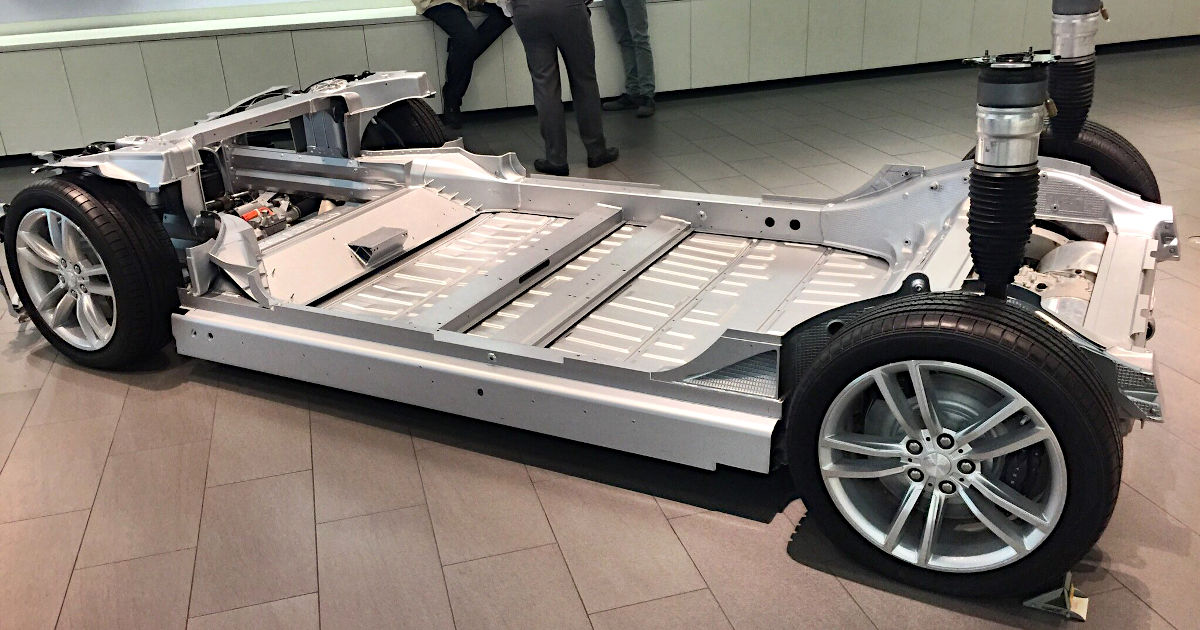

Image Credit: Steve Jurvetson (Flickr)

Lithium Recycling Market Expected to Boom 20% Per Year with Battery Demand

The skyrocketing use of batteries and growing plans to include lithium-ion (Li-ion) batteries as a solution to many of today’s environmental initiatives has challenges. Not the least of these is that the mining of lithium has a number of negative impacts on the environment. One of these is water pollution from chemical leakage. From these issues, a rapidly growing recycling industry is blooming. The rapidly expanding lithium battery recycling business helps manufacturers ensure a sufficient quantity of lithium and other components for the continued creation of batteries and other applications.

The Market

As the need for minerals and other materials for Li-ion batteries burgeons from EV growth, the need for li-ion battery recycling methods and facilities has dramatically increased. According to Research

and Markets the market for recycling these batteries was $161.4 million in 2020. It is expected to grow almost 20% a year and is estimated to be 614% larger in 2030. This falls in line with other expectations. According to the International Energy

Agency (IEA)’s Sustainable Development Scenario, the number of electric vehicles (excluding two- and three-wheelers) across the globe will increase to 245 million units by 2030, this, in turn, is expected to encourage the recycling of lithium-ion batteries to meet the future demand. Investors may find looking at companies involved in battery recycling, interesting and an alternative to expose your portfolio to the growth of EVs.

Investing

in Li-ion Recycling

One company accelerating its plans and making headway is Comstock Mining (LODE). Management has spent the last six months developing their capacity and expects to conduct lithium recycling in the first and second quarters of 2022. In a research report released today, Mark Reichmann, Noble Senior Natural Resources Analyst, discusses Comstock’s full transformation plans. The report explains many of Comstock’s other “green” initiatives, including mercury remediation, hemp-based fuels, and cellulosic fuels. Also, in the report, the analyst provides reasons for his current rating and price targets.

Take-Away

The pace of EVs expected to take to the highways over the next ten years, along with increasing needs for clean ion electricity storage, along the grid and in other applications, is stressing the supply and availability of lithium for manufacturing. Lithium mining is also a dirty process that is not considered environmentally friendly.

A growing solution is recycling which could provide an interesting opportunity for investors looking for alternative ways to be involved in the growth of the EV and green fuel initiatives.

Channelchek provides top-tier research to your inbox without the burden of a paywall; register now.

Managing Editor, Channelchek

Suggested Reading:

Future for Lithium Prices Looks Strong Due to Expected Demand Growth for Evs

|

Lithium-Ion vs Hydrogen Fuel Cell

|

Investment Opportunities in Hydrogen

|

How Does the Buffett Gates Natrium Reactor Work?

|

Sources:

Noble Capital Markets Research

(11/12/21)

Research and Markets Li-ion Report

IEA’s Sustainable Development

Scenario

Stay up to date. Follow us:

|