Market Bifurcation Can Confuse Investors

Market bifurcation happens when relative moves between stock groupings that usually trade in semi-tandem, branch into different directions. A classic example would be energy stocks and the travel industry. When energy prices are stable, the two typically move up and down in rough synch with the overall market. When energy costs quickly rise, travel stocks may become weaker and even move in the complete opposite direction. This disconnect, branching in different directions, is called bifurcation.

Other bifurcation possibilities could include growth stocks and value, tech and industrials, and consumer cyclical vs. non-cyclical. The move in different directions, typically ebbing and flowing together, can be long-lived and last for months, or short-lived lasting only days.

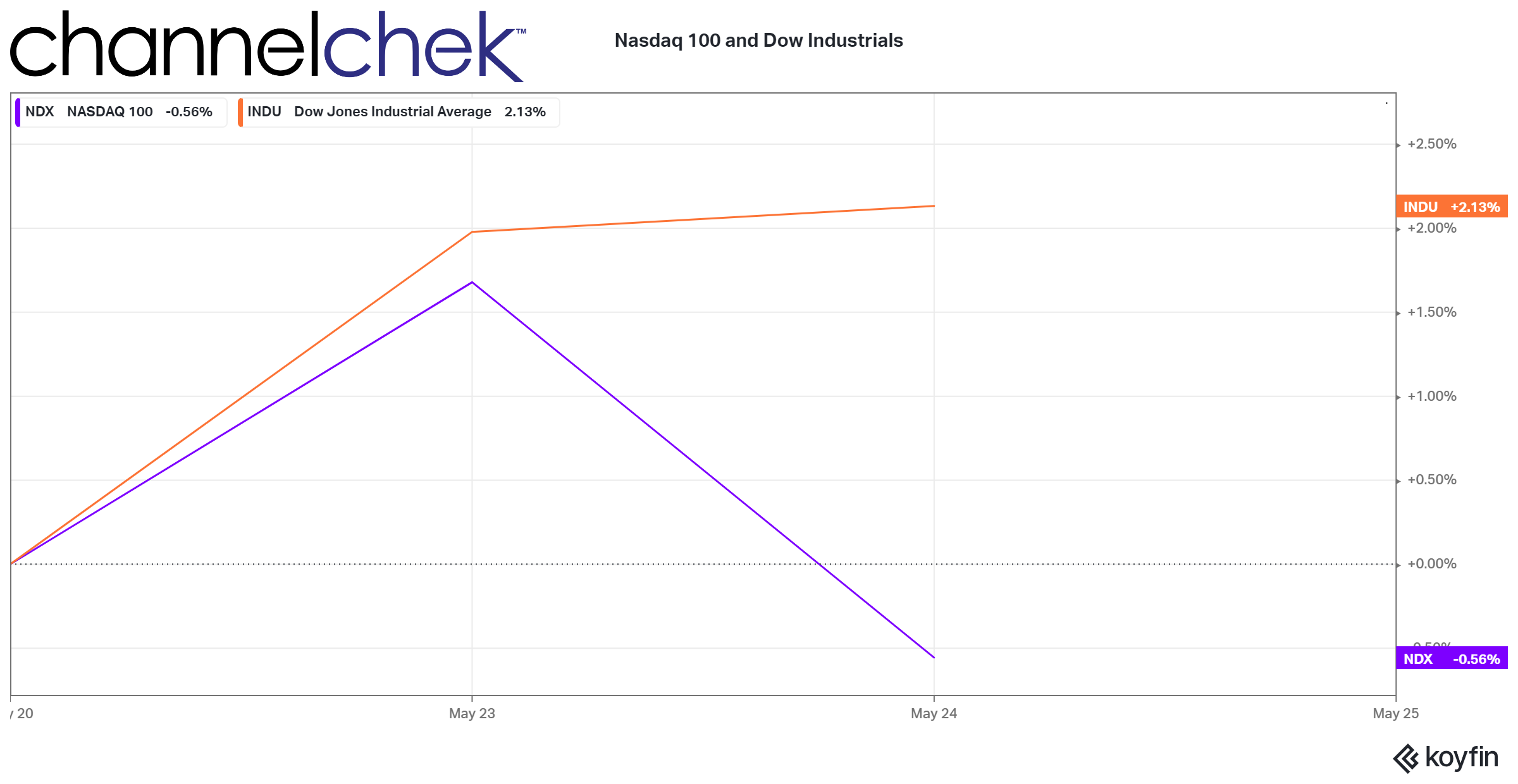

Soruce: Koyfin.com

The graph above demonstrates a bifurcation between large industrial stocks represented by the Dow 30, and large tech stocks represented by the Nasdaq 100.

While this only shows three trading days (May 20, 2022-May 24, 2022) The bifurcation between the two, which had previously tracked in the same direction, is extreme. Investors may play bifurcation by expectations that the two will eventually revert to their mean. Shorter-term traders should recognize the split early since the two major benchmarks are acting in complete contrast to the other.

There is no telling how long a bifurcation will last. As with most market anomalies, expectations of how long the cause of the trend will exist dictates the future. The Nasdaq, over the past three years (May 2019- May 2022) has trounced the Dow 30 performance, earning an additional 35%. The two typically tack closer. This may indicate the beginning of a rotation and money flows out of the high PE Nasdaq 100 and into more conservative dividend-paying companies.

It is unclear if a long-lived trend has developed until entrenched (three days does not make a trend). But an astute trader will pick up on early signs of strength and weakness in order to recognize market rotations. They may choose to take advantage of – or steer clear of these. Active investors may benefit by reallocating with a larger percentage in the stronger areas of a bifurcated market and reducing allocation in the weaker.

Managing Editor, Channelchek

Suggested Content

Small-Cap Stocks and How They’re Different

|

Initial Public Offerings (IPO) Can be Considered a Ground Floor Opportunity

|

Stay up to date. Follow us:

|