The Polarized Opinions Surrounding the GameStop Short Squeeze

Gamestop (GME) short-sellers have been handed a lesson in taking on a short position without a plan. At least that’s one way to look at what’s being called the most painful short-squeeze in history. But there are many ways to look at the GME short; it is as polarizing as so many other events we’ve seen in the past 24 months. Events where people line up to choose sides. This includes unaffected people, even those that still can’t explain a “short stock position” yet are vehemently arguing for or against the activities that lead to the GameStop short-squeeze.

Most of the short positions are hedge funds and other institutional investors. Those buying GameStop now at what is considered excessive prices are viewed as newbies treating the stock market as a game. The headlines, quotes, and reporting below are from various media outlets, print, TV, online video channels, bloggers, vloggers, and a few social media posts. There is a good deal of emotion surrounding this historic event, including those who cheer it and those looking to the regulators asking them to make sure this can’t happen again.

If you’re well versed in going long and short stock, skip over the next two paragraphs (show them to your less informed friends).

What is Shorting a Stock?

When an investor buys a stock, the potential for upside, in theory, is unlimited. If the price keeps rising, the cash it can put in their pocket increases as well. Speculators that expect a decline in the value of a company’s shares sell stocks they don’t own (short sale) to buy it back later at a lower price. This is known as covering their shorts. The potential for gain is finite in that it can only be as much as the initial trade’s sale price. Conversely, if the price goes up after they sold a stock in expectation of covering at a lower price, their potential for loss is as infinite as if they owned it and it kept rising.

Disciplined traders with well-defined stop-losses don’t have greater risk, whether long or short. Stock market participants that are willing to let their shorts move far against them because they are “sure” the stock will go down and that they will reap the rewards could suffer if they hold too long. If faced with further price increases, they have this difficult question, “do I close out my position, take the loss and redeploy my resources someplace else, with less than I started, or do I continue to hold the short position despite my original misjudgment?”

Davey vs. Goliath

The shorting activity that had taken root by Monday (Jan. 25) had grown tremendously Tuesday in after-hours trading after Elon Musk posted on Reddit, which fueled dramatic price moves (Musk’s company TSLA was a popular short by hedge funds last year). The message posted on the subreddit board (wallstreetbets) suggested support for the buyers; he later amplified the message on Twitter

Many news outlets first reported the GameStop stock activity as a Davey vs. Goliath story. U.S. News and World Report spread a widely distributed Associated Press article titled “Smaller Investors Face Down Hedge Funds, as GameStop Soars” The article published on Monday held the view that “A head-scratching David and Goliath story is playing out on Wall Street over the stock price of a money-losing video game retailer.” One Bloomberg article characterized the short-sellers as not motivated by greed, but instead “…engaged in an anger-driven uprising against the establishment.” The Bloomberg headline read: “GameStop is Rage Against the Financial Machine.

Political commentator Dan Bongino who is a large investor in the social media platform Parler, even had something to contribute. Parler’s fate is uncertain in their battle against Amazon and Apple, among others. Bongino put his own spin on what’s happening. In his daily podcast, The Dan Bongino Show (Episode 1444), Dan described it as “Wall Street elites in meltdown mode.” He took glee in the coordination and tactics used by the masses in what he labeled “A war of attrition between the elites and the great unwashed.”

Part of the polarizing is the natural conflict between generations. Older generations don’t always cede control as quickly as younger generations may want. In contrast, younger generations find their own methods and rules for acting in an adult world. This GME story is being reported in that way by some. A Reddit moderator of wallstreetbets titled a post, “How’d you guys manage to win so big it made these old guys drown in their tears?” It is a lengthy post that ends in this way:

“…That fuzzy sensation you are feeling is called

RESPECT, and it is well earned. Wall Street no longer dismisses your presence

anymore. The smart ones know that you guys do things differently and will adapt

in ways to accommodate you and how you as the next generation want things done.

You should all be proud of yourselves.

Your time is now.

On behalf of the Mod team,

Make that money and be the change you want to see.”

Market Manipulators to be Dealt With

The articles and support of the “small guy” flexing their collective muscles are giving way to stories describing the dangers of coordinated trading. The SEC, Nasdaq, U.S. Treasury Secretary Yellen, and even online brokerage firms discussed actions they would take.

In an opinion piece published by MarketWatch on Wednesday (Jan. 27), Jeremy C. Owens wrote, “Reddit’s WallStreetBets is really the same old story — a concerted effort of market manipulators who will get rich and surely destroy some unwitting participants in the process.”

Stock Broker TD Ameritrade blocked some trades on Wednesday in GME according to a notification received by some clients. The SEC said late Wednesday that it is monitoring the “volatility in the options and equities markets” and “working with our fellow regulators to assess the situation,” according to The Wall Street Journal.

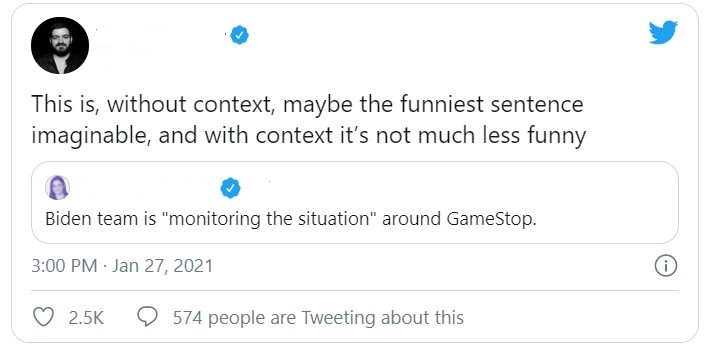

Regulators were urged in recent weeks by “tipsters” to review statements made on message boards and social media to determine whether there was fraud in plain sight. The Biden Administration’s economic team is “monitoring the situation,” White House Press Secretary Jen Psaki told reporters Wednesday afternoon regarding GameStops activity. The Securities and Exchange Commission (SEC) also released a statement Wednesday evening saying they are “aware of and actively monitoring the on-going market volatility in the options and equities markets.”

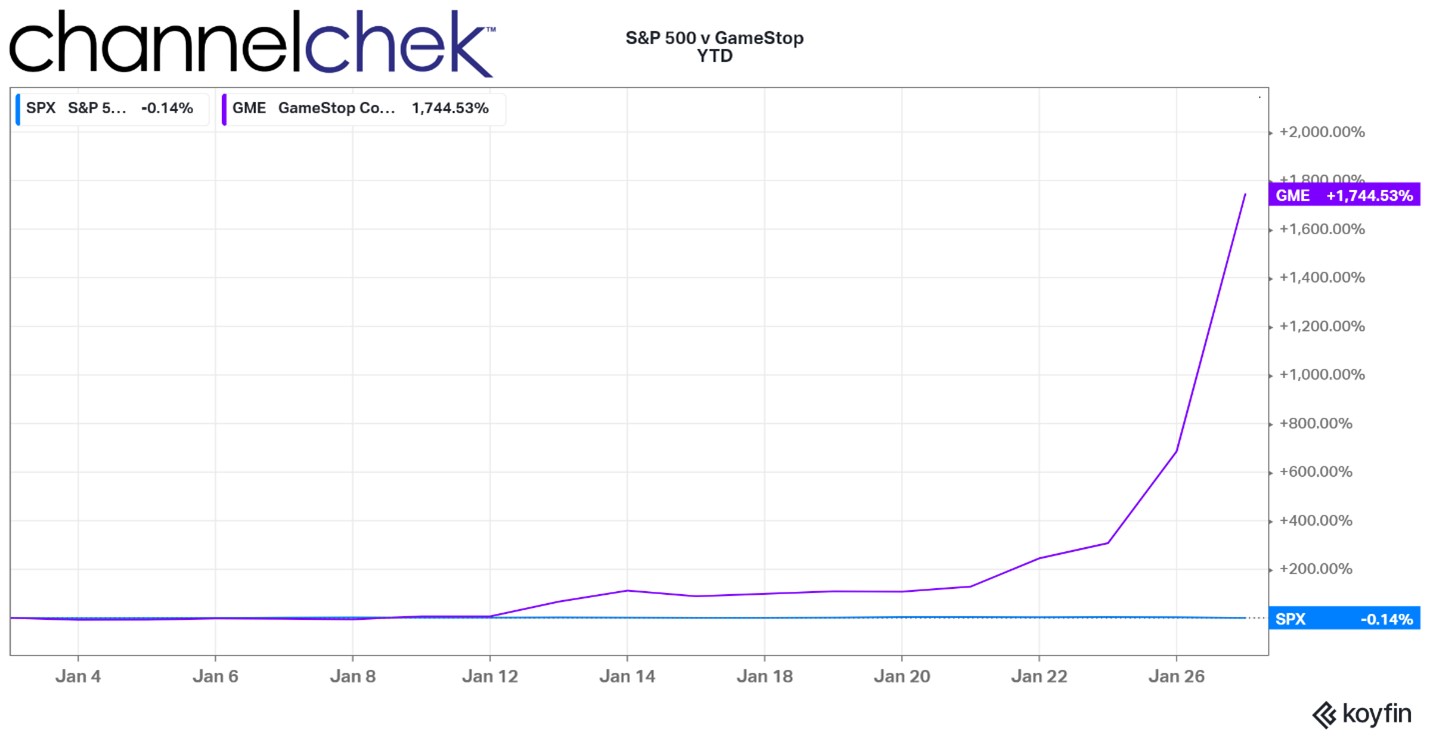

Movement in GME vs. S&P 500 since January 1, 2021

Nasdaq’s CEO Adena Friedman told CNBC Thursday they actively monitor social media chatter and will halt stock trading if the content it sees matches with “unusual activity in stocks.” Bloomberg reported that Wells Fargo had banned its advisors from making stock recommendations on GameStop.

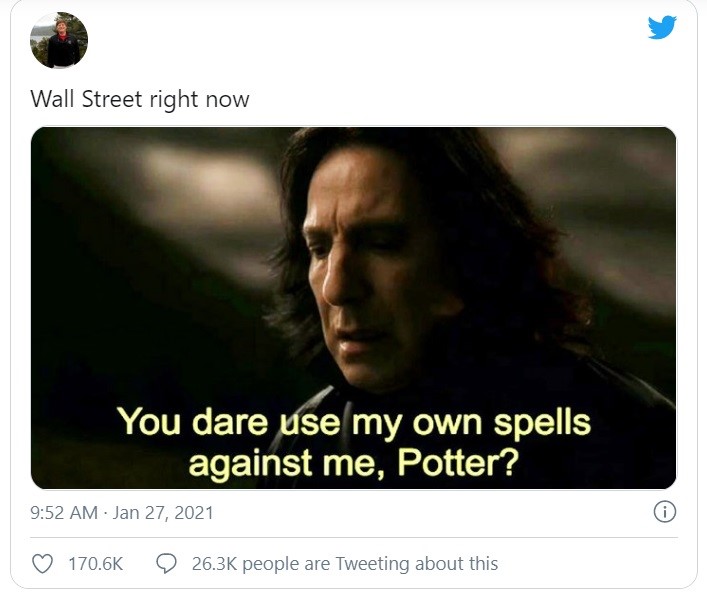

“The Internet” Weighs In

It was clear that many social media posters were also piling on — not by buying GME, but by posting memes. To be sure, many of them were not involved in the stock market but had to quickly learn in order to understand the buzz going on around them.

These Tweets are just a small sampling found on only one social media platform. The number of comments, retweets, and “Likes” measure in the hundreds of thousands.

Take-Away

Interactive Brokers Chief Strategist Steve Sosnick referred to short sellers, in general, as a “curious bunch” who profit through “courage and careful research.” But as the Reddit/GME battle continues, he warned, “many” could quickly “find themselves swamped.” Sosnick also commented that no one can withstand an investor “tsunami.” He seems to be more than aware of the skills required.

Whether or not you’re involved in Gamestop, you can use what is happening to professional money managers as a lesson and a reminder not to let losses get too far away from you. Unexpected events occur, pandemics, contango, disasters, accounting fraud, legislative changes, and competition. There is also the dreaded “tape bomb” where someone of prominence says something unexpected that unravels your reason for holding the position in the first place. Part of being in any position is having an exit plan. The reason for the exit plan is to know what to do when you were “more sober” neither cheering your gains or agonizing over losses.

It’s also a reminder of how power shifts in the market. It is only recently individuals enjoy free trades, true equity research, increased communication, and screening software. Throw in a few stimulus checks, and perhaps some power has shifted away from Wall Street for now.

Suggested Reading:

Investment

of Excess Corporate Cash

Contango,

ETFs, and Alligators

How

Good are Experts at Predicting the Market

Stay up to date. Follow us:

|

|

|

|

|

|

Stay up to date. Follow us:

|

|

|

|

|

|

Sources:

SEC Statement Ongoing Market Volatility

Reddit WallStreetBets – How’d You Guys Manage to Win so Big?

GameStop Jumps on Elon Musk Tweet

Rage Against the Financial Machine