Stocktwits Daily Rip is a Favorite of Mine, but Last Friday’s Left me Tearing my Hair Out

I have a gripe with a number of newsletters, blogs, daily market reports, and others that report on events that impact the stock market. This might seem picky, but at the most basic level, it’s best if we all speak the same language – our readers’ money is on the line.

Inflation and Interest Rates

One increasingly intent focus this year has been inflation. More specifically, bond yields which are driven by inflation and inflation expectations. Many of the stock market pundits and purveyors of news find themselves weighing in on this “other market.” A frightening percentage of the news that hits my inbox has been confusing basic concepts. To those unfamiliar with interest rate securities and trying to understand by studying their own chosen and trusted thought provider’s words, this must cause some difficulty. One common contradiction I’ve noticed is when rates have risen, I’ve seen it described as a “rally,” or “bonds strengthening.” Last week a friend that trades 10-year Treasuries sent me an article from a prominent source that read “bonds had a good day” after rates had spiked upward in May. Rates moving higher is a bond market sell-off. If they continue to move higher, bonds are considered in a bear market. They haven’t been in a prolonged bear market for over 40 years, so when this happens it will mean quite an adjustment.

Not a Word Snob

Despite being the Content Manager/Managing Editor here at Channelchek, I’m not a word snob. I enjoy seeing creativity and new ways to avoid repeating old market jargon. Especially when it comes to bonds, they can be boring enough. However, there are certain phrases and descriptions when used, need to mean the same thing, whether it’s in a newsletter from a broker, heard on CNBC, an influencer you follow on YouTube, or anyplace else you’re seeing and reacting as part of trading decisions.

One source I read daily to keep my finger on the pulse of the market, and because it informs in an amusing style, disappointed me on Friday.

StockTwits Daily Rip?

Let me first say I look forward to the email I get from Stocktwits each day, just after dinner. The Daily Rip is a recap of the trading day. It’s thorough, lighthearted, and there’s always some fun along the way. At times it makes me aware of something I missed in sectors or markets that weren’t on my radar. My hats off to the people at Stocktwits that keep this 7-day a week email fun and informative.

On Friday, while getting ready to do nothing the rest of the night, I opened my Daily

Rip, that’s when my head almost exploded. This is what I saw:

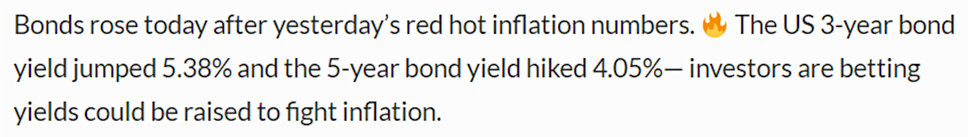

Source: Stocktwits Daily Rip 6/11/2021

How many things can you count that are not right with this sentence? “Not right,” in that they don’t follow the accepted convention for discussing bonds. Perhaps you don’t see any. If that’s the case, then the rest of this will be helpful. After all, stock market investors are going to be hearing more about bonds and interest rate’s impact on stocks than we have since January 2020. Equity investors don’t need a Frank Fabozzi understanding on the subject, but I’m sure some Channelchek readers will be helped by being reminded of bond basics. Let’s break down the above two sentences from Friday.

“Bonds rose today after yesterday’s red hot inflation numbers.”

The term “bonds rose” or “bonds fell” in fixed income parlance refers to price. I checked to verify that yields actually rose on Friday in response to above-expected inflation. They did. When yields rise, bonds get cheaper in price, they “fall.” Bondholders looking at their accounts are less happy than they were before.

The second sentence is loaded with problems, but only two are critical to be understood.

“The US 3-year bond yield jumped 5.38% and the 5-year bond yield hiked 4.05% – investors are betting

yields could be raised to fight inflation.”

Subscribers to the Daily Rip know the writing style is fun snippets of info, so I don’t think anyone would be confused by having to translate “US 3-year bond” to “US Treasury Note maturing in three years.” It is the next part that could cause a great deal of puzzlement and, written in this way, is largely meaningless. The yield on the 3-year USTN went from .293% to .308% based on one source of pricing (remember, there is no central bond market exchange). This is indeed an increase in the magnitude of the yield in excess of 5%. However, to say the yield jumped 5.38% might cause one to think the additional yield on this note has added more than 5%. In reality, the yield increased by around .015%. The occurrence worded as “up .015%” is much more useful. The same with the 5-year note which we’re told was hiked 4.05%; it rose from close to a 0.74% yield on Thursday to 0.75% on Friday. This additional 0.01% equated to a price loss of $0.046 per $100 worth of 5-year bonds. These two are not the big moves that they appeared to be the way they were presented. In contrast, hard-core bond market outlets reported that bonds shrugged off inflation news. Bloomberg even quoted Mischler Financial Group’s Tony Farren as referring to the Treasury market as appearing “Bullet-Proof.”

Bond-Speak Vocabulary

When I travel anyplace that I am not fluent in the language, I make sure I know a couple of common phrases. First, I learn to admit I don’t speak the language. Then I learn to ask where the bathroom is. And, of course, what’s a vacation without being able to ask for a beer. It’s the same when you visit a market that you don’t plan on living in; you need to provide yourself a basic ability to get around.

The points to take away from this rant (educational piece) is if we are being told “bonds rose,” most people in and around the industry would assume rates went down. And, one doesn’t report a change in yield as the percentage difference between the old yield and the new one. This is even more misguided and magnified when rates are below 1%. Price changes, just like stocks, are what investors in bond and stock markets care about. A very small inconsequential change in price can move yields ever so slightly, but if reported on a percent growth in yield basis, it tells a story that could unintentionally mislead. The percentage change in price is more useful to those looking at the total return in the bond market; the dollar change is more useful for those keeping track of their portfolio valuation. Also, Remember that closing prices can be different on bonds depending on your source as they are not traded on an exchange.

As I was working to dig up data to write this without my office Bloomberg terminal for prices, I found that historic bond prices are hard to come by on the internet, (yields can be found on ustreas.gov). I visited my go-to places for stock quotes and found US Treasury notes and bonds would show yield and call it price. I was further shocked to see that many very useful stock market charting sites confuse yield history with the yield curve. This is like asking for a beer and being directed to the bathroom. Hopefully, we all get some agreement as to how to communicate interest rate information.

Take-Away

It’s your most well-behaved child that has the potential of disappointing you most. I used the Stocktwits Daily Rip as my example, although I have others, because I am a fan – I find myself on their message board several times a day. In fact, investors that haven’t registered free for access to research reports, video interviews and daily articles on Channelchek first find us on Stocktwits. If you aren’t registered with Channelchek now is a good time to get that done. If you aren’t following us on Stocktwits or a YouTube subscriber, I’d strongly encourage making sure you follow us so you don’t miss anything.

Managing Editor, Channelchek

Suggested Reading:

|

|

Robotics and AI are Being Tapped for Cannabis Cultivation

|

Crypto Mining Gives Mothballed Fossil Fuel Plants New Life

|

|

|

Is Inflation Going to Hurt Stock?

|

Seeking Alpha Paywall Causes Frustration

|

Sources:

https://dailyripblog.com/2021/06/11/whats-going-on-amazon/

https://finance.yahoo.com/news/bullet-proof-treasury-market-eyes-200000195.html

Stay up to date. Follow us:

|

|

|

|

|

|

Stay up to date. Follow us:

|

|

|

|

|

|