Gary Gensler’s SEC Files 13 Charges Against Changpeng Zhao and His Company Binance

In a pair of press releases, one from the Securities and Exchange Commission, and the other from Binance, the world’s largest cryptocurrency exchange, there were charges, allegations and answers fired back and forth. The SEC named the founder and CEO of Binance, Changpeng Zhao as a defendant in the suit. Binance quickly shot back how disappointed Binance is that 13 complaints were filed against the company.

Allegations

The SEC press release indicates that they are suing Binance and founder Changpeng Zhao for misusing customers’ funds and for diverting funds to a trading entity that Zhao controlled called Sigma Chain. It further charges Sigma Chain for engaging in fraudulent trading that made Binance’s volume appear larger than it actually was.

Among the charges, Binance is also supposed to have concealed that it commingled billions of dollars in customer assets, sending them to a third-party, Merit Peak, which was owned by Zhao.

The SEC filed the case in federal court in the District of Columbia. Binance engaged in “blatant disregard of the federal securities laws and the investor and market protections these laws provide,” the regulator wrote in its court complaint.

Binance Response

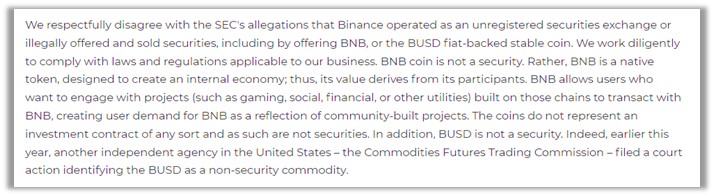

Binance said in a written statement that it intends to defend its platform and denied allegations that user assets on the Binance.US platform were ever at risk. “All user assets on Binance and Binance affiliate platforms, including Binance.US, are safe and secure, and we will vigorously defend against any allegations to the contrary,” the company said. Binance.US also said it would defend itself against the litigation.

Binance alleges that because of their size, they are a target for the US regulator. The company expressed concerns through a press release that despite cooperating with the SEC, that a reasonable amount of time was not given on the most recent 26 different requests, and that they may have been intentionally burdensome. Binance said that despite its willingness to do whatever was necessary to address the US regulator’s concerns and take whatever reasonable steps they could, the SEC would not share any evidence it might have regarding its purported concerns, and the SEC rejected attempts at engagement, instead going straight to court. “It is now clear to us that the SEC’s goal here was never to protect investors, as the SEC has claimed—if that were indeed the case, the SEC would have thoughtfully engaged with us on the facts and in our efforts to demonstrate the safety and security of the Binance,” according to a company statement.

Channelchek will continue to follow and report on major news impacting this case and others of interest to the investment world. Various sources indicate that there does not appear to be any type of a run by customers from Binance, there are some reports that it is business as usual. Register here to receive our daily emails.

Managing Editor, Channelchek