.

About FenixOro Gold Corp.

FenixOro Gold Corp is a Canadian company focused on acquiring and exploring gold projects with world class exploration potential in the most prolific gold producing regions of Colombia. FenixOro’s flagship property, the Abriaqui project, is located 15 km west of Continental Gold’s Buritica project in Antioquia State at the northern end of the Mid-Cauca gold belt, a geological trend which has seen multiple large gold discoveries in the past 10 years including Buritica and Anglo Gold’s Nuevo Chaquiro and La Colosa. As documented in “NI 43-101 Technical Report on the Abriaqui project Antioquia State, Colombia” (December 5, 2019), the geological characteristics of Abriaqui and Buritica are similar. The report also documents the high gold grade at Abriaqui with samples taken from 20 of the veins assaying greater than 20 g/t gold. Since the preparation of this report a Phase 1 drilling program has been completed at Abriaqui following surface and underground geological mapping and sampling, as well as a magnetometry survey.

FenixOro’s VP of Exploration, Stuart Moller, led the discovery team at Buritica for Continental Gold in 2007-2011. At the time of its latest public report, the Buritica Mine contains measured plus indicated resources of 5.32 million ounces of gold (16.02 Mt grading 10.32 g/t) plus a 6.02 million ounce inferred resource (21.87 Mt grading 8.56 g/t) for a total of 11.34 million ounces of gold resources. Buritica began formal production in November 2020 and has expected annual average production of 250,000 ounces at an all-in sustaining cost of approximately US$600 per ounce. Resources, cost and production data are taken from Continental Gold’s “NI 43-101 Buritica Mineral Resource 2019-01, Antioquia, Colombia” (18 March, 2019). Continental Gold was recently the subject of a takeover by Zijin Mining in an all-cash transaction valued at C$1.4 billion.

Forward Looking Information

This news release contains certain forward-looking information. All statements included herein, other than statements of historical fact, are forward-looking information and such information involves various risks and uncertainties. There can be no assurance that such information will prove to be accurate, and actual results and future events could differ materially from those anticipated in such information. Specifically, this news release contains forward looking information regarding the significance of Phase 1 drill results at the Abriaqui Project, conclusions as to resource potential derived from that data set, potential results of the Phase 2 drill program, and implied assumptions as to the potential future economic viability of the gold grades and vein thicknesses reported. There can be no assurance that such information will prove to be accurate, and actual results and future events could differ materially from those anticipated in such information. Although FenixOro has no reason to believe otherwise, there can be no assurance that the planned drill program will be completed as uncertainties exist related to future project financing and future environmental permitting. Although FenixOro has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be additional factors that cause results not to be as anticipated, estimated or intended. Accordingly, readers should not place undue reliance on forward-looking information.

FenixOro Gold Corp

John Carlesso, CEO

Email: [email protected]

Website: www.FenixOro.com

Telephone: 1-833-ORO-GOLD