Gold Softens as Yields Rise on US Treasuries From Inflation Stickiness

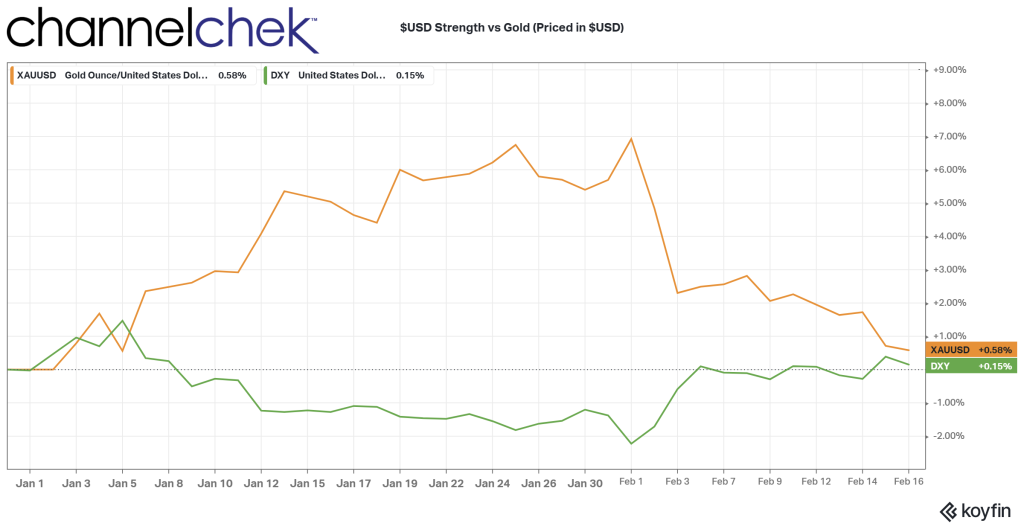

As the month of February began, the talk was for gold to hit $2,000 an ounce in the first quarter. But, as is often the case with investment markets, once certainty creeps into the mindset, something unexpected often comes along and undermines it. Gold may very well reach the $2,000 price in early 2023, but it has, for now, taken a small hit caused by a resurgence of expectations related to inflation’s pervasiveness. The inflation itself isn’t necessarily a problem, it is the chain reaction of events that then follows.

The One Two-Punch Catches Gold Off-Guard

Gold futures reached 10-month highs near $1,975 just before the release of January U.S. non-farm payrolls were reported on February 3rd. The Friday release showed large gains in the employment condition which stoked old inflation worries.

Concerns about inflation had been settling down before the jobs number. One indication of that is US bond yields had been priced, by most measures, for an eventual easing of rates, not tightening of conditions. The employment report itself began to unwind gold’s strength. The price sank to below $1,830 before recovering to around $1,875. The reason is that higher inflation, begets higher expectations of bond yields, which then begets capital flows into dollars to take advantage of the higher rates available. Gold becomes relatively weaker and less desirable under these conditions.

On February 14th, as some AU investors were falling out of love with gold, an inflation report (CPI) for January showed a tick-up in January prices over December’s numbers. This exacerbated U.S. inflation fears and helped to bring gold back under $1,850.

New Expectations

The shift in expectations over a two week period are not likely to unwind without new information which undermines the new employment and inflation reports. That doesn’t seem likely in the coming days as a just released wholesale price report (PPI) now indicates inflation is more than a services sector concern.

Gold long positions are now caught in the crosshairs of the Fed’s resolve to fight inflation. Every treasury yield spike has led to a dollar spike and been used as an opportunity to reduce demand for gold or reduce it’s relative value against US dollars.

Historically, gold prices had risen with inflation as investors bought the currency alternative as a hedge against paper currency. Currency typically loses value when prices go up. What happened then is more typical and is what is still taught in textbooks – good economic news was good for risk assets.

More recently, good economic news, worries investors because it has the potential to make inflation hotter, prompting the Fed to dial up rates and hurt everything from stocks to gold and oil. The positive correlation is on hiatus, probably until the Fed’s finger comes off the rates trigger.

Take Away

The markets had begun looking past the tightening phase after 450 bp worth of Fed Funds increases. The numbers reported in February have many investors, including those that trade currencies, precious metals, stocks, bonds, and other commodities less certain about the Fed calling for a cease fire in its inflation battle.

Of course, this new trend is young, it can conceivably be unwound in an instant in a changing world with many concerns outside and away from price increases.

Managing Editor, Channelchek

Sources: