Research News and Market Data on GHM

February 06, 2026 6:30am EST Download as PDF

Third Quarter Fiscal 2026 Highlights:

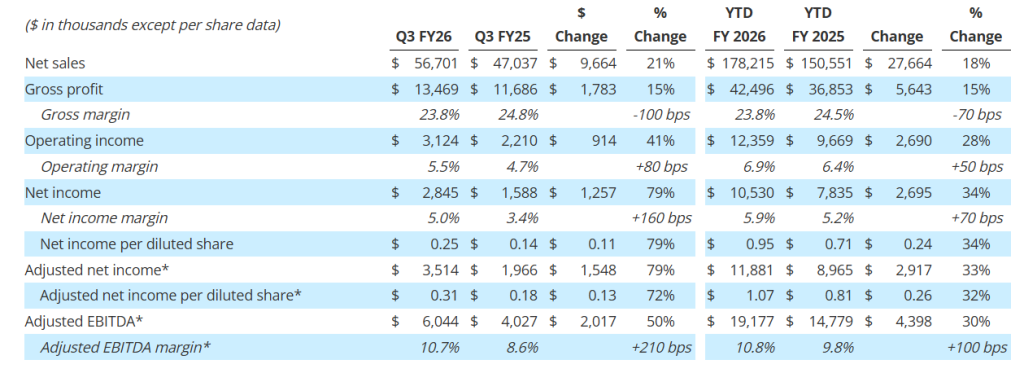

- Revenue increased 21% to $56.7 million

- Gross profit increased 15% to $13.5 million; Gross profit margin was 23.8%

- Net income per diluted share increased 79% to $0.25; adjusted net income per diluted share1 increased 72% to $0.31

- Adjusted EBITDA1 increased 50% to $6.0 million; Adjusted EBITDA margin1 was 10.7%

- Orders2 were $71.7 million; Book-to-Bill ratio2 of 1.3x and record backlog2 of $515.6 million

- Strong balance sheet with no debt, $22.3 million in cash, and access to $43.0 million under its revolving credit facility at quarter end to support growth initiatives

- Updating and increasing full year fiscal 2026 guidance; Remain on track to reach strategic goal of 8% to 10% annual organic revenue growth and low to mid-teen Adjusted EBITDA margins1 by fiscal 2027

BATAVIA, N.Y.–(BUSINESS WIRE)– Graham Corporation (NYSE: GHM) (“GHM” or the “Company”), a global leader in the design and manufacture of mission critical fluid, power, heat transfer, vacuum, and advanced mixing technologies for the Defense, Energy & Process, and Space industries, today reported financial results for its third quarter for the fiscal year ending March 31, 2026 (“fiscal 2026”).

Graham’s President and Chief Executive Officer, Matthew J. Malone stated, “Our third quarter results reflect continued strong, disciplined execution across the organization as we progress through the back half of fiscal 2026. Revenue growth and profitability were driven by solid performance across our end markets and supported by a record backlog, which provides meaningful visibility into future demand. Activity in our Defense market remains robust, while the Energy & Process and Space markets continue to perform in line with our expectations.”

Mr. Malone continued, “As we move through the remainder of the fiscal year, we remain focused on disciplined execution, operational efficiency, and advancing strategic initiatives that strengthen our competitive position. We continue to invest in automation, advanced testing, and new technical capabilities that enhance productivity and support margin expansion. In addition, the recent acquisition of FlackTek in January 2026 meaningfully expands our technology portfolio and further positions Graham to deliver differentiated, mission-critical solutions to our core end markets.”

1 Adjusted net income per diluted share, Adjusted EBITDA, and Adjusted EBITDA margin are non-GAAP measures. See attached tables and other information for important disclosures regarding Graham’s use of these non-GAAP measures.

2 Orders, backlog, and book-to-bill ratio are key performance metrics. See “Key Performance Indicators” below for important disclosures regarding Graham’s use of these metrics.

Third Quarter Fiscal 2026 Performance Review

(All comparisons are with the same prior-year period unless noted otherwise.)

*Graham believes that, when used in conjunction with measures prepared in accordance with U.S. generally accepted accounting principles (“GAAP”), adjusted net income, adjusted net income per diluted share, adjusted EBITDA, and adjusted EBITDA margin, which are non-GAAP measures, help in the understanding of its operating performance. See attached tables and other information provided at the end of this press release for important disclosures regarding Graham’s use of these non-GAAP measures.

Quarterly net sales of $56.7 million increased 21%, or $9.7 million over the prior year reflecting our diversified revenue base. Sales to the Defense market contributed $8.3 million to growth primarily due to the timing of project milestones, new programs, and growth in existing programs. Sales to the Energy & Process market increased $2.1 million or 13% over the prior year driven by Aftermarket sales, as well as continued momentum in our New Energy markets and in particular small modular reactors (“SMRs”). Aftermarket sales to the Energy & Process and Defense markets totaled $10.8 million for the quarter, 11% above the prior year. See supplemental data for a further breakdown of sales by market and region.

Gross profit for the quarter increased $1.8 million, or 15%, to $13.5 million compared to the prior-year period of $11.7 million. As a percentage of sales, gross profit margin decreased 100 basis points to 23.8%, compared to the third quarter of fiscal 2025. This decrease in gross profit margin reflects the mix of sales during the third quarter of fiscal 2026, and a higher level of material receipts which carry lower profit margins. Additionally, the third quarter and the first nine months of fiscal 2025 gross profit benefited $0.3 million and $1.5 million, respectively, from a grant received in the prior year from the BlueForge Alliance to reimburse the Company for the cost of its defense welder training programs in Batavia, which did not repeat in fiscal year 2026. For the first nine months of fiscal 2026, we estimate the impact of tariffs on our consolidated financial statements to be approximately $1.0 million compared to the prior year and was immaterial for the third quarter of fiscal 2026. For the full fiscal 2026, we now expect the potential impact of tariffs to be between an incremental $1.0 to $1.5 million compared to the prior year.

Selling, general and administrative expense (“SG&A”), including intangible amortization, totaled $10.6 million, an increase of $0.9 million compared with the prior year due to the investments being made in operations, employees, and technology, higher acquisition and integration costs due to the Xdot and FlackTek acquisitions, as well as higher performance-based compensation due to Graham’s increased profitability, which was partially offset by a reversal of bad debt reserves. As a percentage of sales, SG&A, including amortization of 18.6%, decreased 200 basis points compared to the prior year period, reflecting the higher level of sales during the quarter, as well as our continued financial discipline.

Cash Management and Balance Sheet

Cash provided by operating activities totaled $4.8 million for the quarter ended December 31, 2025. As of December 31, 2025, cash and cash equivalents were $22.3 million.

Capital expenditures, net for the third quarter fiscal 2026 were $2.2 million, focused on capacity expansion, increasing capabilities, and productivity improvements.

The Company had no debt outstanding as of December 31, 2025, with $43.0 million available on its revolving credit facility after taking into account outstanding letters of credit.

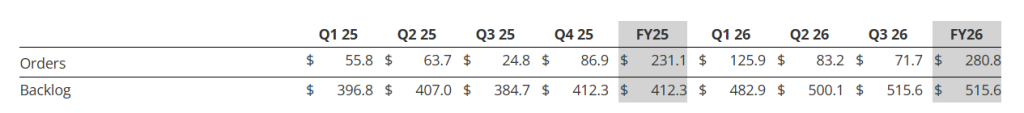

Orders, Backlog, and Book-to-Bill Ratio

See supplemental data filed with the Securities and Exchange Commission on Form 8-K and provided on the Company’s website for a further breakdown of orders and backlog by market. See “Key Performance Indicators” below for important disclosures regarding Graham’s use of these metrics ($ in millions).

Orders for the third quarter of fiscal 2026 were $71.7 million. This increase was primarily in the Defense and Space markets, which continue to exhibit strong tail-winds. Energy & Process orders were consistent with prior year levels, as strong demand in New Energy offset weaker Aftermarket orders. Total Aftermarket orders for the third quarter of fiscal 2026 decreased $5.2 million to $8.0 million from the record levels of the prior year.

Note that our orders tend to be lumpy given the nature of our business (i.e. large capital projects) and in particular, orders to the Defense industry, which span multiple years and can be significantly larger in size.

Backlog at quarter end was a record $515.6 million, a 34% increase over the prior-year period, driven by strong bookings including contributions from Xdot of $0.5 million, primarily in the Defense and Space markets. For the quarter, the Company achieved a book-to bill ratio of 1.3x. Approximately 35% to 40% of orders currently in backlog are expected to be converted to sales in the next twelve months, another 25% to 30% are expected to convert to sales within one to two years, and the remaining beyond two years. Approximately 85% of our backlog as of December 31, 2025, was to the Defense industry, which provides stability and visibility to our business.

FlackTek Acquisition

On January 23, 2026, subsequent to the end of the third quarter, Graham acquired FlackTek Manufacturing, LLC and FlackTek Sales, LLC (collectively, “FlackTek”). The acquisition establishes advanced mixing and materials processing as a third core technology platform for Graham, complementing its existing vacuum, heat transfer, and turbomachinery capabilities and further aligning with the Company’s Defense, Energy & Process, and Space end markets.

Under the terms of the transaction, Graham acquired 100% of the equity of FlackTek for a purchase price of $35.0 million, comprised of 85% cash and 15% using 75,818 shares of Graham’s common stock, along with the potential to earn an additional $25 million in future performance-based cash earnouts over four years beginning in fiscal year 2027, based upon achieving progressively increasing adjusted EBITDA performance targets. The base purchase price represents approximately 12x FlackTek’s projected adjusted EBITDA for 2026. The transaction was funded through a combination of cash on-hand and borrowings under the Company’s revolving credit facility.

In connection with the acquisition, Graham amended its revolving credit agreement with Wells Fargo Bank, National Association, increasing the borrowing limit from $50 million to $80 million. Following the closing of the transaction, the Company’s pro forma leverage ratio is approximately 1.2x.

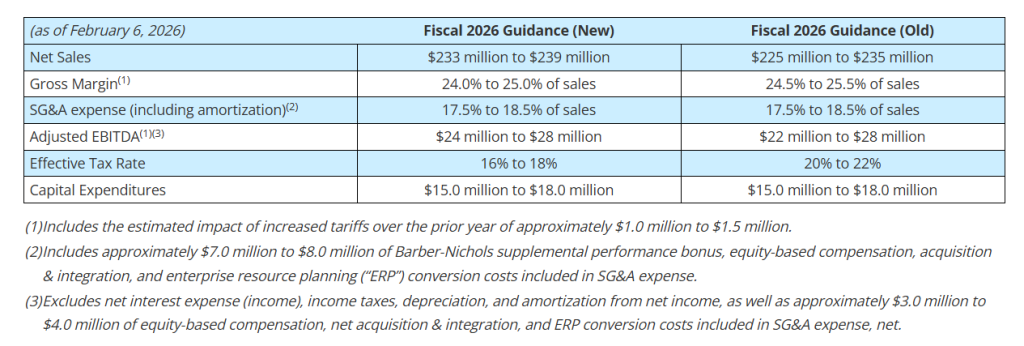

Fiscal 2026 Outlook

Based upon the results for the first nine months of fiscal 2026, our expectations for the remainder of the fiscal year, and inclusive of the acquisition of FlackTek and Xdot, Graham is updating its full year fiscal 2026 guidance as follows:

Graham’s Chief Financial Officer, Christopher J. Thome, said, “We are pleased with our performance through the first nine months of fiscal 2026 and continue to see strong demand across most of the markets we serve. Reflecting this momentum, including the contribution from the FlackTek acquisition, we are increasing our full-year fiscal 2026 guidance.

Mr. Thome continued, “After the acquisition of FlackTek, our balance sheet remains strong with low leverage, a modest amount of debt of $20 million, and increased capacity under our line of credit. We believe this increased capacity, along with our strong operating cash flow, provides us ample liquidity to continue to execute our capital allocation strategy and future growth.”

Webcast and Conference Call

GHM’s management will host a conference call and live webcast on February 6, 2026, at 11:00 a.m. Eastern Time (“ET”) to review its financial results as well as its strategy and outlook. The review will be accompanied by a slide presentation, which will be made available immediately prior to the conference call on GHM’s investor relations website.

A question-and-answer session will follow the formal presentation. GHM’s conference call can be accessed by calling (201)-689-8560. Alternatively, the webcast can be monitored from the events section of GHM’s investor relations website.

A telephonic replay will be available from 3:00 p.m. ET today through Friday, February 13, 2026. To listen to the archived call, dial (412) 317-6671 and enter conference ID number 13757532 or access the webcast replay via the Company’s website at ir.grahamcorp.com, where a transcript will also be posted once available.

About Graham Corporation

Graham is a global leader in the design and manufacture of mission critical fluid, power, heat transfer, vacuum, and advanced mixing technologies for the Defense, Energy & Process, and Space industries. Graham Corporation and its family of global brands are built upon world-renowned engineering expertise, proprietary technologies, as well as its responsive and flexible service and the unsurpassed quality customers have come to expect from the Company’s products and systems. Graham Corporation routinely posts news and other important information on its website, grahamcorp.com, where additional information on Graham Corporation and its businesses can be found.

View source version on businesswire.com: https://www.businesswire.com/news/home/20260205698839/en/

For more information, contact:

Christopher J. Thome

Vice President – Finance and CFO

Phone: (585) 343-2216

Tom Cook

Investor Relations

(203) 682-8250

[email protected]

Source: Graham Corporation

Released February 6, 2026