The Small Cap Effect Suggests Oversized Gains if You Weed Out Certain Stocks

According to a June 5th article in the Wall Street Journal, “small-cap stocks are priced for jumbo gains.” The Journal explains that small-caps have experienced lower average volatility than large-caps during periods of market stress. Examples are the 2013 “taper tantrum,” when investors turned bearish after the Federal Reserve said that it would reduce bond purchases; also the United Kingdom’s Brexit referendum in 2016; and the Covid-19 pandemic. This fact is counter-intuitive to what investors expect from what are considered the riskier securities.

The Journal reports that one prominent money manager predicts that the smaller companies will outshine large-caps by close to four percentage points a year over the next five years. They also report a large investment bank is even more bullish on small-caps for the coming decade.

What are Small-Caps?

Small-caps are most commonly defined as companies with lower-than-average market capitalizations. This is most often defined as between $300 million and $2 billion. However, the index that is often quoted to reflect small-cap stocks overall performance is the Russell 2000 Small-cap Index (RUT). The stocks represented in the RUT have a median market cap of $1 billion and the largest stands near $13 billion. Well outside of the range of the more common definition.

Small-Cap Effect

The small-cap effect was documented decades ago and demonstrates the propensity of small companies to produce higher average returns than companies over extended holding periods. The thought process includes the idea that small companies are riskier, so additional expected return is necessary to compensates investors for taking extra risk.

But the past decade has left the small caps with a lot of catching up to do. The large-company Russell 1000 (RUI) has beaten the small-company Russell 2000 by three points a year over the past decade, returning an average of 13.1%.

The lack of comparative performance is not because small-caps have been bad performers. Larger companies, particularly those at the very top, had a fantastic run during that decade. Now, there’s an ongoing debate over whether the small-cap effect is still valid, if it is, there is much catching up to do in terms of performance. Time will tell what direction and pace prices change moving forward. It is unknowable right now. What is knowable is that many small-caps are currently cheap.

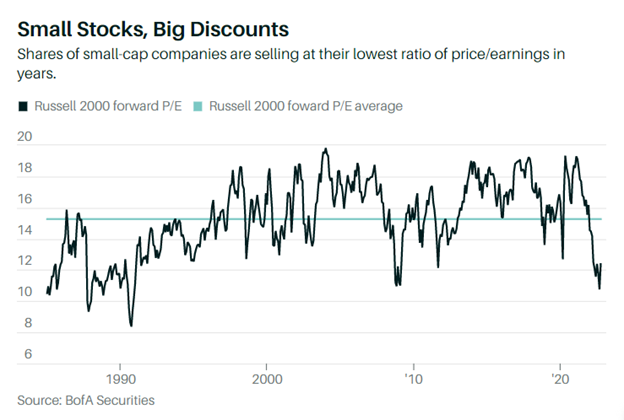

According to the Wall Street Journal, The Russell 2000 is flirting with 20 times earnings, a hair above its long-term average and certainly not deep value territory. But weed out the index’s unprofitable companies and statistical outliers, and the price/earnings ratio drops to about 12, versus a long-term average of 15.

This adjustment to the index make-up makes sense for two reasons. One is that 33% of Russell 2000 members today have negative earnings, up from 20% a decade ago, and at a record high. But there’s a bigger reason to exclude unprofitable companies when sizing up the Russell 2000: The adjusted P/E has been a better predictor of future returns than the unadjusted one, (based on a B of A analysis of data going back to 1985. Right now, the adjusted P/E has B of A to predicting 12% annual returns for small-caps over the coming decade. That’s five points more than it sees for large-caps. The analysts calculate that small-caps are 30% cheaper than large-caps now. This would be the biggest discount since the dot-com stock bubble more than two decades ago.

What do Equity Analysts Think?

On December 15th, 2022 – 9:00am EST there will be a rare opportunity to hear from analysts covering different sectors of the small-cap space.

At no cost for investors, the well-recognized veteran analysts will highlight how they set their price targets and market ratings. And the underlying fundamental reasons to consider an investment. As an attendee, you can get further involved by submitting your own questions. And learn which stocks the research analysts may favor.

This is the season to set your sites on maximizing returns in the coming year and the years that follow. This event is online and free, courtesy of Noble Capital Markets and Channelchek.

Get ahead of your investments in the coming year by attending this special event, learn how by going here now.

Managing Editor, Channelchek

Sources

https://www.barrons.com/articles/small-cap-stocks-funds-51670023712?mod=hp_LEAD_1