Image Credit: Zombiette (Flickr)

Small Caps Could Benefit from Tax Changes, M&A, and Simple Reversion to Mean in 2022

In a recent Barron’s article titled “Small-Cap Stocks Are in Line to Be Big Winners in 2022” the publication makes a good case for smaller company stocks. The article demonstrates smaller stocks are “cheap in an expensive market, have attractive fundamentals,” and that large caps may have problems that small-caps could avoid. It also points to a tax law change that could work in favor of smaller companies.

Valuation Comparison

The two most followed benchmark indexes by investors to measure the performance of the small-cap market are the S&P 600 and the Russell 2000. The S&P 600, views only 30% as many stocks as the Russell 2000. Both indexes stood at about 17 times expected earnings over the next 12 months, compared to about 22 times for the large-cap S&P 500. In the past, small-caps have traded at a premium multiple. The S&P 600’s 17-times multiple is in line with its historical average since 2000. In a market where most stocks are trading well above their average, a company or index trading closer to a historical mean suggests potential outperformance if stocks revert to their mean average.

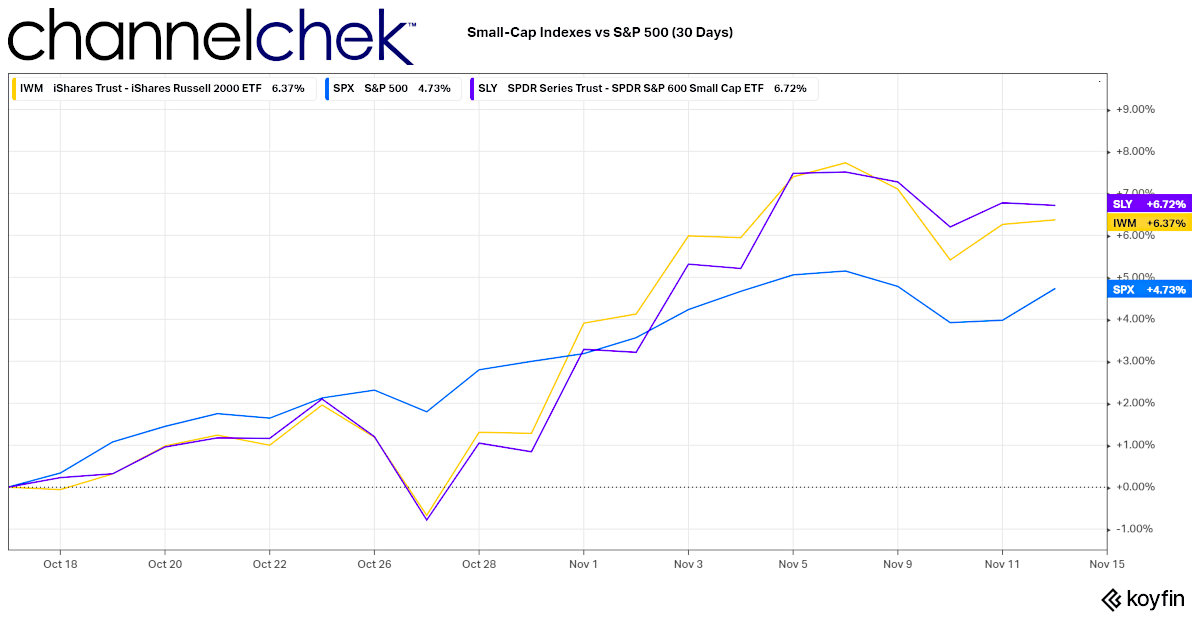

Image/Data: Koyfin

Playing Catch up?

Jill Carey Hall, the head of U.S. small and midcap strategy at Bank of America Securities, has recently said, “The historical relationship between valuation and subsequent returns suggests small-caps should lead large-caps over the next decade, and points to slightly negative annualized price returns for the S&P 500 but high-single-digit annualized price returns for the Russell 2000.” The small-cap sector is beginning to show increased relative performance after a long period of malaise.

Over the past 30 days, while the S&P was up a comfortable 4.73%, the two small-cap indexes were substantially higher at 6.72% (Russell 2000) and 6.73% (S&P 600). One notable difference in how stocks are selected for these two indexes is that the S&P requires companies to have four consecutive quarters where the total earnings sum is positive.

As interest rates are expected to rise, large-tech and consumer discretionary stocks are expected to be impacted both by longer-term borrowing needs and dividend yield comparisons. More than 40% of the S&P 500’s market cap is in the technology and consumer-discretionary sectors. In comparison, the S&P 600 has only a quarter of its market value in tech and consumer discretionary, and about 45% combined in financials, industrials, materials, and energy.

Tax Changes Benefitting Small-Cap Stocks?

Washington tax policy proposals bode well for small-cap and even the smaller microcap sectors. Although it’s still being debated in Washington, lawmakers controlling the direction of new tax policy plan a 15% minimum tax for companies that report earnings of at least $1 billion in a year. Based on results over the past year, that would affect just one company in the S&P 600, Genworth Financial, while many larger companies in the larger S&P 500 index could be impacted as early as next year.

Mergers and Acquisitions

U.S. mergers-and-acquisitions activity has been running high in 2021, and cash is still abundant on many corporate balance sheets and private equity firms. The conditions remain ripe for more acquisitions going forward. This, of course, benefits these companies that are small enough to be attractive and still affordable to companies that feel their business is complimentary. Small companies don’t necessarily need to be acquired to experience a rise in value, as their competitors are gobbled up, it’s reasonable to presume their own value will increase.

Take-Away

Do you remember when small-cap stocks came from behind in 2020? This sector has consistently outperformed large-caps from November through February. The performance differential, along with recent movement, provides reason to believe that this sector is again gaining momentum to rise to where it “should” be in relation to higher capitalized stocks.

A tax change that imposes a minimum tax on companies above a certain profit limit would create maneuvering among investors, and companies right on the cusp. This shifting also could bode well for the smaller stocks held in portfolios.

Channelchek provides information on over 6,000 small and microcap companies, register today to receive research and timely articles each day in your inbox.

Managing Editor, Editor

Suggested Reading:

Small-Caps are Bigger than Ever, Investors Need to Adjust

|

Is Biden Tightening the Reins on Large Companies?

|

Index Funds Still May Fall Apart over Time

|

Does Insider Selling Indicate Bearishness on the Company

|

Sources:

https://app.koyfin.com/share/9e8ca3c111

https://www.barrons.com/quote/index/us/s&p%20us/spx

https://www.barrons.com/articles/small-company-barrons-stock-picks-51636763348?tesla=y

https://www.barrons.com/articles/cheap-small-company-stocks-51636763053?mod=hp_LEADSUPP_3

Stay up to date. Follow us:

|