The Wild Ride of Digital World Acquisition Corp. Has Mostly Been Positive

You never know what kind of surprise you may eventually end up with when purchasing a Special Purpose Acquisition Corp (SPAC). Digital World Acquisition Corp. (DWAC) is the perfect example of how a SPAC can provide a wild ride for those that were originally involved in the IPO and those that have since been involved in the stock of the “blank check company.” Before plans to merge with Truth Media, a subsidiary of Trump Media Group, it started out as most SPACs do, with a $10 a share price and a description of what an appropriate target would look like, and credentials of managing a financial company.

Most Recent

News impacting social media competitors to Truth Social and information involving the former President’s stature have historically driven prices of the acquiring company in a sporadic fashion. On Monday, DWAC took off by 66.5% to $29.10 during the trading day. On the prior trading day it had already risen 7% to $17.48. The impetus for this was news that Donald J. Trump was making plans to announce his candidacy as a Republican hopeful in the 2024 election.

The strong updraft of the DWAC price came the day before the US Election Day when political power struggles are at the forefront of most investors’ minds. It also occurred on the same day the former President announced plans to make a “Big” announcement next week.

Last week the SPAC shares rose after management delayed a shareholder vote — for the sixth time — on whether to approve a year extension to complete its merger with Trump Media and Technology Group. The shareholders meeting is now set for Nov. 22. DWAC’s deadline to complete its merger with Trump’s company had originally been in early September. However, the SPAC has said an SEC investigation of the merger deal delayed progress.

Highlights of DWAC Price Action

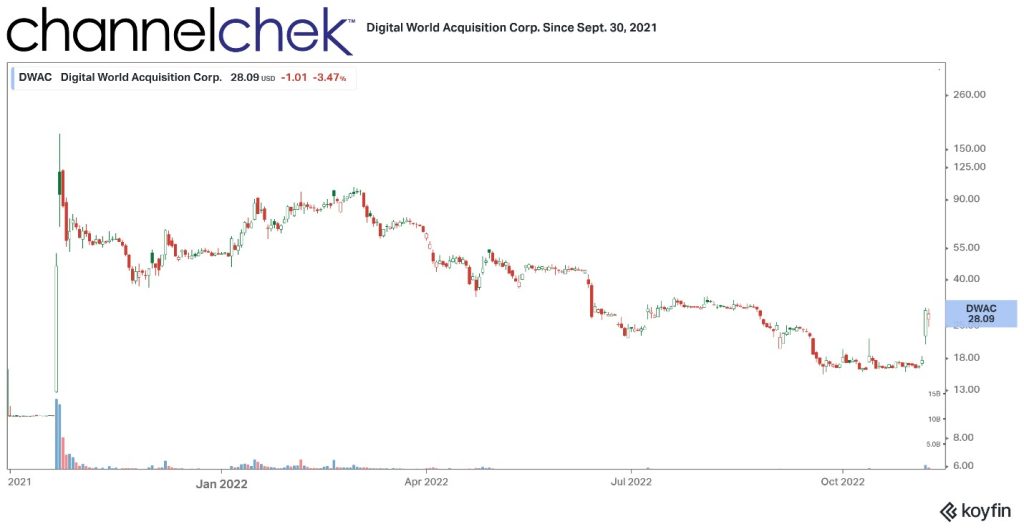

October 2021 – The chart above shows the upward SPAC spike (1,650%) as it became known in late October of its intent to merge with Trump’s fledgling social media venture. A retail trading frenzy had sent prices of the Trump media-linked SPAC, Digital World Acquisition Corp., ripping up an incredible 1,650% in just two days.

The stock reached a peak of $175, within two days and closed the week up 845% from an unusual amount of enthusiasm from retail interest.

News reports at the time highlighted the company had no fundamentals to speak of and te action was purely speculation and momentum.

Digital World Acquisition Corp. ended on the Friday at $94.20 after closing Wednesday at $9.96.

December 2021 –The stock traded off after the initial enthusiasm, especially after the media company fell short of its plan to have a beta version of Truth Social in November. It then caught fire later during the first week of December 2021. The impetus here was an announcement that the former President was raising $1 billion (mostly from family offices and hedge funds) to support the company’s projects.

Federal regulators cast a dark cloud over the deal, beginning the second week of December. The SEC was overall looking at tax and accounting of all SPACs, this had the potential to impact DWAC. Additionally, FINRA requested information to investigate whether than were any improper communications between Trump Media and Digital World.

Moving forward that December, a new CEO of Truth Social was appointed. This was a former representative to the House, Devin Nunes from California.

January 2022 – On the 7th of January, the stock rose 20%, up 505% from the day the plans to merge was announced. The stock’s market cap was also up by the same percentage at $2.24 billion.

Plans were made to launch the social platform on February 21st. The company had been still sitting at lofty heights on faith, not an actual product.

In late January, the SPAC experienced its largest one-day jump of the year (to date), a 21% increase on no new information. There was, however speculation that the stock’s rally may have been connected to a Trump rally the still politically active Trump held in his home state.

As shown on the chart above, momentum for the stock was again building after a January 6 announcement of the launch date, the stock climbed 71%. Phunware (PHUN), the designer of the platform, was up 25%.

February 2022 – The Trump social media platform becomes available in the app store in late February and the price of DWAC increases 28% pre-market open. Institutional investors gain a new respect for the power of self-directed retail investors and the power they hold. Prices in February are sitting at a 750% increase from the day the SPAC merger was announced.

April 2022 – Two private investors bail on Truth Social, and shares of Digital World drop following a negative (30%) March. The share value has now declined 70% from its all-time high. Adding to the drag on values, new SPAC rules from the SEC cast even more doubt on the ability to bring the deal to a close.

June 2022 – Since the beginning of the year, the stock’s value dropped 47%. The SEC began expanding its inquiry into the proposed merger, having subpoenaed the company for more information on the deal. Investors think the deal will likely be delayed, perhaps even torpedoed.

July 2022 – Elon Musk made good on a Tweet to offer to buy Twitter. His intent was to “free the bird” and allow open discourse, in other words, turn it into what Trump envisioned for Truth Social. Both Trump and Musk have fans and foes, so the drama picked up when Elon suggested openly Trump ought to “hang up his hat and sail into the sunset.”

Prices of DWAC originally declined but then found their footing as expectations of Elon Musk successfully buying the huge competitor of Truth Social waned.

August 2022 –Digital World says it isn’t sure whether they are the right vehicle to take Truth Social public. And it wants to keep financials under wraps until it can decide. The SEC allows an automatic five-day extension.

It’s the regulatory and legal obstacles DWAC’s been faced with since announcing the merger that could have caused them to look for the surrender flag. The two entities were subjected to a federal criminal probe that caused every single one of the SPAC’s board members to receive a subpoena after already warning that any investigations would jeopardize the deal. Shares were down 73% since October.

November 2022 – The momentum that may have been responsible for the original run-up over a year earlier again surfaces as it is rumored that the ex-President with a massive amount of loyal followers will be running to be re-elected. “In a very, very, very short period of time, you’re going to be very happy,” former president Donald Trump told attendees at a rally on November 5.

Trump Media’s merger with DWAC still faces many legal and financial hurdles that have resulted in at least $138m in investment being pulled. Trump will post on Truth Social exclusively for 8 hours before posting elsewhere. He has been widely followed on the social platforms he has been part of, so whether investors support the potential candidacy, they’re almost certain it’ll drive traffic to the app.

Take Away

One never knows what target companies a SPAC may unearth, if any, as a suitor for its acquisition plans. For investors that jump into the unknown early, before a SPAC announces any plans, their downside is somewhat limited as their investments are held in escrow as the target is procured. Should a deal be struck, they get to decide if they wish to stay involved. If, after two years, the SPAC fails to close on a target, investors still holding shares receive the original purchase price (usually $10), fewer expenses, plus interest. Considering how volatile other investments have been, this effectively puts a floor in to protect against the downside for investors near the $10 level.

Managing Editor, Channelchek

Sources

https://www.theverge.com/2021/12/6/22821450/devin-nunes-ceo-tmtg-spac-dwac-truth-social-media

https://www.cbsnews.com/news/trump-announcement-november-15-mar-a-lago/

https://www.tradingview.com/symbols/NASDAQ-DWAC/history-timeline/#trump-spac-goes-soaring-2021-10-15