Research News and Market Data on SHIP

February 17, 2026 08:00 ET | Source: Seanergy Maritime Holdings Corp.

Declares $0.20 Per Share Dividend and Expands Prompt Newbuilding Program Totaling $226m

- Fifth consecutive year of profitability, delivering adjusted EPS of $1.28, underscoring the resilience and earnings power of Seanergy’s pure-play Capesize strategy across cycles

- Declared a Q4 cash dividend of $0.20 per share and total cash dividends for 2025 of $0.43 per share

- The Q4 dividend marks the Company’s 17th consecutive quarterly dividend bringing cumulative distributions to $2.64 per share, or approximately $51.2 million

- Expanded the prompt newbuilding program to three eco vessels totaling $226million, securing attractive early delivery positions and enhancing future earnings capacity:

- Two scrubber-fitted 181,000 dwt Capesize bulkers with expected deliveries in Q2 and Q3 2027

- One scrubber-fitted 211,000 dwt Newcastlemax bulker with expected delivery in Q2 2028

- Advanced fleet renewal through the sale of the 2010-built M/V Dukeship at a highly attractive valuation, via an 18-month bareboat charter with purchase obligation, generating positive cash flows and releasing significant liquidity

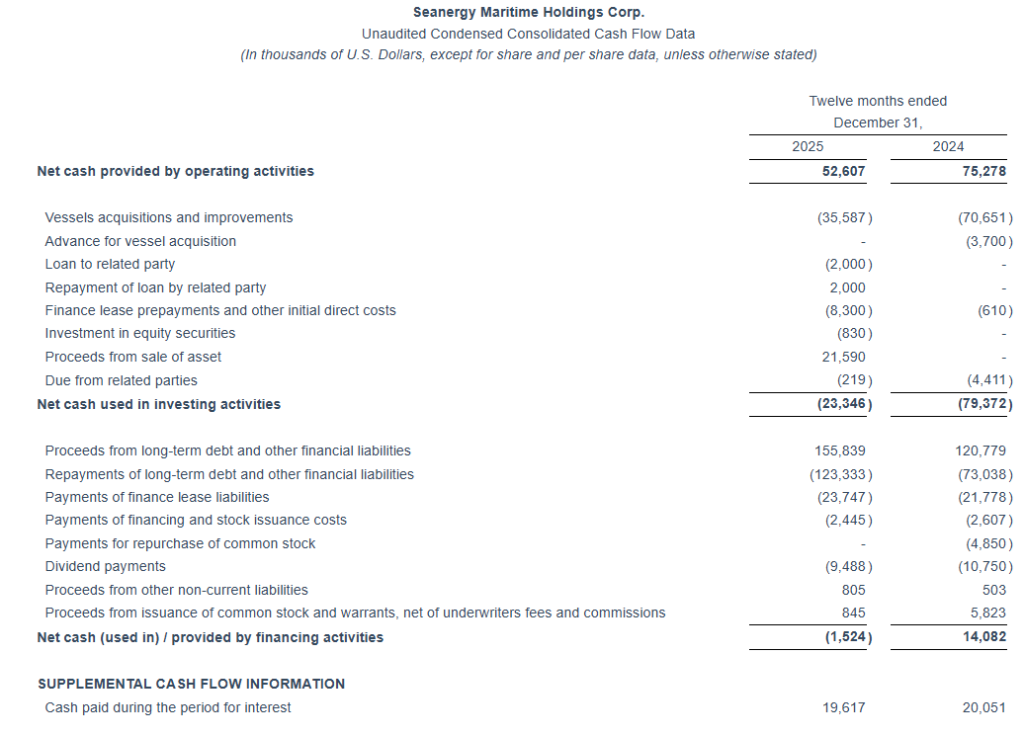

- Completed $123.0 million of refinancings at improved terms, generating $51.9 million of incremental liquidity in Q4 and this year to date

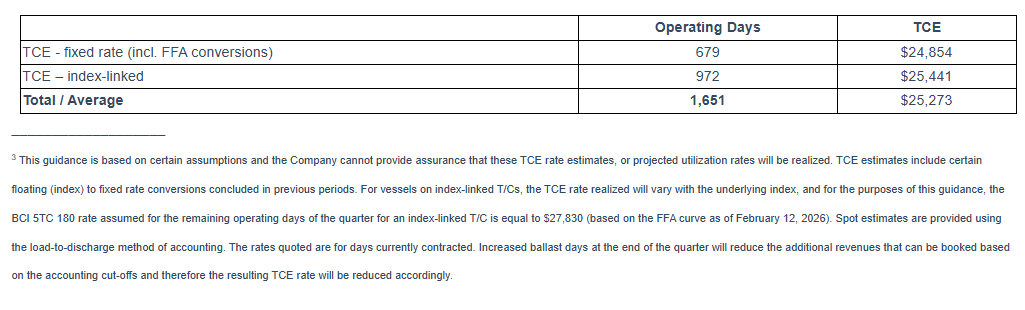

- Q1 TCE guidance of $25,2732, representing a 14% premium to the average AV5 Baltic Capesize Index year-to-date

____________________________

1 Adjusted earnings per share, Adjusted Net Income, EBITDA and Adjusted EBITDA are non-GAAP measures. Please see the reconciliation below of Adjusted earnings per share, Adjusted Net Income, EBITDA and Adjusted EBITDA to net income, the most directly comparable U.S. GAAP measure.

ATHENS, Greece, Feb. 17, 2026 (GLOBE NEWSWIRE) — Seanergy Maritime Holdings Corp. (“Seanergy” or the “Company”) (NASDAQ: SHIP), a leading pure-play Capesize shipping company, today reported its financial results for the fourth quarter and twelve months ended December 31, 2025, and announced a quarterly cash dividend of $0.20 per common share. This represents Seanergy’s 17th consecutive quarterly dividend under its capital return policy, with total cash dividends for 2025 of $0.43 per common share, underscoring the Company’s commitment to disciplined capital allocation and consistent shareholder returns.

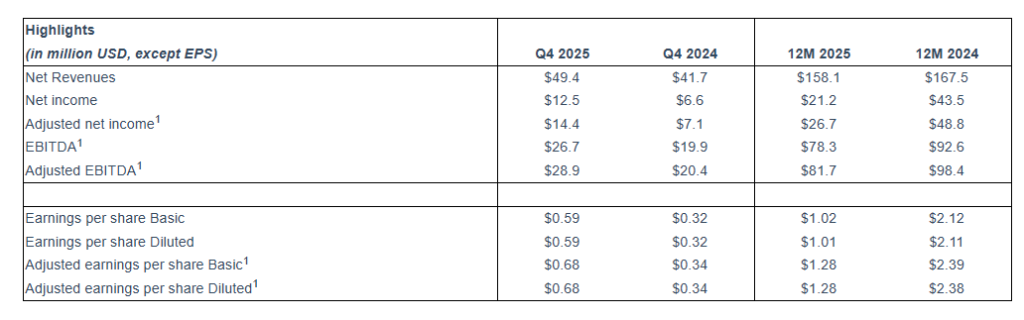

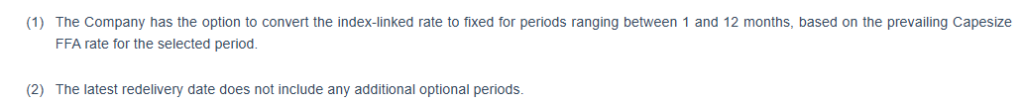

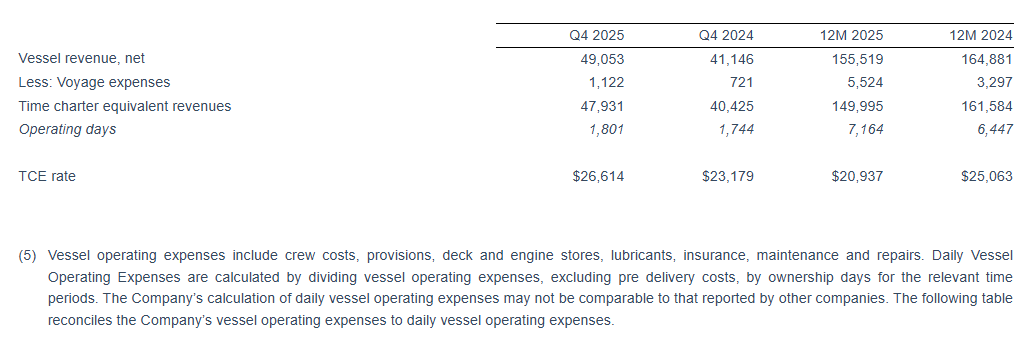

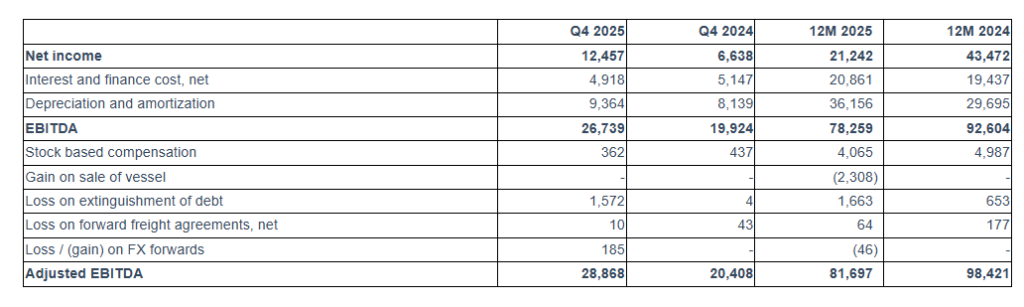

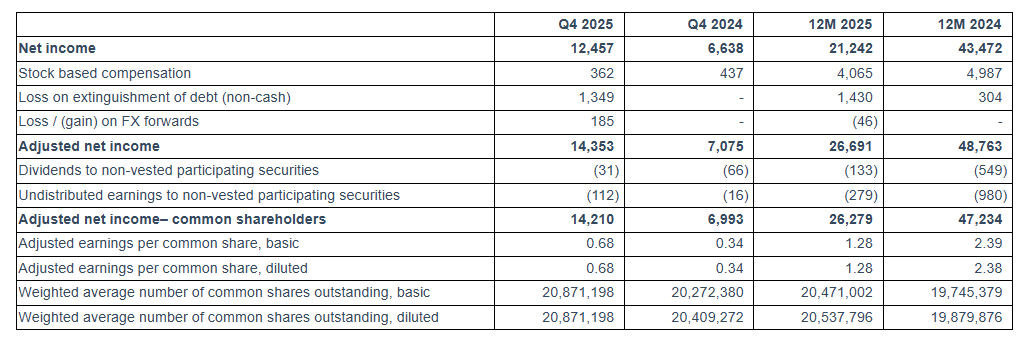

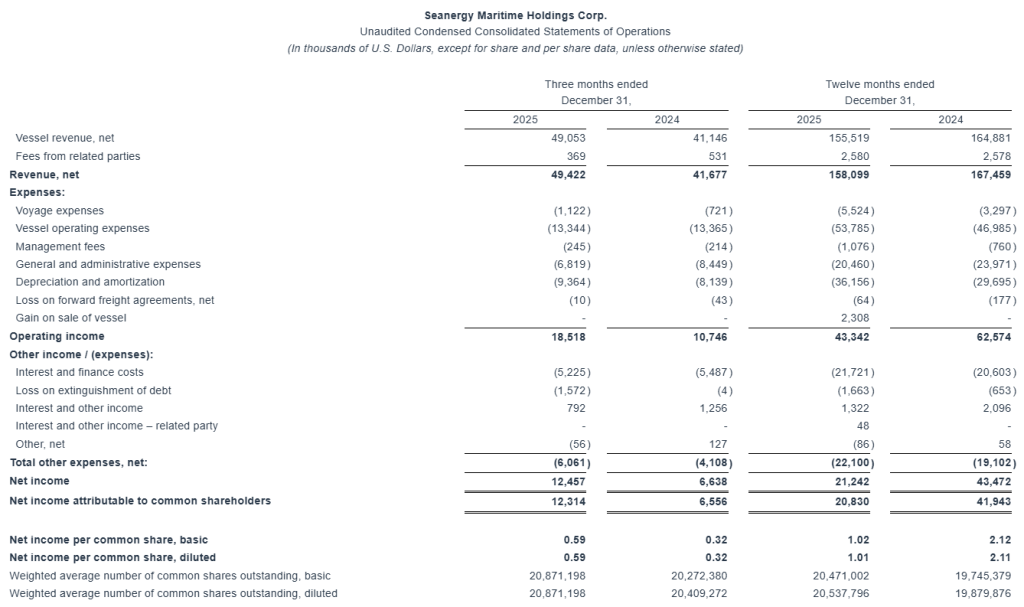

For the quarter ended December 31, 2025, Seanergy generated Net Revenues of $49.4 million, up from $41.7 million in the fourth quarter of 2024. Net Income and Adjusted Net Income for the quarter were $12.5 million and $14.4 million, respectively, compared to Net Income of $6.6 million and Adjusted Net Income of $7.1 million in the fourth quarter of 2024. Adjusted EBITDA for the quarter was $28.9 million, compared to $20.4 million in the same period of 2024. The fleet achieved a daily Time Charter Equivalent (“TCE”) of $26,614 for the fourth quarter of 2025.

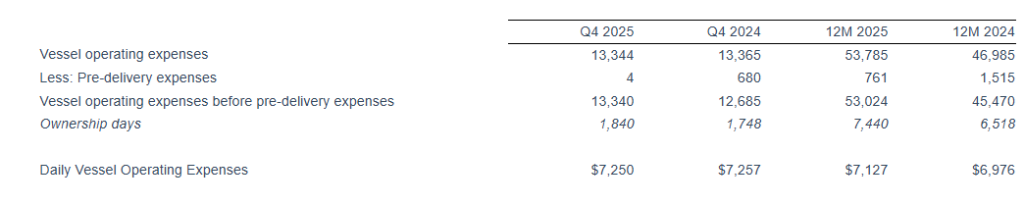

For the full year 2025, Seanergy delivered Net Revenues of $158.1 million, compared to $167.5 million in 2024. Net Income and Adjusted Net Income were $21.2 million and $26.7 million, respectively, compared to Net Income of $43.5 million and Adjusted Net Income of $48.8 million in 2024. Adjusted EBITDA for the twelve months was $81.7 million, compared to $98.4 million for 2024. The daily TCE rate of the fleet for 2025 was $20,937, compared to $25,063 in 2024. The average daily OPEX was $7,127 compared to $6,976 in 2024.

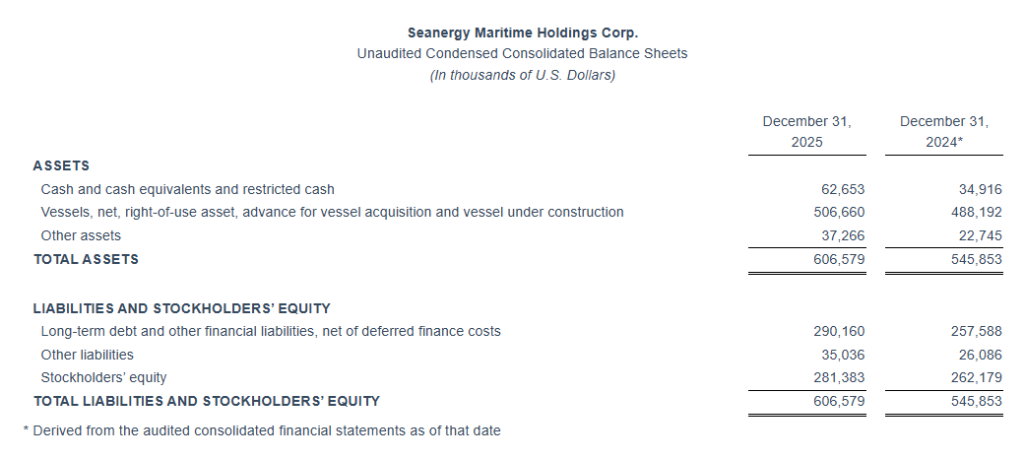

Cash and cash-equivalents and restricted cash, as of December 31, 2025, stood at $62.7 million. Stockholders’ equity at the end of the fourth quarter was $281.4 million. Long-term debt (senior loans and other financial liabilities) net of deferred charges stood at $290.2 million, while the book value of the fleet was $506.7 million, including vessels under construction.

Stamatis Tsantanis, the Company’s Chairman & Chief Executive Officer, stated:

“Driven by a strong Capesize market, Seanergy delivered a very strong fourth quarter, marking our fifth consecutive year of profitability. This performance reflects the durability of our pure-play Capesize strategy, disciplined balance sheet management, and our ability to consistently capture market upside.

“We remain firmly focused on delivering consistent shareholder returns. In 2025, we distributed $0.43 per common share in cash dividends, and with the declaration of the Q4 dividend of $0.20 per common share, we marked our 17th consecutive quarterly dividend. Since launching our dividend program, we have returned $2.64 per common share, or approximately $51.2 million, to our shareholders, underscoring both the strong earnings capacity of our fleet and our disciplined approach to capital allocation.

“Looking ahead, market fundamentals remain constructive as we move into 2026. Robust iron ore and bauxite trade flows, limited Capesize newbuilding supply, and favorable ton-mile dynamics continue to support earnings visibility. With a high-quality fleet, predominantly index-linked employment, and balanced leverage profile, we believe Seanergy is well positioned to capture meaningful upside in this favorable environment.

“Our fleet renewal program is progressing as planned and remains a core strategic priority. In recent months, we added two prompt, eco newbuilding orders at leading Chinese shipyards: a scrubber-fitted Capesize sister vessel to the unit previously announced, scheduled for delivery in Q3 2027, and a scrubber-fitted Newcastlemax scheduled for delivery in Q2 2028. The total current newbuilding investment of approximately $226 million reflects our intention to continue pursuing selective and prompt newbuilding opportunities when market conditions and financing terms are favorably aligned.

“In parallel, and taking advantage of firm secondhand values, we recently agreed to sell the 2010-built Dukeship through an 18-month bareboat arrangement, crystallizing a solid price and generating positive cash flows through the bareboat period. We continue to actively evaluate opportunities to optimize our fleet through selective acquisitions and targeted disposals, while keeping long-term shareholder value and returns as a top priority.

“On the commercial front, we secured index-linked renewals for five vessels, maintaining full participation in a strengthening market while selectively utilizing FFAs to manage volatility. This disciplined approach continues to deliver strong commercial performance. For the first quarter of 2026, we estimate a daily TCE of approximately $25,300, representing a 14% premium to the prevailing AV5 BCI year-to-date, based on the current FFA curve, with approximately 77% of available days fixed at an average rate of $24,739.

“Seanergy enters 2026 from a position of financial strength, operational excellence, and strategic clarity, with a clear path toward continued per-share value creation for our shareholders.”

______________________________

2 This guidance is based on certain assumptions and the Company cannot provide assurance that these TCE rate estimates, or projected utilization rates will be realized. TCE estimates include certain floating (index) to fixed rate conversions concluded in previous periods. For vessels on index-linked T/Cs, the TCE rate realized will vary with the underlying index, and for the purposes of this guidance, the BCI 5TC 180 rate assumed for the remaining operating days of the quarter for an index-linked T/C is equal to $27,830 (based on the FFA curve as of February 12, 2026). Spot estimates are provided using the load-to-discharge method of accounting. The rates quoted are for days currently contracted. Increased ballast days at the end of the quarter will reduce the additional revenues that can be booked based on the accounting cut-offs and therefore the resulting TCE rate will be reduced accordingly.

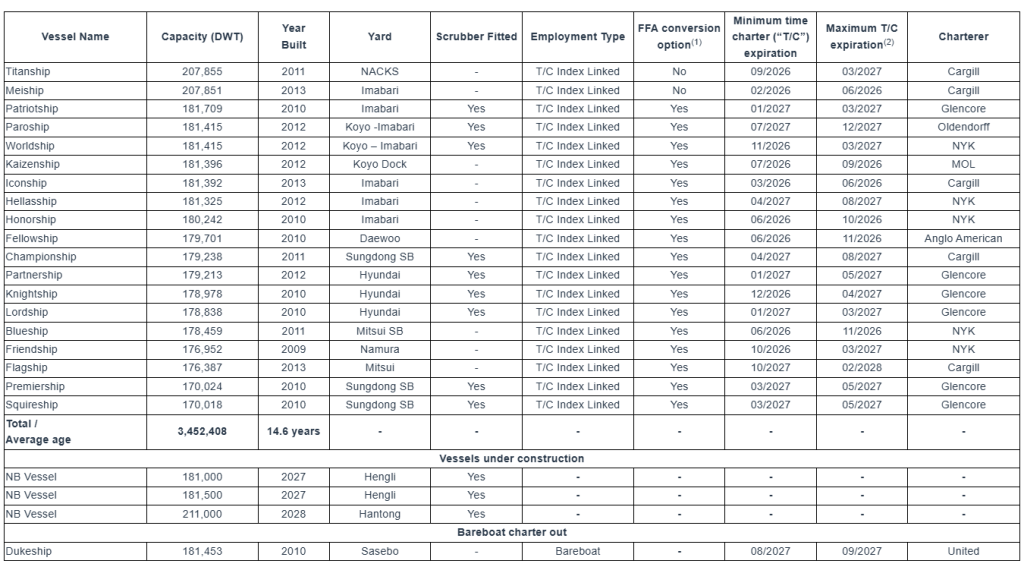

Company Fleet:

Fleet Data:

(U.S. Dollars in thousands)

(In thousands of U.S. Dollars, except operating days and TCE rate)

(In thousands of U.S. Dollars, except ownership days and Daily Vessel Operating Expenses)

Net income to EBITDA and Adjusted EBITDA Reconciliation:

(In thousands of U.S. Dollars)

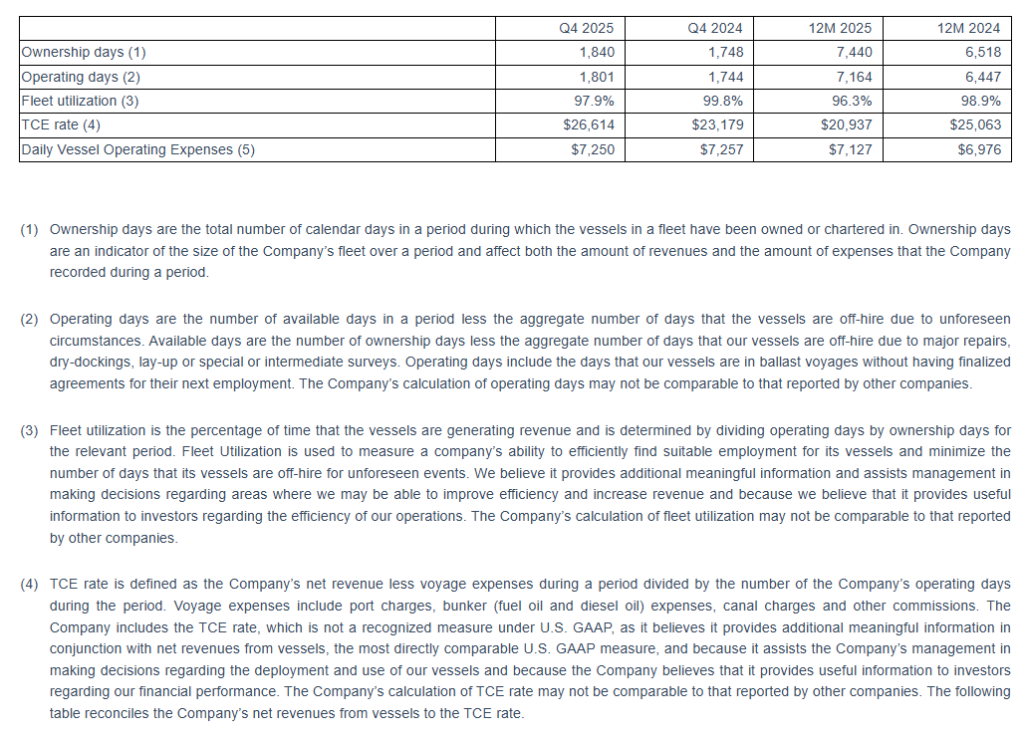

Earnings Before Interest, Taxes, Depreciation and Amortization (“EBITDA”) represents the sum of net income, net interest and finance costs, depreciation and amortization and, if any, income taxes during a period. EBITDA and Adjusted EBITDA are not recognized measurements under U.S. GAAP. Adjusted EBITDA represents EBITDA adjusted to exclude stock-based compensation, gain on sale of vessel, loss on forward freight agreements, net, loss on extinguishment of debt, and loss / (gain) on FX forwards (“Other, net” in statement of operations), which the Company believes are not indicative of the ongoing performance of its core operations.

EBITDA and adjusted EBITDA are presented as we believe that these measures are useful to investors as a widely used means of evaluating operating profitability. Management also uses these non-GAAP financial measures in making financial, operating and planning decisions and in evaluating the Company’s performance. EBITDA and adjusted EBITDA as presented here may not be comparable to similarly titled measures presented by other companies. These non-GAAP measures should not be considered in isolation from, as a substitute for, or superior to, financial measures prepared in accordance with U.S. GAAP.

Adjusted Net Income Reconciliation and calculation of Adjusted Earnings Per Share

(In thousands of U.S. Dollars, except for share and per share data)

To derive Adjusted Earnings Per Share, a non-GAAP financial measure, from Net Income, we adjust for dividends and undistributed earnings to non-vested participating securities and exclude non-cash items, as provided in the table above. We believe that Adjusted Net Income and Adjusted Earnings Per Share assist our management and investors by increasing the comparability of our performance from period to period since each such measure eliminates the effects of such non-cash items as loss on extinguishment of debt, stock based compensation, loss / (gain) on FX forwards and other items which may vary from year to year, for reasons unrelated to overall operating performance. In addition, we believe that the presentation of the respective measure provides investors with supplemental data relating to our results of operations, and therefore, with a more complete understanding of factors affecting our business than with GAAP measures alone. Our method of computing Adjusted Net Income and Adjusted Earnings Per Share may not necessarily be comparable to other similarly titled captions of other companies due to differences in methods of calculation.

First Quarter 2026 TCE Rate Guidance:

As of the date hereof, approximately 77% of the Company fleet’s expected operating days in the first quarter of 2026 have been fixed at an estimated TCE rate of approximately $24,739. Assuming that for the remaining operating days of our index-linked time charters, the BCI 5TC 180 rate will be equal to $27,830 (based on the FFA curve as of February 12, 2026), our estimated TCE rate for the first quarter of 2026 will be approximately $25,2733. The following table provides the breakdown of index-linked charters and fixed-rate charters in the first quarter of 2026:

Fourth Quarter and Recent Developments:

Dividend Distribution for Q3 2025 and Declaration of Q4 2025 Dividend

On January 9, 2026, the Company paid a quarterly cash dividend of $0.13 per common share for the third quarter of 2025 to all shareholders of record as of December 29, 2025.

The Company has declared a quarterly cash dividend of $0.20 per common share for the fourth quarter of 2025 payable on or about April 10, 2026, to all shareholders of record as of March 27, 2026.

Fleet Updates

Newbuilding Contract for a Newcastlemax Vessel at Hantong Shipyard

In November 2025, the Company entered into an agreement for the acquisition of a newbuilding 211,000 dwt scrubber-fitted Newcastlemax vessel from Jiangsu Hantong Ship Heavy Industry Co., Ltd., with delivery expected in the second quarter of 2028. The purchase price is approximately $75.8 million. The first installment, representing 15% of the purchase price, has already been paid. The remaining installments are linked to the vessel’s construction milestones, with 30% of the purchase price payable over the next 2 years and the remaining 55% upon delivery of the vessel.

The new vessel will be built incorporating the latest technological advancements and eco-friendly design features, resulting in enhanced fuel efficiency and reduced emissions in line with the Company’s ongoing fleet renewal and decarbonization strategy.

Newbuilding Contract for a Second Capesize Vessel at Hengli Shipyard

In January 2026, the Company entered into an agreement with Hengli Shipbuilding (Dalian) Co., Ltd. and Hengli Shipbuilding (Singapore) Pte. Ltd. for the construction of a 181,500 dwt scrubber-fitted Capesize vessel. The contract price is approximately $75.2 million, with delivery expected in the third quarter of 2027. The purchase price will be paid in five installments, linked to the vessel’s construction milestones, with 45% of the purchase price payable over the next 14 months and the remaining 55% upon delivery of the vessel.

The new vessel will be built incorporating the latest technological advancements and eco-friendly design features, resulting in enhanced fuel efficiency and reduced emissions in line with the Company’s ongoing fleet renewal and decarbonization strategy.

M/V Dukeship – Disposal of Vessel through Bareboat Charter

In February 2026, the Company entered into an agreement with United Maritime Corporation (“United”), a related party, for the disposal of the M/V Dukeship through an 18-month bareboat charter. The charter period commenced following the delivery of the vessel on February 12, 2026. United has advanced a downpayment of $5.5 million and will pay a daily charter rate of $9,450, with a purchase obligation of $22.1 million at the end of the bareboat charter. A special committee of disinterested members of our Board of Directors negotiated the terms and approved the agreement.

Commercial Updates

M/V Flagship – New T/C agreement

In December 2025, the M/V Flagship commenced a new T/C agreement with Cargill International SA with the agreement set to terminate between November 1, 2027 to February 1, 2028, each date subject to (+/- 15 days). The daily hire is based on the 5 T/C routes of the BCI, with an option for the Company to fix the rate for 3 to 9 months based on the prevailing Capesize FFA curve.

M/V Paroship – New T/C agreement

In December 2025, the M/V Paroship commenced a new T/C agreement with Oldendorff GMBH & CO. KG., Ltd for a period of about 20 to about 24 months. The daily hire is based on the 5 T/C routes of the BCI, with an option for the Company to fix the rate for 3 to 9 months based on the prevailing Capesize FFA curve. The Company will also receive most of the benefit from the scrubber profit-sharing scheme.

M/V Friendship – New T/C agreement

In January 2026, the M/V Friendship commenced a new T/C agreement with Glencore Freight Pte. Ltd (“Glencore”) for a period of about 10 to about 14 months. The daily hire is based on the 5 T/C routes of the BCI, with an option for the Company to fix the rate for 1 to 9 months based on the prevailing Capesize FFA curve.

M/V Partnership – New T/C agreement

In February 2026, the M/V Partnership commenced a new T/C agreement with Glencore for a period of about 12 to about 15 months. The daily hire is based on the 5 T/C routes of the BCI, with an option for the Company to fix the rate for 1 to 9 months based on the prevailing Capesize FFA curve. The Company will also receive most of the benefit from the scrubber profit-sharing scheme.

M/V Lordship – Time charter extension

In January 2026, the charterer of the M/V Lordship agreed to extend the time charter agreement in direct continuation from the previous agreement. The extension period will commence on August 21, 2026, for a duration of minimum January 1st, 2027 until maximum March 31st, 2027. The Company receives most of the benefit from the scrubber profit-sharing scheme while the daily hire will be based on a revised premium over the BCI.

M/V Hellasship – Time charter extension

In February 2026, the charterer of the M/V Hellasship agreed to extend the time charter agreement in direct continuation from the previous agreement. The extension period will commence on April 9, 2026, for a duration of minimum 12 to maximum 16 months. The daily hire is based on a revised premium over the BCI, while all other main terms of the time charter remain materially the same.

Financing Updates

M/Vs Premiership, Fellowship, Championship & Flagship – Sustainability linked loan facility

In December 2025, the Company entered into a new sustainability linked loan facility with Danish Ship Finance secured by the M/Vs Fellowship, Premiership, Championship and Flagship to refinance the sale and leaseback agreement for the M/V Flagship and to increase the existing indebtedness of the other three vessels.

The facility includes a new tranche of $16.8 million secured by the M/V Flagship, with a five-year term. The principal is repayable in 20 quarterly installments of $0.8 million each and a balloon of $1.8 million payable together with the final installment. The interest rate is 2.10% plus 3-month Term SOFR and can fluctuate by 0.05% based on certain emission reduction thresholds.

The additional top-up tranche of $7.3 million, secured by the M/Vs Fellowship, Premiership & Championship, has a three-and-a-half year term and is repayable in 14 quarterly payments of $0.5 million resulting in zero outstanding balance at maturity. The interest rate is 1.95% plus 3-month Term SOFR and can fluctuate by 0.05% based on certain emission reduction thresholds.

M/Vs Hellasship, Patriotship, Iconship & Newbuilding Capesize vessel – Huarong Sale and Leaseback agreements

In December 2025, the Company entered into three separate sale and leaseback agreements totaling $72.5 million for the M/Vs Hellasship, Patriotship & Iconship with entities affiliated with China Huarong Financial Leasing Co., Ltd. The proceeds were used to refinance the outstanding indebtedness of the respective vessels under three sale and leaseback agreements with AVIC International Leasing Co., Ltd. On January 8, 2026, the vessels were sold and chartered back on a bareboat basis for a period of 81 months. The Company has continuous options to purchase the vessels at predetermined prices, starting one year after the commencement date and a purchase obligation at expiry date of each charter. The charterhire principal for the three agreements amortizes in 27 quarterly installments of $2.0 million along with the aggregate purchase obligations of $18.3 million at the expiry of the bareboat charters. Each financing bears interest at a rate of 3-month Term SOFR plus 2.00% per annum, 55 bps lower than the rate of the refinanced agreements. The sale and leaseback agreements do not include any financial covenants or security value maintenance provisions.

Regarding the upcoming delivery of our newbuilding Capesize vessel previously announced, the Company has agreed to enter into a sale and leaseback agreement of $56.3 million to partially finance its acquisition with an entity affiliated with China Huarong Financial Leasing Co., Ltd., which will also provide pre-delivery financing for certain installments under the shipbuilding contract. Upon delivery, the vessel will be sold and chartered back for a period of 60 months. The Company will have continuous purchase options at predetermined prices, commencing one year after the charter commencement date and a purchase obligation at the expiry date. The charterhire principal amortizes in 20 quarterly installments of $0.6 million along with a purchase obligation of $43.5 million at the expiry of the bareboat charter. The financing will bear interest at a rate of 3-month Term SOFR plus 1.80% per annum, while pre-delivery financing amounts will accrue interest payable quarterly in arrears. The sale and leaseback agreement will not include any financial covenants or security value maintenance provisions.

M/V Partnership and Newbuilding Newcastlemax vessel – BOCL Sale and Leaseback agreement

The Company is in the process of finalizing a $26.5 million sale and leaseback agreement for the M/V Partnership with an affiliate of BOC Financial Leasing Corporation Limited to refinance the outstanding indebtedness of the respective vessel under the sale and leaseback agreement with Chugoku Bank, Ltd. The agreement will become effective upon the delivery of the M/V Partnership to the lessor which is expected in March 2026. The Company will sell and charter back the vessel on a bareboat basis for a period of 78 months and will have continuous options to repurchase the vessel at any time following the second anniversary of the delivery at predetermined prices as set forth in the agreement. The charterhire principal will amortize in 26 quarterly installments of $0.8 million along with a purchase option of $6.3 million at the expiry of the bareboat charter. The financing will bear an interest rate of 3-month Term SOFR plus 1.85% per annum, 105 bps lower than the rate of the refinanced agreement. The sale and leaseback agreement will not include any financial covenants or security value maintenance provisions.

Regarding the upcoming delivery of our newbuilding Newcastlemax vessel described above, the Company has agreed to enter into a sale and leaseback agreement of $57.8 million to partially finance its acquisition. The lessor will be an affiliate of BOC Financial Leasing Corporation Limited, which will also provide pre-delivery financing for certain installments under the shipsales contract. Upon delivery, the vessel will be sold and chartered back for a period of 96 months. The Company will have continuous purchase options at predetermined prices as set forth in the agreement, commencing two years after the charter commencement date. The charterhire principal will amortize in 32 quarterly installments of $0.7 million along with a purchase option of $36.3 million at the expiry of the bareboat charter. The financing will bear interest at a rate of 3-month Term SOFR plus 1.85% per annum, while pre-delivery financing amounts will accrue interest payable quarterly in arrears. The sale and leaseback agreement will not include any financial covenants or security value maintenance provisions.

Conference Call:

The Company’s management will host a conference call to discuss financial results on February 17, 2026, at 10:00 a.m. Eastern Time.

Audio Webcast and Earnings Presentation:

There will be a live, and then archived, webcast of the conference call and accompanying presentation available through the Company’s website. To access the presentation and listen to the archived audio file, visit our website, following the Webcast & Presentations section under our Investor Relations page. Participants to the live webcast should register on Seanergy’s website approximately 10 minutes prior to the start of the webcast, following this link.

Conference Call Details:

Participants have the option to register for the call using the following link. You can use any number from the list or add your phone number and let the system call you right away.

About Seanergy Maritime Holdings Corp.

Seanergy Maritime Holdings Corp. is a prominent pure-play Capesize shipping company publicly listed in the U.S. Seanergy provides marine dry bulk transportation services through a modern fleet of Capesize vessels. The Company’s operating fleet consists of 19 vessels (2 Newcastlemax and 17 Capesize) with an average age of approximately 14.6 years and an aggregate cargo carrying capacity of 3,452,408 dwt. Upon the delivery of the newbuilding vessels, the Company’s operating fleet will consist of 22 vessels (3 Newcastlemax and 19 Capesize), with an aggregate cargo carrying capacity of 4,025,908 dwt. Additionally, the Company owns one Capesize vessel that has been chartered out on a bareboat basis.

The Company is incorporated in the Republic of the Marshall Islands and has executive offices in Glyfada, Greece. The Company’s common shares trade on the Nasdaq Capital Market under the symbol “SHIP”.

Please visit our Company website at: www.seanergymaritime.com.

Forward-Looking Statements

This press release contains forward-looking statements (as defined in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended) concerning future events, including with respect to declaration of dividends, market trends and shareholder returns. Words such as “may”, “should”, “expects”, “intends”, “plans”, “believes”, “anticipates”, “hopes”, “estimates” and variations of such words and similar expressions are intended to identify forward-looking statements. These statements involve known and unknown risks and are based upon a number of assumptions and estimates, which are inherently subject to significant uncertainties and contingencies, many of which are beyond the control of the Company. Actual results differ materially from those expressed or implied by such forward-looking statements. Factors that could cause actual results to differ materially include, but are not limited to, the Company’s operating or financial results; the Company’s liquidity, including its ability to service its indebtedness; competitive factors in the market in which the Company operates; shipping industry trends, including charter rates, vessel values and factors affecting vessel supply and demand; future, pending or recent acquisitions and dispositions, business strategy, impacts of litigation, areas of possible expansion or contraction, and expected capital spending or operating expenses; risks associated with operations outside the United States; risks arising from trade disputes between the U.S. and China, including the re-imposition of reciprocal port fees; broader market impacts arising from trade disputes or war (or threatened war) or international hostilities, such as between the U.S. and Venezuela, Israel and Hamas or Iran, China and Taiwan and Russia and Ukraine; risks associated with the length and severity of pandemics; and other factors listed from time to time in the Company’s filings with the SEC, including its most recent annual report on Form 20-F. The Company’s filings can be obtained free of charge on the SEC’s website at www.sec.gov. Except to the extent required by law, the Company expressly disclaims any obligations or undertaking to release publicly any updates or revisions to any forward-looking statements contained herein to reflect any change in the Company’s expectations with respect thereto or any change in events, conditions or circumstances on which any statement is based.

For further information please contact:

Seanergy Investor Relations

Tel: +30 213 0181 522

E-mail: [email protected]

Capital Link, Inc.

Paul Lampoutis

230 Park Avenue Suite 1540

New York, NY 10169

Tel: (212) 661-7566

E-mail: [email protected]

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/f0568e18-f58f-4591-93d1-44d92080add0