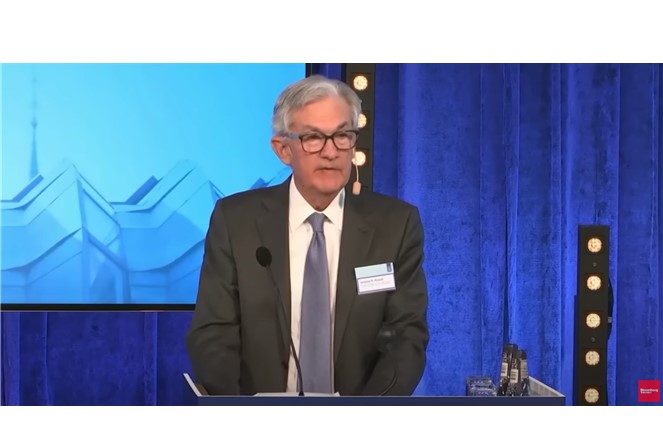

Fed Chair Jerome Powell made three strong points during the panel on “Central Bank Independence and the Mandate—Evolving Views,” which just took place in Stockholm. These points include the role of elected representatives and unelected agency officials, the transparency of a central bank’s intents and actions while remaining independent of political agendas, and not becoming sidetracked from the established mandates.

Continued Independence and Transparency

Powell reminded the international audience, which included central bankers, that the purpose of monetary policy independence is the benefits allowed the policymakers. This independence can insulate policy decisions from short-term political considerations. “Price stability is the bedrock of a healthy economy and provides the public with immeasurable benefits over time. But restoring price stability when inflation is high can require measures that are not popular in the short term as we raise interest rates to slow the economy,” said Powell. The head of the US central bank then explained the absence of politics over central bank decisions provides for less conflicted decision-making in light of short-lived political considerations.

While speaking from a US point of view, Powell said that in a “well-functioning democracy, important public policy decisions should be made, in almost all cases, by the elected branches of government.” He explained that agencies trusted to act independently, such as the Federal Reserve, should have a narrow and explicitly defined mission that protects the agency from fleeting political considerations.

Within this kind of independence in a representative democracy, including transparency that allows for oversight, the Fed and other agencies find legitimacy. Powell said about of the current makeup of the Fed, “We are tightly focused on achieving our statutory mandate and on providing useful and appropriate transparency.”

Focus on Mandates

Climate change is not part of the US central bank’s statutory goals and authority. On the subject of climate, Powell added, “we resist the temptation to broaden our scope to address other important social issues of the day. Taking on new goals, however worthy, without a clear statutory mandate would undermine the case for our independence.”

In the area of bank regulation, Powell told the audience that independence helps ensure that the public can be confident that the overseer’s supervisory decisions are not influenced by political considerations. In response to his own hypothetical question about whether it is wise to incorporate into bank supervision the perceived risks associated with climate change, consistent with existing mandates, Powell sounded strongly opposed. “Addressing climate change seems likely to require policies that would have significant distributional and other effects on companies, industries, regions, and nations. Decisions about policies to directly address climate change should be made by the elected branches of government and thus reflect the public’s will as expressed through elections.”

He did, however, share his view that any climate-related financial risks that pose material risks to the banking system are the Fed’s responsibility and under their supervision. “But without explicit congressional legislation, it would be inappropriate for us to use our monetary policy or supervisory tools to promote a greener economy or to achieve other climate-based goals. We are not, and will not be, a “climate policymaker.”

Take Away

On January 10th, the head of the US central bank participated in an international symposium to mark the end of Stefan Ingves’ time as governor of Sweden’s central bank. Senior central bank officials and prominent academics participate in four panels that address central bank independence from various angles – climate, payments, mandates, and global policy coordination. Fed Chair Powell stood determined and resolute that the Fed’s mandate is narrow, well-defined, and should not be clouded with short-term political goals.

There has been pressure on the Fed to adopt additional mandates that include social reforms and climate concerns. His talk before a world audience may be the first time Jerome Powell has publicly addressed this pressure. The US House of Representatives has just shifted its balance to a more conservative power base; this may have had an empowering impact on Powell’s open remarks.

Managing Editor, Channelchek

Sources

https://www.federalreserve.gov/newsevents/speech/powell20230110a.htm