Seanergy Maritime Provides Guidance on TCE and EBITDA

Research, News, and Market Data on Seanergy Maritime

January 24, 2022 – Glyfada, Greece – Seanergy Maritime Holdings Corp. (the “Company” or “Seanergy”) (NASDAQ: SHIP) updated its time charter equivalent (“TCE rate”) guidance upwards for the fourth quarter of 2021, provided preliminary TCE guidance for the first quarter of 2022, as well as EBITDA projections for FY 2022.1 2

TCE Guidance

In the fourth quarter of 2021, the Company is expected to exceed an average TCE rate of approximately $36,000 per ship per day, outperforming our previously announced guidance of $35,200 per ship per day.3

As of the date of this press release, our estimated TCE rate for the first quarter of 2022 is expected to be approximately $19,0004. This estimate assumes that the remaining unfixed operating days of our index-linked vessels for this period will be equal to the average Forward Freight Agreement (“FFA”) rate of $13,500 per day. Our TCE guidance for the first quarter includes certain conversions of index-linked charters to fixed, which were concluded in the third and fourth quarter of 2021, as part of our freight hedging strategy.

EBITDA Projections5

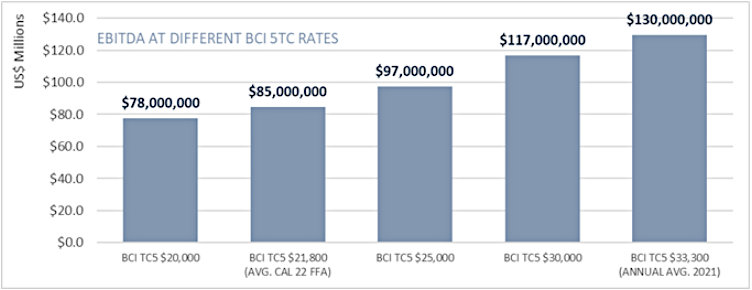

The following graph provides the Company’s estimates for its EBITDA for 2022, based on various scenarios for the average TCE for the 5 T/C routes of the Baltic Capesize Index (“TC5” of the “BCI”).

Stamatis Tsantanis, the Company’s Chairman & Chief Executive Officer, stated:

“As a result of our pro-active hedging strategy in 2H21, we estimate that we will overperform the current spot market rate by approximately 50% in the first quarter. Moreover, our robust EBITDA generating capacity in multiple freight environments attests to our firm belief that our shares are currently significantly undervalued.

“Despite the seasonal market weakness, we expect that supply and demand fundamentals will result in a strong recovery of Capesize rates within the following months. Our solid balance sheet, modern fleet and strong relationships with world leading charterers in combination with our substantial operating leverage place Seanergy in an optimal position to generate strong revenues and profitability in an improving charter rate environment.”

About Seanergy Maritime Holdings Corp.

Seanergy Maritime Holdings Corp. is the only pure-play Capesize ship-owner publicly listed in the US. Seanergy provides marine dry bulk transportation services through a modern fleet of Capesize vessels. The Company’s operating fleet consists of 17 Capesize vessels with an average age of 11.7 years and aggregate cargo carrying capacity of approximately 3,011,083 dwt.

The Company is incorporated in the Marshall Islands and has executive offices in Glyfada, Greece. The Company’s common shares trade on the Nasdaq Capital Market under the symbol “SHIP” and its Class B warrants under “SHIPZ”.

Please visit our company website at: www.seanergymaritime.com.

Note Regarding Non-U.S. GAAP Financial Measures

The Company reports its financial results in accordance with U.S. generally accepted accounting principles (“U.S. GAAP”). EBITDA and TCE rate are non-GAAP financial measures.

Earnings Before Interest, Taxes, Depreciation and Amortization (“EBITDA”) represents the sum of net income / (loss) (the most directly comparable U.S. GAAP measure), interest and finance costs, interest income, depreciation and amortization and, if any, income taxes during a period. EBITDA is not a recognized measurement under U.S. GAAP.

EBITDA is presented as we believe that this measure is useful to investors as a widely used means of evaluating operating profitability. EBITDA as presented here may not be comparable to similarly titled measures presented by other companies. This non-GAAP measure should not be considered in isolation from, as a substitute for, or superior to, financial measures prepared in accordance with U.S. GAAP.

TCE rate is defined as the Company’s net revenue less voyage expenses during a period divided by the number of the Company’s operating days during the period. Voyage expenses include port charges, bunker (fuel oil and diesel oil) expenses, canal charges and other commissions. The Company includes the TCE rate, a non-GAAP measure, as it believes it provides additional meaningful information in conjunction with net revenues from vessels, the most directly comparable U.S. GAAP measure, and because it assists the Company’s management in making decisions regarding the deployment and use of the Company’s vessels and in evaluating their financial performance. The Company’s calculation of TCE rate may not be comparable to that reported by other companies.

Forward-Looking Statements

This press release contains forward-looking statements (as defined in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended) concerning future events. Words such as “may”, “should”, “expects”, “intends”, “plans”, “believes”, “anticipates”, “hopes”, “estimates” and variations of such words and similar expressions are intended to identify forward-looking statements. These statements involve known and unknown risks and are based upon a number of assumptions and estimates, which are inherently subject to significant uncertainties and contingencies, many of which are beyond the control of the Company. Actual results may differ materially from those expressed or implied by such forward-looking statements. Factors that could cause actual results to differ materially include, but are not limited to, the Company’s operating or financial results; the Company’s liquidity, including its ability to service its indebtedness; competitive factors in the market in which the Company operates; shipping industry trends, including charter rates, vessel values and factors affecting vessel supply and demand; future, pending or recent acquisitions and dispositions, business strategy, areas of possible expansion or contraction, and expected capital spending or operating expenses; risks associated with operations outside the United States; risks associated with the length and severity of the ongoing novel coronavirus (COVID-19) outbreak, including its effects on demand for dry bulk products and the transportation thereof; and other factors listed from time to time in the Company’s filings with the SEC, including its most recent annual report on Form 20-F. The Company’s filings can be obtained free of charge on the SEC’s website at www.sec.gov. Except to the extent required by law, the Company expressly disclaims any obligations or undertaking to release publicly any updates or revisions to any forward-looking statements contained herein to reflect any change in the Company’s expectations with respect thereto or any change in events, conditions or circumstances on which any statement is based.

For further information please contact:

Seanergy Investor Relations

Tel: +30 213 0181 522

E-mail: [email protected]

Capital Link, Inc.

Paul Lampoutis

230 Park Avenue Suite 1536

New York, NY 10169

Tel: (212) 661-7566

E-mail: [email protected]

1 EBITDA and TCE rate are non-GAAP measures. Please see the discussion above under the heading “Note Regarding Non-U.S. GAAP Financial Measures” for more information.

2 Guidance is provided for TCE rate and EBITDA on a non-U.S. GAAP basis only, because information regarding various items necessary to determine net revenue from vessels and net income / (loss), the most directly comparable financial measures calculated and presented in accordance with U.S. GAAP for TCE rate and EBITDA, respectively, on a forward looking basis is unavailable due to the uncertainty and inherent difficulty of predicting the occurrence and the future financial statement impact of such items, including, but not limited to, voyage expenses, stock-based compensation and the non-recurring gain on sale of vessel and gain on debt refinancing, and certain non-ordinary course matters. Because of the uncertainty and variability of the nature and amount of such items, which could be significant, the Company is unable to provide a quantitative reconciliation of the differences between expected TCE rate and EBITDA and the most directly comparable financial measures calculated and presented in accordance with U.S. GAAP without unreasonable efforts. The unavailable reconciling items could significantly affect the Company’s financial results for the periods discussed on a forward-looking basis herein.

3 The Company has not finalized its financial statement closing process for the fourth quarter. During the course of that process, the Company may identify items that would require it to make adjustments, including possible material adjustments to these preliminary results.

4 This guidance is based on certain assumptions, including projected utilization, and there can be no assurance that these assumptions and the resulting TCE estimates will be realized. TCE estimates include certain floating (index) to fixed rate conversions concluded in previous periods. For vessels on index-linked T/Cs, the TCE realized will vary with the underlying index, and for the purposes of this guidance, the TCE assumed for the remaining operating days of an index-linked T/C is equal to the average FFA rate of approximately $13,500 per day for the remaining days of the first quarter of 2022 based on the FFA curve as of January 19, 2022.

5 These projections are based on certain assumptions, including no change to the current composition of our fleet, fleet utilization or commissions and expenses, including operating and general & administrative expenses, based on the historical performance of the Company in the first nine months of 2021. EBITDA projections exclude extraordinary items such as gain/loss on vessel sales, loan refinancing etc. There can be no assurance that these assumptions and the resulting projections will be realized. As a result, the above projections constitute forward-looking statements and are subject to risks and uncertainties, including possible material adjustments to the projections disclosed. The Company is providing this information on a one-time basis only, subject to these assumptions, risks and uncertainties, and does not intend to update this information.