Image Credit: Nigam Machchhar, (Pexels)

Facts About the Fed Being Hawkish

In my reading last week, I came across a number of articles suggesting the US Federal Reserve (The Fed) has done a 180-degree turn to a more “hawkish” stance. This would mean that they have become inflation fighters. As a reformed “bond guy” that participated in the Treasury’s first TIPS auction, I can’t help but mourn for the old bond market, the one that seemed to trade largely on inflation expectations rather than on kitchen sink monetary resolve. Below discusses why the Fed may actually be more “Dovish” than ever before in history with inflation above 4%. The ramifications of this have implications for the US Stock and Bond markets going into the New Year.

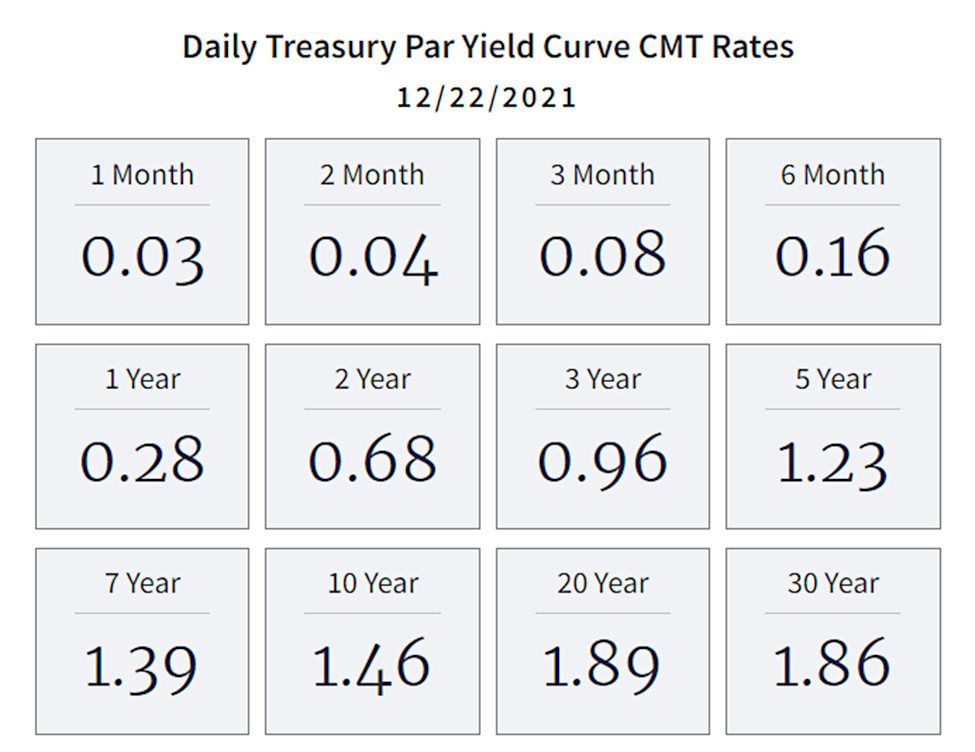

With year-over-year U.S. inflation running at 6.8% (CPI-U) and the Fed inflation projection for 2022 at 2.6% to 2.7%, one would expect 30-year Treasuries to be yielding higher than the annual inflation rate. Instead, it’s running 500 basis points (bp) below the pace, and 50 bp below the FOMC’s seemingly optimistic projections. Does the bond market know something that undermines the most basic tenets of interest rate movement? Or, is something else impacting bond prices?

Source: https://home.treasury.gov/

Background

During the early summer of 2020, in response to pandemic-related stress on the economy, the Fed introduced yield curve control as one of their tools. The way this seldom-used tool works is the Fed enters the open market and buys bonds across a large period of the yield curve in order to prevent rates from rising above a pre-set level. In this way, if market demand would tend to let rates rise, the Fed is there to bid prices up (keep rates down). If bond prices (yields) of targeted maturities remain above the pre-set level, the central bank does nothing. The Fed, in this way, provides unlimited demand should bonds trade-off.

Additionally, the Fed has been implementing quantitative easing (QE) since March 2020. The result is the Fed now holds $5.64 trillion in Treasuries out of the $22.3 trillion available U.S. Treasury debt.

Along with Treasuries the Fed also holds $2.63 trillion in government-guaranteed Mortgage-Backed Securities (MBS). These securities, which are also backed by the full faith and credit of the US, trade at a small spread to similar duration Treasuries.

When QE got underway last year, the Fed purchased roughly $110 billion a month in MBS: $40 billion a month in new money and $70 billion to replace principal pay downs. Unlike other market participants, the Fed does not trade these securities, they get put away until they pay off. Investors need not worry if the extremely large buyer may decide to sell one day. They won’t.

Out of the $5.64 trillion of Treasuries held by the Fed, only $326 billion mature within a year. The remaining $5.31 trillion impact longer rates, in fact, $1.02 trillion mature in 5-10 years, and $1.34 trillion mature in over 10 years. With over two trillion in debt securities pulled from the five years or longer end of the market, it now holds long-dated Treasury debt equivalent to 10% of U.S. GDP.

Is

Tapering Tightening?

While the Fed now regularly addresses inflation in its comments and intentionally avoids the word “transitory” when referring to it, there is very little economic brake tapping being done from a monetary policy level. Instead, it continues to suppress rates by buying bonds. While the Fed is not dropping as much money into the bond markets as they had been to control yields, they are still purchasing massive amounts. Each month they are tapering their purchases by $20 billion. But still, last month the Fed took down $120 billion in government-backed bonds – $80 billion in Treasury debt and $40 billion in mortgage-backed securities. These are now securities the market doesn’t have to absorb, which keeps rates down, but it is also stimulative as these securities were purchased on the open market.

Bond purchases are monetary policy tools used to ease rates and stimulate the economy; they are a tool used to tighten. The purchases repress rates along the entire curve and serve to reduce borrowing costs spread to Treasuries that would include everything from mortgage borrowing to junk bonds.

Take-Away

If the Fed has become an inflation fighter and is now hawkish, the stock market, particularly companies that rely on borrowing, have a lot to be concerned about. Interest rates across the entire curve have been held down for a long time. By historical measures, interest rates should be paying inflation plus a premium for uncertainty. A rapid return to historical norms would be devastating for stocks. More directly, it would be devastating for bonds.

The Federal Reserve Act mandates that the Fed conduct monetary policy “so as to promote effectively the goals of maximum employment, stable prices, and moderate long-term interest rates.” Allowing rates to seek their natural level any time soon would impact the markets, which is not mentioned as a mandate. However, “maximum employment” is one of the goals of monetary policy. Allowing the markets to sink would likely reduce employment greatly. With this, the Fed is likely to remain accommodative using all the tools necessary to maximize employment.

As long as rates are low, savers will need to search for ways to protect their money from inflation. This could keep the stock market on its upward trend.

Suggested Reading:

How Difficult Will it be for the Fed to Control Inflation?

|

Inflation Seems Persistent, What Now?

|

Yield Curve Control, Stock Prices, and Trust (June 2020)

|

The Fed is Clear that they Intend to Hold Rates Down

|

Sources:

https://www.bls.gov/opub/ted/2021/consumer-prices-up-6-8-percent-for-year-ended-november-2021.htm

https://www.usinflationcalculator.com/inflation/current-inflation-rates/

https://www.sifma.org/resources/research/us-treasury-securities-statistics/

Stay up to date. Follow us:

|