|

|

|

|

Fin Tech is one of the Fastest Growing Tech Sectors

(Note: companies that

could be impacted by the content of this article are listed at the base of the

story [desktop version]. This article uses third-party references to provide a

bullish, bearish, and balanced point of view; sources are listed after the

Balanced section.)

So, what is FinTech? Financial Technology (FinTech) is the technology and innovation that aims to compete with traditional financial methods in the delivery of financial services. (1) In short, FinTech uses technology to improve activities in finance. FinTech is composed of the new applications, processes, products, or business models in the financial services industry often composed of one or more complementary financial services and provided as an end-to-end process via the internet. (1) According to Federal Reserve Board Governor Lael Brainard, “FinTech has the potential to transform the way financial services are delivered and designed and change the underlying processes of payments, clearing, and settlement.” (2)

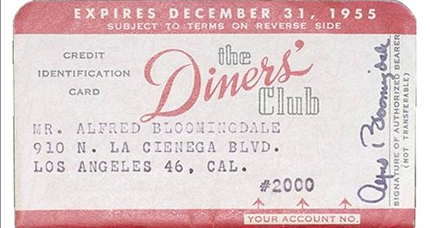

Interestingly, a form of FinTech has been around for a long time but was often limited to use in the back-office operations of traditional financial services providers. Today, FinTech is enabling numerous non-legacy financial services firms—from financial service start-ups to non-traditional financial services firms such as automobile firms and retailers—to compete in the financial services industry. FinTech has been used to automate such financial services as insurance, banking services, retail brokerage, trading, and risk management. (1) Key technologies used in FinTech include artificial intelligence (AI), big data, robotic process automation (RPA), and blockchain. FinTech is one of the fastest-growing tech sectors, with companies innovating in almost every area of finance. (3)

Adoption of FinTech services has moved steadily upward, from 16% in 2015, the year EY’s first FinTech Adoption Index was published, to 33% in 2017, to 64% in 2019. According to the EY study, awareness of FinTech, even among nonadopters, is now very high. Worldwide, for example, 96% of consumers know of at least one alternative FinTech service available to help them transfer money and make payments. (4) Some of the most active areas of FinTech innovation include cryptocurrency, smart contracts, open banking, insurtech, robo-advisors, unbanked/underbanked services, and cybersecurity. (5)