Image Credit: Third Way Think Tank (Flickr)

Looming Cryptocurrency Regulation and SEC Thoughts

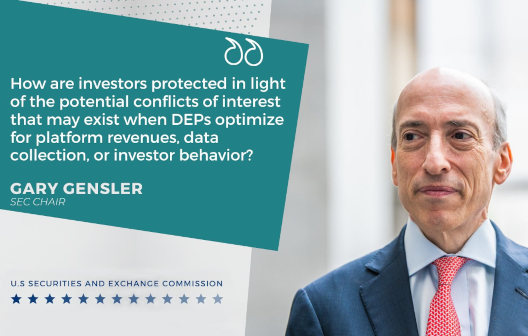

Gary Gensler, the chairman of the Securities and Exchange Commission (SEC) has asked the Commission’s staff to study how to extend investor protections to cryptocurrency platforms. The staff was also tasked with determining how to regulate platforms where securities and non-securities, like cryptocurrencies, trade together. This information was made public by the SEC chairman at the annual conference of the Penn Law Capital Markets Association at the University of Pennsylvania Carey Law School (Monday, April 4).

Platforms that enable trading in tokens and even lending platforms, whether centralized or decentralized, are averaging volume of more than $100 billion worth of cryptocurrencies a day. The majority of transactions, a full 99% of all trading is done on only five platforms. DeFi, or decentralized finance, is similarly concentrated with the top five platforms accounting for about 80% of trading, he said.

The SEC oversees brokers that trade securities, so Gensler has asked those that report to him at the SEC “how best to register and regulate platforms where the trading of securities and non-securities is intertwined.” He said the SEC and the Commodity Futures Trading Commission, using their respective authorities, should jointly address platforms that might trade both crypto-based security tokens and some commodity tokens.

“These crypto platforms play roles similar to those of traditional regulated exchanges,” the chairman said. “Thus, investors should be protected in the same way.”

Gensler expects the same set of rules would help the crypto/securities platforms. He said if a company builds a crypto market that protects investors against fraud and manipulation and safeguards market integrity, “then customers will be more likely to trust and have greater confidence in that market.”

He offered help from the authorities, Gensler said, if a security is being offered to the public and not registering or making the requisite disclosures, he would suggest: “Come in, work with us, and get registered.”

The current SEC head, a former Wall Street executive and MIT crypto professor, said he wants crypto platforms to be registered and regulated to protect customers’ assets. Unlike traditional exchanges, centralized crypto trading platforms take custody of their customers’ assets, Gensler noted. And last year, a whopping $14 billion was stolen.

Gensler also asked if crypto platforms’ market-making functions should be separated. His reasoning, cryptocurrency trading platforms can also act as market makers, trading for their own accounts against customer trades. This poses conflicts of interest, the kind which are regulated against at traditional exchanges like the New York Stock Exchange. He also said tokens that are securities should be registered with the agency. “Issuers of crypto tokens that are securities must register their offers and sales of these assets with the SEC and comply with our disclosure requirements, or meet an exemption.”

Yet there is little incentive for token creators to go through the registration process. If there is no exchange to list them, registration would leave them no place to trade. The exchanges may have to change their requirements and definitions first. “Until the platforms are registered and regulated, I don’t think the tokens will significantly come in and register,” Gensler said.

It is a chicken and egg conundrum. If crypto assets have forms or disclosures with which they “truly cannot comply [with], our staff is here to discuss and evaluate those concerns,” he said. However, if a token is in structure also a security, Gensler said it must “…play by the same market integrity rulebook as other securities under our laws.“ Crypto may offer new ways for entrepreneurs to raise money to fund their projects and for investors to trade, but “when a new technology comes along, our existing laws don’t just go away,” he said.

Take-Away

Broadly, at the Penn Law Capital Markets Association, SEC Chair Gensler made a renewed call for comprehensive regulations to protect investors and allow the crypto market to grow with uniform rules. He expressed the auto industry, benefitted from speed limits, with police enforcing them, and traffic lights. “If we hadn’t done that, would we have sold as many cars? No way,” he said. “Our capital markets and our economy benefit from some basic rules of the road.”

Suggested Reading

Will the SEC Allow ETFs to Own Cryptocurrency?

|

SEC Climate Change Disclosure Rules and Challenges

|

SEC Investigates Digital Engagement Practices in Broker Apps

|

Cryptocurrencies in 2022, a View from Academics

|

Sources

https://www.investopedia.com/sec-chair-regulate-crypto-platforms-like-exchanges-5224794

Stay up to date. Follow us:

|