Will Gold Related Assets Continue to Outperform?

Gold, which has been moving up slowly over the past weeks and months, stood out on this first business day of the year by noticeably outperforming other asset classes. By late afternoon gold had passed the highest level it had been in six months. Why, after a full year of market turmoil and economic uncertainty, is exposure to gold now attracting investors? Will this trend continue? And what are the various ways a stock market investor can benefit from rising interest in this element?

Background

A strong and upward-trending US dollar provides a parking place for those looking for a safe-harbor investment – one with limited risk. For much of last year, US interest rates led the way among central banks, increasing yields on Treasury debt. This pushed the dollar value upward. The dollar exchange rate then began to weaken as Japan recently began raising its rates.

On the first trading day of 2023, Treasury yields fell as investors began to position for a possible change of monetary policy. This is somewhat cautionary as the FOMC minutes are released on Wednesday. The Fed has already begun tapering its increases in rates. The prospect of many more Federal Reserve interest rate hikes is unlikely. There is fear that the FOMC minutes may make this even more clear. Higher US dollar exchange rates as a result of yield increases had been dampening any natural increase in demand the safe haven metal may have had to push values higher. Plus, there is heightened talk of a US recession; this does not bode well for dollar strengthening moving forward. Investor caution is adding to the performance of gold.

What Investors Pay Attention To

A big investor focus is a release on Wednesday of the minutes from the Fed’s Dec. 13-14 monetary policy meeting. If the minutes make clear that the U.S. central bank is more likely to slow or end interest rate hikes, it opens the door for more assets to move to bullion, gold mining stocks, junior gold mining stocks, and ETFs.

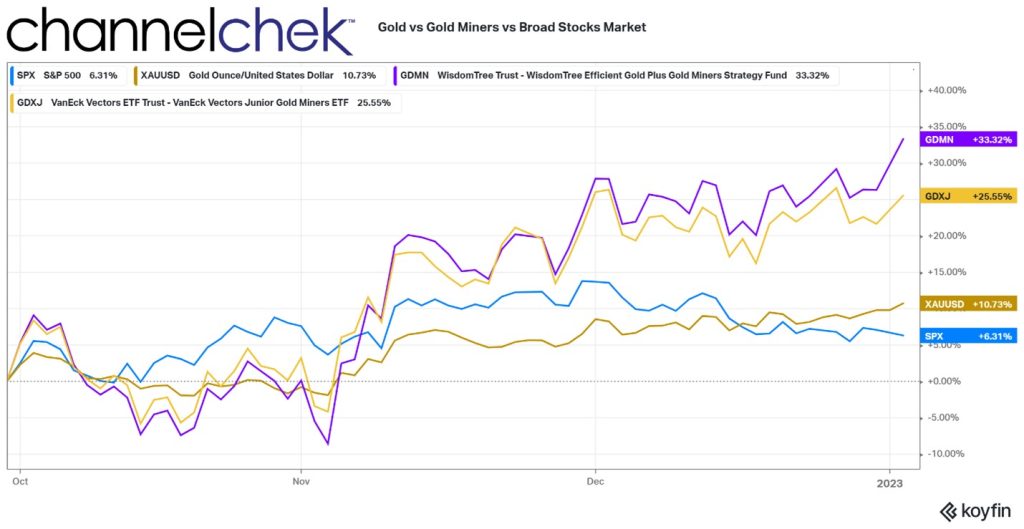

As far as the performance of market-related exposure to gold, it shines compared to the S&P 500. XAU is gold bullion, as shown above as XAU/USD; it is the performance of one troy ounce of gold’s cost per dollar. Over the past three months, this has risen by 10.73%. For the same period, the junior mining stocks (GDXJ) and the major miners (GDMN) have risen by 25.55% and 33.32%, respectively.

The three-month performance accelerated today, we will get clues this week if this heightened interest continues.

To Consider

Did you know that Channelchek provides up-to-date material from a natural resources research analyst, including gold mining stocks, that the Wall Street Journal bestowed the ‘Best on the Street’ label, and that has been awarded the Forbes/Starmine’s ‘Best Brokerage Analyst’ honor? Today, Mark Reichman released his quarterly Metals and Mining Fourth Quarter Review and Outlook. Explore this report by clicking here.

If you have an interest in mining stocks, take advantage of your free access to Mr. Reichman’s research and reporting on many interesting natural resource producers by clicking here.

Managing Editor, Channelchek

Source