With Access to More Capital, GameStop’s Future is More Assured

GameStop Corp. (NYSE: GME) announced yesterday that it filed a prospectus supplement with the SEC. The supplement defines how it may now offer and sell up to 3,500,000 shares of its common stock from time to time through an “At-the-Market” equity

offering program. The alternative capital financing, often referred to as an ATM offering, is best when used during strong markets. It should be noted that the potential for additional shares in the market trading could negatively impact the price movement of the stock issued through ATM capital raises. Added supply is just another price determinant dictating where traders value a company, certainly, the price movement of GME has many competing factors creating volatility.

GameStop is expected to use any proceeds from sales under the ATM to further accelerate its transformation from its dated business lines and general corporate purposes and to help to solidify its balance sheet. The timing and amount of any stock sales are at the option of the company using their own discretion. For other companies tapping an ATM, timing is typically based on stock price allowing them more capital per share, or needs that can’t be provided more economically by other methods.

Quick A-T-M Discussion

An ATM offering is different than a standard secondary stock offering. In the case of a traditional secondary offering, the company announces they’ll be selling more shares from the corporation’s treasury stock (or follow-on IPO) into the market. The offering is completed as scheduled for the amount of shares announced. The corporation gets cash-in-hand at the cost of (in most cases) some dilution of shares outstanding. When the same company stock is being traded on the open market (for example a wallstreetbets style trader buys from a hedge fund) no money winds up in the hands of the company whose shares were traded, only the seller. Offering more shares in the market is the method that the company that makes itself the seller of new stock. Non-A-T-M secondary company capital raises take the form of “X number of shares at Y dollars apiece.”

In both the ATM and standard secondary offerings, share price can be impacted by the additional supply of stock. If the company deploys the cash effectively, it could raise the companies worth long-term.

An ATM is a little different than a traditional secondary offering in how it is offered. With an ATM, the company reserves the right to sell shares whenever they want. This is important as a stock like GME has seen severe swings in the share price. These swings create the potential for them to take advantage of an above-average period. They may also sell in any quantity they want, up to the SEC registration. The primary advantage is that the ATM offering allows the company to maximize benefit if the share price is high. It also allows the company to go to the ATM and pull out some money (up to the maximum shares x price) when needed. This is different than a traditional secondary, where all shares are sold at the same time.

The GME Situation

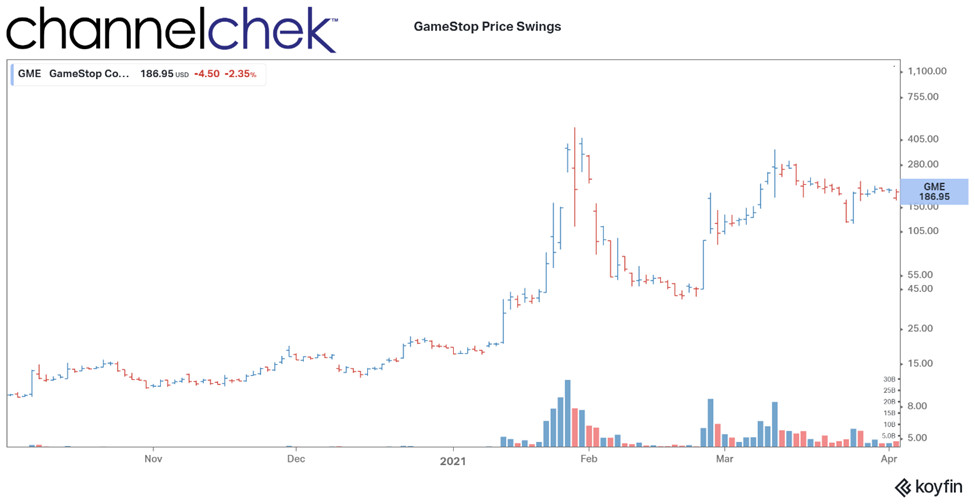

This year, from January 11, 2021, to April 1, 2021, the closing price of GME ranged from as low as $19.94 to as high as $347.51. The daily trading volume fluctuated from approximately 7,060,000 to 197,200,000 shares per day. At the open this morning (4/6/21,) GME was set to trade around $189, almost half of its recent high and almost ten times higher than its low this year. The company has come back on to the radar of many people who weren’t even sure if they were still in business. The elevated status and celebrity among millennials who may have grown up renting games at GameStop, including some who more recently increased their wealth by trading the stock, could help with whatever revised business model management can put in play with 3,500,000 shares with which to use if and when desired.

Take-Away

As the saying says goes “if life gives you lemons, make lemonade.” But, what if life hands your fading business model a rip-roaring high stock price? Well, one option is, a savvy management team, of a once cutting-edge video game distributor, may be able to raise capital and put it to work to successfully serve the needs of a new generation. This remains to be seen, there are no guarantees — the only thing we can be sure of is that this story is not even close to over.

Suggested Reading:

|

|

Investors Should Pay More Attention to A-T-Ms

|

Polarized Opinions Around the GameStop Short Squeeze

|

|

|

Investment of Excess Corporate Cash

|

Understanding the Robinhood Class Action Lawsuit

|

|

Virtual Road Show Series – Today, April 6 @ 1pm EDT Join Capstone Turbine CEO Darren Jamison for this exclusive corporate presentation, followed by a Q & A session moderated by Michael Heim, Noble’s senior research analyst, featuring questions taken from the audience. Registration is free and open to all investors, at any level. Register Now | View All Upcoming Road Shows |

Sources:

Stay up to date. Follow us:

|

|

|

|

|

|

Stay up to date. Follow us:

|

|

|

|

|

|