Inflation Expectations, FOMC Meetings, and Investor Anticipation

The Federal Open Market Committee (FOMC) holds eight regularly scheduled meetings during the year to take the pulse of economic measures that it’s targeting and to adjust policy when necessary. The FOMC has at times added phone or in-person meetings in-between those regularly scheduled. In 2021 all eight of the meetings are held over two days. A statement is expected after each meeting from which Fed-watchers and investors pick over even the smallest word change from the previous statement to base their reaction.

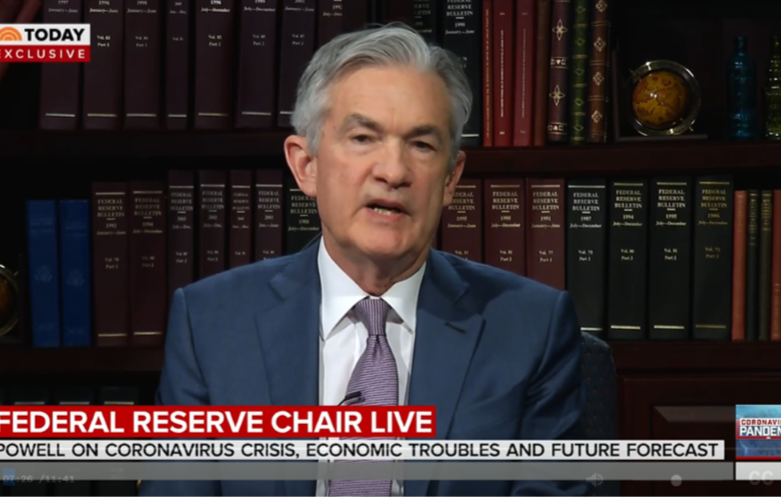

FOMC Meeting

The March 16-17, 2021 FOMC meeting takes place one year after the novel coronavirus was declared a pandemic. The announcement on Wednesday is highly anticipated and has the potential to send the markets in either direction as new economic concerns over inflation and rate movements are likely to be addressed. Money managers and individuals have their ears open for any hint of inflation. An increase in inflation would cause bond investors to hold out for more yield to compensate for inflation’s erosive impact on invested balances. For the past year, the Fed has been guiding the U.S. economy through the pandemic-forced-slowdown by holding rates very low with all the old tools, and many new ones they had never used before, such as buying bond ETFs when rates rise above a certain level.

Inflation

The subject of inflation has not been the topic of investor conversation since 2018. If you recall, in the last quarter of 2018, the stock market plummeted 17%. The cause was largely investor concern that unemployment had fallen to a 49-year low, oil prices were rising, and inflation wasn’t being contained by the previous 7 bump-ups in short-term interest rates. Businesses were beginning to experience mounting pressure for higher wages which would have worked its way into prices. Not just the U.S. markets were impacted, rising U.S. Treasury rates inspired global stock market sell-offs. Rates also rose as the ten-year USTN yield increased to 3.25% during October of 2018.

Inflation and rising interest rates certainly put fixed-income investors at risk. But would it be the end of the world for domestic businesses and those that invest in them? Companies that exclusively do business in the U.S. and don’t have concerns about exchange rates and cost of materials from overseas have far less to be concerned about long-term. Businesses that export may actually increase business. Short term, the stock market could react to the unknown that any change brings, but long-term, native companies supplied by and doing business in the U.S. may have natural protection from rising prices.

Stocks

Some of us remember or have read about the inflation and the lost years of the stock market during the ’70s. The U.S. economy is very different from when we were first taken off the gold standard and OPEC began more tightly controlling oil prices. Asher Rogovy is the Chief Investment Officer at Magnifina, LLC, a New York-based investment advisor that takes a long-term view with their client’s portfolios. He explains rising inflation and equity price risk this way, “Inflation is when prices rise, and this includes asset prices. Over the long-term stock prices rise along with inflation, as do other investment assets. The key here is long-term, because inflation may cause short-term volatility in stock prices. Stock prices are sensitive to interest rates, which are affected by inflation expectations.” Rogovy further explains that this isn’t the 1970s economy, ”Anyone investing during the 1970s remembers the damage caused by the oil crisis. In this case, persistent inflation held stock prices down for a long time. However, today’s economy is structurally different. In the 1970s, many manufacturing stocks were hurt as the cost of energy rose which cut profit margins. Today’s service-based stocks are less sensitive to input prices.”

The idea that inflation leads to higher asset prices is widely held. Andrew M. Aran, Managing Partner at Regency Wealth Management out of New Jersey, agrees but says that post-pandemic may be a bit different. “A pick-up in inflation has historically been good for stock returns as growing demand bodes well for corporate sales and earnings. This time could be different as stock valuations are high, and there may be some disruptions to supply chains and labor. High valuations currently reflect both the anticipated increase in spending as the economy reverts toward normalcy and the low cost of financing. The latter is likely to rise if and when inflation rises.” Said Aran, he then concluded by also suggesting that long term, equities should eventually take their queue from small increases in inflation, “…stock price/earnings multiples may contract partly offsetting revenue growth. Supply chains may not be able to keep up with demand and delays could extend the sales cycle [reduce asset turnover] while labor may need higher wages to incentivize them to work in an environment of liberal government unemployment support. Higher corporate earnings may also give cover to increased corporate taxes in 2022 and further pressure earnings. Once markets normalize, incremental inflation should translate into higher stock prices.”

Take-Away

The Fed Chair J. Powell has as recently as a month ago reiterated his resolve to keep rates low. If inflation should incrementally tick up, the Fed is not likely to remove the proverbial “punch-bowl” before the economy has fully opened. So, the risk is inflation, without the Fed combatting the causes. Equity investors in for the long term may already be exactly where they should be in the event of rising prices. Cash would devalue and fixed income would be in a bear market with tremendous potential to harm those investors.

The March FOMC meeting will have investors of all stripes paying attention to every nuance of the post-meeting announcement. The major indices are at their all-time highs giving them a longer way to fall than ever before in history. So the market seems to be looking for causes to be concerned. Put another way, the fear of missing out (FOMO) is being tested by the fear of staying at the party too long.

The truth that can’t be denied for long-term equity investors, inflation is of small concern. It may even drive more investors out of interest-rate sensitive sectors such as real estate and bonds and into the stock market.

Paul Hoffman

Managing Editor, Channelchek

Channelchek Insight from the Beginnning of the Pandemic:

|

|

| A Significant Indicator of the Feds Resolve | Do Market Scares Provide Uncommon Opportunity? |

|

|

| Climbing a Wall of Worry | What Does the Fed Purchasing ETFs Mean for Equity Investors? |

Sources:

https://www.wsj.com/articles/global-stock-markets-dow-update-03-15-2021-11615797300

Stay up to date. Follow us:

|

|

|

|

|

|

Stay up to date. Follow us:

|

|

|

|

|

|