Image Credit: Kempton (Flickr)

Michael Burry’s Portfolio is Creating More Speculation than Usual

Four times a year, the quarter-end holdings of famous hedge fund manager Dr. Michael J. Burry become public from his firm’s 13-F filing with the SEC. It’s newsworthy because people are interested in this extremely successful investor’s thinking. Of course, the list of public market positions is just a snapshot in time. One day in time, to be exact, so it is possible to read too much into it. The latest 13-F filing, which became public on Monday (August 15) is especially interesting; his entire stock portfolio is one stock. Channelchek featured this company in an article last month; referring back to the article and also a recent Noble Capital Market’s research report, we offer our own three potential reasons why, out of all the securities available on the planet, he may favor this one.

About Scion Asset Management’s One Position

According to the June 30, 2022, SEC filing, Michael Burry’s fund held one position, Geo Group (GEO). These shares represent 0.404% of GEO’s outstanding stock or 501,360 shares. The average price was listed as $6.42 per share.

The quarter-end market value of Scion’s GEO position was $3,309,000. According to Scion’s Form ADV, filed on April 18, 2022, Scion had assets under management of $291,659,289. The GEO position is not likely a significant portion of his entire portfolio, but it represents 100% of the firm’s 13F reportable securities.

Michael Burry first reported owning GEO Group during the fourth quarter of 2020.

The GEO Group, based out of Boca Raton, FL, specializes in owning’ leasing, and managing secure confinement facilities, processing centers, and reentry facilities in the United States and globally. As of December 31, 2021, the company’s worldwide operations included the management and/or ownership of approximately 86,000 beds at 106 secure and community-based facilities, including idle facilities and projects under development.

In addition to owning and operating secure and community facilities, GEO provides compliance technologies, monitoring services, and supervision and treatment programs for community-based parolees, probationers, and pretrial defendants.

For the year ended December 31, 2021, The GEO Group generated approximately 66% of its revenues from the U.S. Secure Services business, 24% from its GEO Care segment, and 10% of revenue from its International Services segment.

Company Trajectory

On August 3, in a research note titled, Continuing

to Outperform Expectations, Noble Capital Markets, Senior Research Analyst Joe

Gomes set a price target of $15.00 and reported on above-expected operating results during Q2 2022.

Mr. Gomes’ report discussed the drivers of GEO’s growth, “Many parts of GEO’s business continue to show operating strength, driving the better than expected performance.” The analyst also discussed the exceptional growth in revenue of the company’s electronic monitoring division.

The report describes management guidance as “upbeat” for the remainder of 2022. The company could get an extra benefit in the coming months if COVID-related restrictions on occupancy are lifted, thus allowing higher capacity within the same facilities.

Michael Burry’s position is not huge compared to his firm’s AUM. However, what is drawing attention is that out of the universe of stocks, GEO Group is a company he finds interesting enough to have as his only position. It would seem appealing to an investor that the clarity of the company’s direction seems to be improving and positive.

Political Winds

Will the mid-term elections in November usher in leadership more friendly to GEO’s business? Six days after President Biden was inaugurated, he signed an executive order to eliminate the use of privately operated criminal detention facilities. Section 2 of this order specifically prohibits renewing any contracts with criminal detention facilities. It looked bleak for the two largest private prison (GEO, CXV) operators in the country.

After the order, the private prison industry shifted gears and focused on the $3 billion market of detaining immigrants. This shift has been positive, and things don’t look as dark for the two largest for-profit prison companies in the U.S., CoreCivic (CXW) and Geo Group (GEO). Each is now making 30% or more of its revenue from U.S. Customs and Immigration (ICE) contracts.

If the Democrats lose the significant power they now have in the legislative branch, it would seem that the party that takes power would almost have a mandate from the public to make changes to many of the less popular moves made over the past year and a half. The southern border situation may be one of the reasons Democrats are likely to have fewer seats.

An argument can be made that new doors may open for private prison companies, and there is not a lot of public competition. Perhaps this is the appeal that keeps Michael Burry involved in GEO Group and why his fund has in the past owned CXW.

Portfolio Management

As of the end of Q1 2022, the value of Burry’s position in GEO Group was almost twice as large as shown in the current filing. So the hedge fund manager has liquidated a portion of his GEO position along with all other holdings. This unwinding may not be driven by anything more than what he sees as better opportunities elsewhere. He has also complained in tweets about how much attention his activities generate. It may very well be that with all the shifting in economies, in the U.S. and worldwide, that Burry has taken positions in non-reportable investments.

Earlier this year, after the first quarter, when Michael Burry released his holding information, the headlines all read that he hated Apple (AAPL). This was because he held puts on the company. There can be many

reasons a hedge fund would own puts on a company without hating the stock. This latest release brought alarmist headlines about Michael Burry “slashing stocks” in his portfolio and “dumping” everything he owns. He may very well be bearish on every U.S. stock except for one, but this isn’t likely. As a reminder, June 30 is just one day on the calendar; his U.S. stock positions could have been quite different by the fourth of July.

Take Away

Michael Burry’s 13F filing for the second quarter showed one holding, an under-the-radar company that has a significant upward trajectory in earnings and growth. The company’s industry had also become challenged when the Biden administration took office since it has successfully found a way to build in a slightly different direction. All indications are that, at minimum, the House of Representatives and possibly the Senate will be more heavily weighted with Republican lawmakers after the upcoming election, the private prison industry could benefit from contracts they may receive with a change in legislative priorities.

If you have not already signed up to receive email from Channelchek with up-to-the-minute research reports on companies like GEO Group and insightful articles, sign-up here.

Managing Editor, Channelchek

Suggested Content

Republicans Likely to Have the Majority in the House – Investors May Want to Pivot Early

|

Michael Burry’s Stock Market Holdings (Filed May 16, 2022)

|

Michael Burry vs Cathie Wood is Not an Even Competition

|

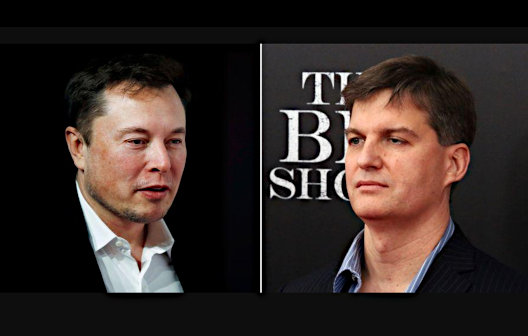

Michael Burry Sees Positive in Elon Musk’s Twitter Stake

|

Sources

https://www.channelchek.com/company/GEO/research-report/3910

https://whalewisdom.com/filer/scion-asset-management-llc#tabholdings_tab_link

Stay up to date. Follow us:

|