Image: Fronteras desk (Flickr)

The Good News and Bad News Surrounding US Uranium Self-Reliance

Is the Russia/Ukraine war providing cause to become more self-reliant producing reactor-grade uranium? Uranium can be mined in many parts of the world, but the processing that allows the reactive mineral to be used as fuel is done in just a few spots on the globe. Currently, a full 20% of electricity in the US is generated from nuclear fuel. Russia has a hand in the production of a lot of it.

Background

Enriched uranium is mined, milled, converted into a gas, then enriched to increase the percentage of the isotope to 3%-5% before rods for fuel can be created.

Each of the steps takes place at specialized facilities. Up until recently, with the reliance on nuclear power diminishing and decades of the power source largely being written out of the power production future, there was no incentive for companies along the U308 supply chain to grow their operations. And mining slowed as raw uranium prices were seen as too low to compete with cheaper imports.

Russian uranium enrichment accounts for around 35% of the global market. In fact, the only commercial plants for uranium conversion into gas are in Russia, France, and Canada. There was a plant operating in Illinois that was mothballed but is scheduled to rejoin this part of the uranium supply chain in 2023.

Price Increase

Russia enriches more uranium for use in nuclear plants than any other country. Russia’s invasion of neighboring Ukraine has shaken the global market, as sanctions, and potential sanctions have increased the scarcity of many resources, including uranium. The risk to US energy generation of relying on all or part of the production to be outside North America has suddenly become apparent. Talk of ramping up domestic production has increased, but it can’t occur overnight.

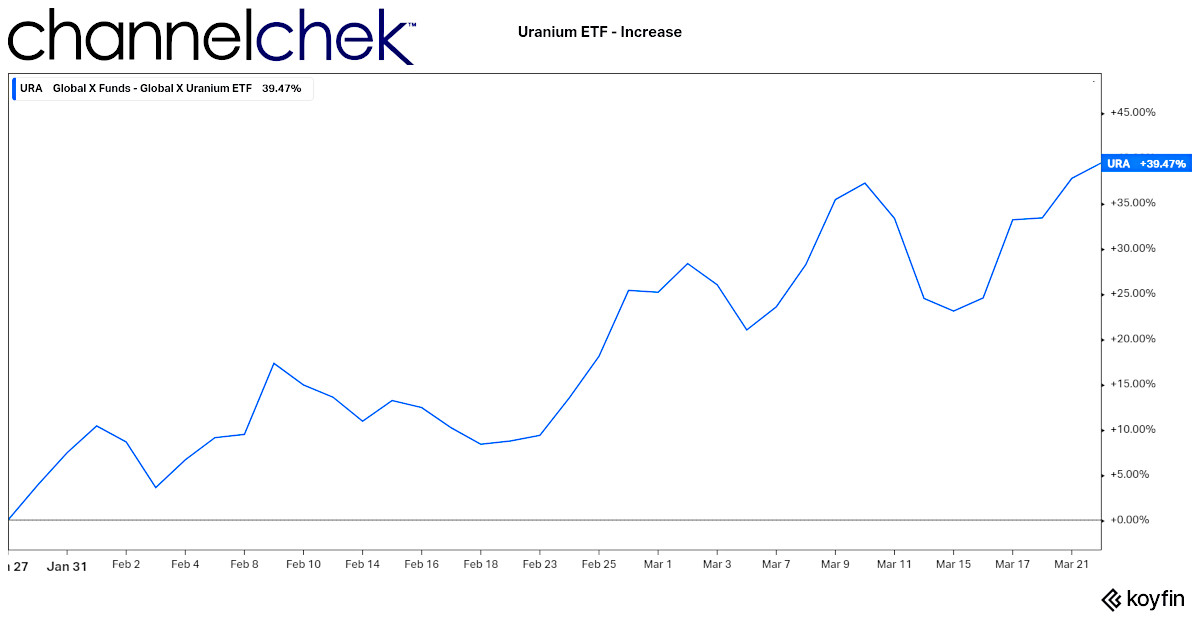

Using $URA as price proxy, Price increase since January 27, 2022

Using $URA as price proxy, Price increase since January 27, 2022

Uranium prices have risen more than 30% since the start of the war, and 40% since the beginning of the threat. Each part of the refining process, from mining the raw material to the enriching processes have experienced price increases.

While further sanctions cause utilities to lock in future needs, a trade agreement has been in place that limits US dependence on Russian uranium to no more than around 20% of domestic reactors demand. That is certainly better than a much higher percentage as the US isn’t fully reliant. But no other country could quickly fill Russia’s role in the supply chain for US usage. Another positive is US plants generally refuel every 18 to 24 months and plan for this at least two to three years in advance. So there is little concern in the short run for existing plants running out. There is time to prepare.

Opportunity

Does this create an opportunity in the stock market? Many of the forces that are weighing on some sectors of the stock market are having a positive impact on North American uranium mining stocks.

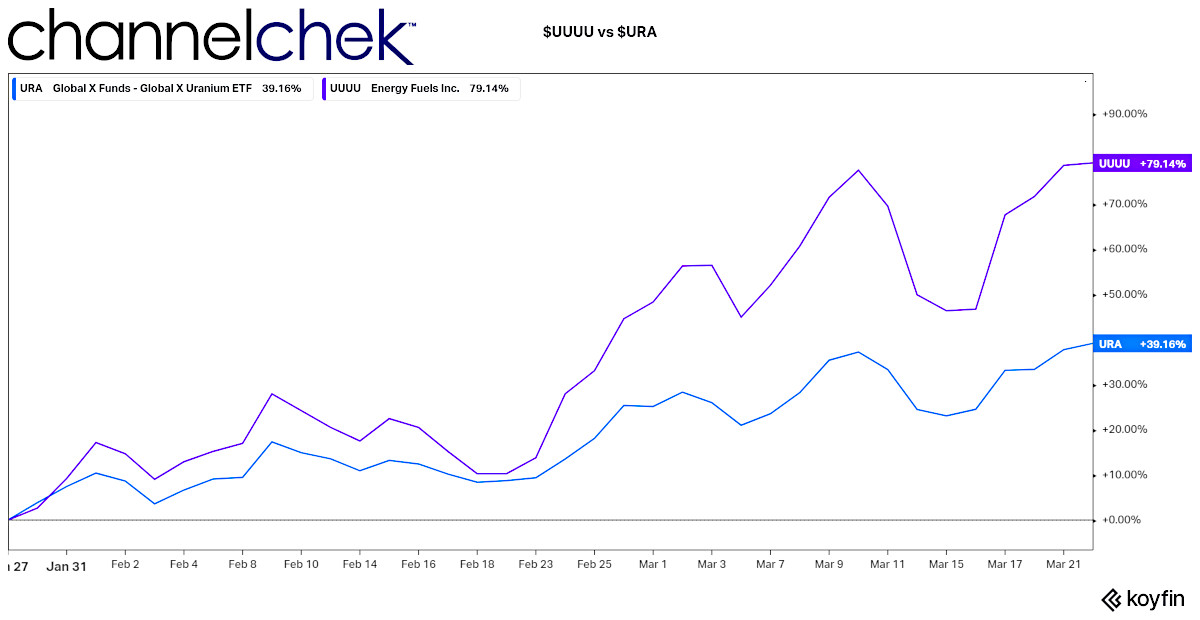

There are a number of companies that are involved in uranium production that were becoming interesting before the recent supply chain problems related to the Russian invasion. The segment was getting much attention as a result of the plans of companies to build modern, smaller nuclear reactors. The sudden change in the market landscape has now caused some of these companies’ stocks to experience price increases well in excess of that of physical uranium or uranium futures contracts.

One such company is Energy Fuels (UUUU). Energy Fuels is the largest uranium producer in the US and holds more production capacity and uranium resources than any other US producer. The current market cap is $1.6 billion. The movement on UUUU for the same period that Uranium ran up near 40%, has pushed the stock price of this producer up near 80% since late January.

On March 17, Noble Capital Markets Senior Energy Analyst Michael Heim released a report on $UUUU titled Ramp Up is Coming Slowly but

Higher Prices Could Spur Activity. The report profiles the analyst’s view on the company and prospects in light of the changing market.

Take-Away

Uranium investments, whether a trust, a producer, or an ETF that tracks uranium prices have all been seeing an upsurge in interest. Part of this has been the move toward non-carbon-based energy and new generation modular plants being built.

The current understanding of how vulnerable the US is as a result of its offshoring much of the acquisition and processes to produce nuclear fuel, is likely to reshuffle where US plants fulfill most of their need in years to come. And those needs are expected to be increasing.

Channelchek is a great resource to analyze companies involved in this mining and energy segment. No cost sign-up provides full access to the website and research, including videos specific to uranium producers.

Suggested Reading

Has Uranium Demand Changed with Russia Ukraine War?

|

Is it Too Late to Benefit from Higher Oil?

|

Uranium and Natural Gas Investments Turn Green in 2023

|

Investor Information on Three Segments of the Uranium Energy Sector

|

Sources

https://www.uxc.com/p/products/spl_cesa.aspx

https://www.eia.gov/energyexplained/nuclear/where-our-uranium-comes-from.php

https://tradingeconomics.com/commodity/uranium

Stay up to date. Follow us:

|