Image Credit: ILO Photostream (Flickr)

Dollar Strength Impacts Commodity Prices, Money Flow, and Worldwide Inflation

As the dollar strengthens against world currencies, US exports and everything else priced in dollars experience additional inflation as it’s exchanged back to the trading partner’s native currency. This is dampening demand, slowing the rise, and perhaps helping to bring down prices of commodities transacted in US dollars.

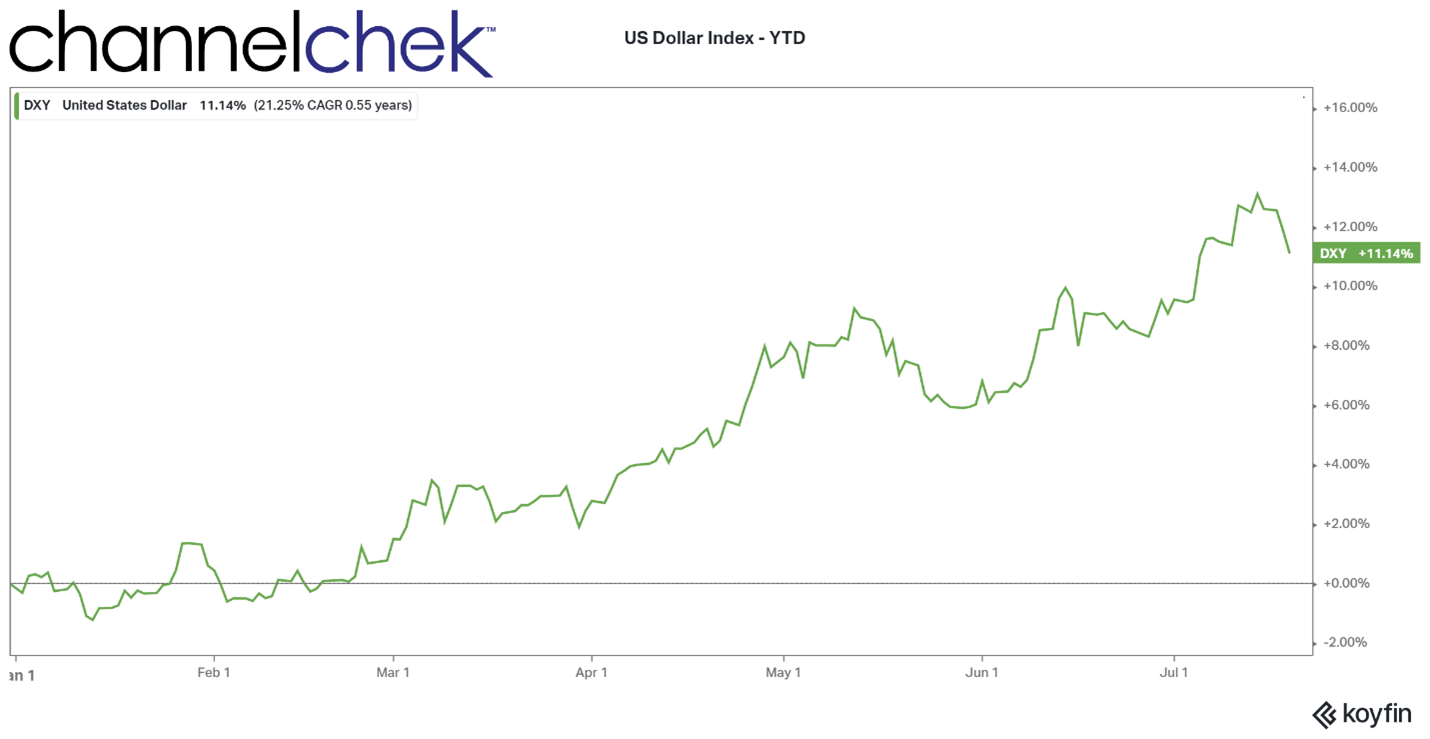

The US dollar index expressed as DXY began the year at 96.21 versus a basket of currencies and is now valued at 106.55 against the same basket. So it has gained over 11% since the beginning of the year. After 20 years of trading below the euro’s value, the US currency has recently met and even exceeded parity with the euro.

Source: Koyfin

Commodities have been falling in response to worldwide economic stagnation and expected weakness for some time. As the dollar has continued to rise, the trend for commodities priced in US dollars has been in decline. This keeps costs closer to neutral for foreign buyers. Since the beginning of June, trends appear to show that commodities are largely hinged, with a negative correlation, to US dollars. These commodity prices may remain under downward pressure unless there is a correction in the US currency.

Prices of oil, metals, and grain shot up earlier this year in response to Russia’s invasion of Ukraine. These markets are now trading based on dollar conversion rates and expectations that central bank activities will cause a global recession. Additional lockdowns in China are also impacting demand. Copper has slipped below $7,000 a ton for the first time since September 2020, and it is down 27.4% year-to-date.

As economic weakness is expected, investment portfolio risk has come off, and the move out of foreign equities, foreign currencies, and commodities has brought in buyers of US Treasury bonds (transacted in dollars). Other traditional safe havens like gold, yen, or Swiss francs are not attracting much interest.

The Bank of Japan (BOJ) and the European Central Bank (ECB) are scheduled to hold their respective monetary policy meetings in the coming week. The BOJ is expected to maintain its extremely easy money policies. The ECB is expected to begin a cycle of raising rates. This could help unwind some of the strength of the dollar vs. the euro as higher real rates tend to create demand for the underlying method of payment.

In the US, the Federal Reserve (Fed) has its next meeting on monetary policy next week, beginning on July 26 and concluding on the 27th. The Fed kicked off a hawkish monetary cycle in March and has raised the magnitude of rate hikes from 0.25 percent in March to 0.5 percent in May and 0.75 percent in June. With accelerating inflation well above the 2% Fed target, the Fed chairman has been resolute in his determination to get back ahead of rising prices.

Take Away

To avert risk and earn better yields, there has been an excess of money flowing to US dollar-denominated investments, especially treasuries. This has played out in the foreign exchange markets in a way that has caused a stronger dollar than we’ve experienced in 20 years versus other currencies.

The strong dollar works to lower the prices of goods denominated in US dollars and then converted to a weakening native currency. This dynamic has been pushing commodity prices lower since the second quarter or before. Also pushing prices lower are expectations of a weaker economy and, therefore, less demand.

The lower commodity prices have a slight dampening impact on US costs of manufacturing. Goods coming to the US from overseas also have a favorable exchange rate; combined, these could take some of the steam out of red hot inflation.

The FOMC meets next week to decide on interest rates. The announcement after the meeting is when the Fed chairman sets expectations going forward. These Fed statements will have as much or more implications for market moves (all markets) then the rate adjustment.

Managing Editor, Channelchek

Suggested Content

Why Natural Gas Opportunities Should Not Always be Lumped in With the Oil Sector

|

Uranium and Natural Gas Investments Turn Green in 2023

|

Is Biotech’s Outperformance Reaching a New Stage of Development?

|

The Expected Slower Economy is Bringing Oil Prices Down

|

Sources

https://www.wsj.com/market-data/commodities

https://www.nasdaq.com/articles/what-is-the-dxy-index-2021-03-07

Stay up to date. Follow us:

|