Image Credit: Pixabay (Pexels)

Michael Burry’s Latest Portfolio Brings the FAANGS Out

On Monday, May 16, Michael Burry filed his company’s holdings report with the SEC. Relative to the previous quarter, there was significant reshuffling. While it’s rare to get an explanation of his thinking beyond an occasional tweet of warning or tweet of frustration, his quarterly positions report is worth reviewing. It lends a rare clue as to what the celebrated hedge fund manager is expecting.

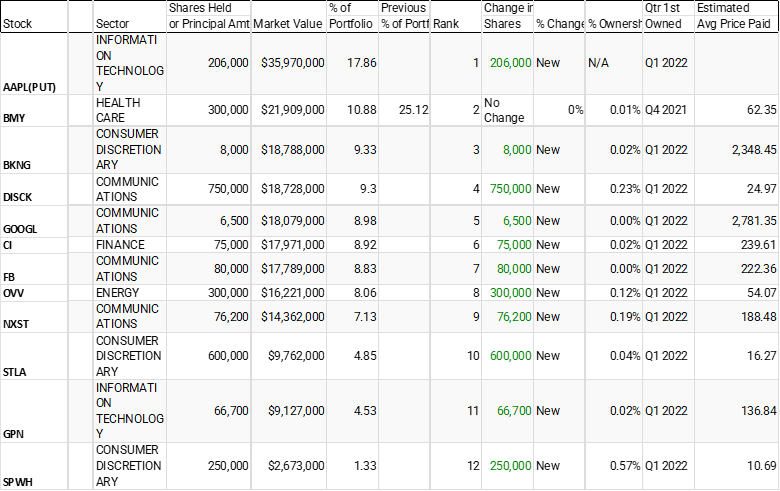

Michael Burry’s thinking, reflected in Scion Asset Management’s 13F holdings (a/o March 31), are shown below. Following the holdings we offer company descriptions and some thinking related to a few of the holdings.

Source: WhaleWisdom

Why it Matters

The positions in Scions portfolio are usually few, quite deliberate, and not the result of herd thinking. During the prior quarter (Q4 2021), among the scant positions were two public prison stocks ($GEO and $CXW). While many pundits and YouTube “gurus” hazarded a guess as to what Burry may have expected to occur with crime, the positions may have had nothing to do with an expected need for jail cells. Following the stock tickers links above to the Channelchek reports discloses that public policy on for-profit prisons is in flux. The positions may have just been a play on policy direction.

Burry’s investment universe is broader than the average self-directed investor and even deeper than the average hedge fund manager. The positions report reflect just those required to be disclosed in an SEC 13F filing. With this in mind, out of the entire universe of public securities Scion could hold, there are only a dozen that Burry’s portfolio felt were worthy at the end of the first quarter. One is a Put position which effectively makes him short the stock and possibly expecting more red than green, but not necessarily.

Holdings Breakdown

Scion has a Put on Apple (AAPL) with contracts to control 206,000 shares. The portfolio is also long shares of two other megacap high-tech stocks adding to a similar notional amount. Of the three, based on price earnings ratio, Apple is by far the most expensive. Apple’s P/E is at 23.7 earnings, while Google/Alphabet (GOOGL) is trading at a much lower PE of 20.7x, and Facebook/Meta (FB) is even lower yet at 15.1x price to earnings. This AAPL Put may not be a bet against Apple as much as it is a play that FAANG stocks should trade with multiples more in-line with each other. If this is the case, he’s not looking to hit a home run, but instead looking for movement either down by Apple, or up by the two other FAANG stocks to net incremental capital gains.

Since the 4Q of 2021, he has held Bristol Myers Squibb (BMY). Year-to-date 2022 the biopharmaceutical company is up 19% vs the S&P 500 which is down 9.8%. Discover Network C shares (DISCK) is his fourth largest by market value. The C shares of Discovery allow no voting rights. Discovery’s A shares allow one vote per share, and B shares 10 votes per share.

Moving down the list shows a very diversified portfolio of long positions including Cigna (CI) a health care insurer, Ovintiv (OVV) a Canadian based fossil fuel company trading at 8x earnings, and Nexstar Media (NXST) which is a media company that owns television broadcast networks not unlike DISCK.

Stellantis NV (STLA) is a Dutch automaker trading on the NYSE and London exchanges. It owns the Chrysler and Jeep brands as well as Alpha Romeo, Peugeot, and Maserati. STLA pays above-average annual dividends. It declared a dividend on February 25, with an ex-dividend date of April 19. The period covered in Scion’s 13F is through March 31.

In the consumer discretionary category Scion’s portfolio held two companies month-end that stand to benefit as consumers fill their need to travel and play outdoors. Bookings.com (BKNG) which is a huge online travel website and retailer Sportsman’s Warehouse (SPWH) which is a small-cap value stock trading at only 3.75x earnings.

The last is a payment tech company called Global Payments (GPN). The company’s product line runs the full gamut of electronic merchant payment products.

Take-Away

Dr. Michael J. Burry has an excellent record of spotting investment opportunities before the rest of the market. His picks are as disparate as the mortgage market in 2008 and GameStop (GME) in 2020.

The portfolio reported by the SEC on May 16, reflecting March 31 quarter-end holdings does not have a strong theme. The most talked-about position has been the Puts on Apple. As mentioned, that play may be more complicated and be a hedge involving other long holdings.

Sign-up to receive Channelchek updates in your inbox.

Managing Editor, Channelchek

Suggested Content

Michael Burry Sees Positive in Elon Musk’s Twitter Stake

|

Why Michael Burry has Better Opportunity Than Cathie Wood

|

Is the Index Bubble Michael Burry Warned About Still Looming?

|

Michael Burry’s Stock Market Holdings (Filed Feb 14, 2022)

|

Sources

https://www.sec.gov/Archives/edgar/data/0001768023/000156761922010751/xslForm13F_X01/primary_doc.xml

https://whalewisdom.com/filer/scion-asset-management-llc#tabholdings_tab_link

Stay up to date. Follow us:

|