How Investors Really Feel About ESG Initiatives

When a person invests in a mutual fund, ETF, or other managed asset pool that owns stocks, they are usually relinquishing a right to the fund manager. This is the right to vote as a shareholder on one’s own behalf. Shares held in the fund or trust are instead voted by the fund manager. Are the managers voting in a way the participants in the pooled assets would prefer? Does the environmental, social, and governance (ESG) vote on by fund managers meet their average client’s own leaning for their investment fund shares?

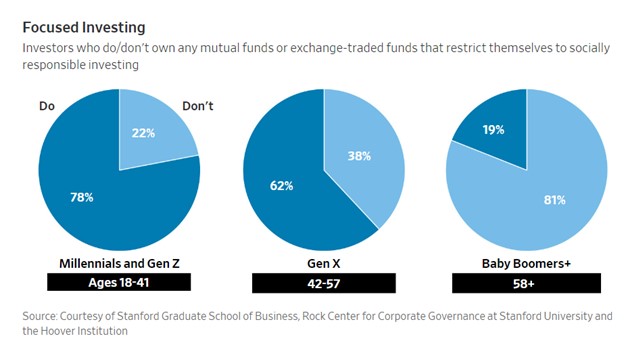

There is newly reported results of a research survey by Stanford University. The survey’s goal was assessing individual investors’ views about ESG investing. The authors surveyed 2,470 investors in the summer of 2022, with accounts ranging from $10,000 to more than $500,000. The survey found that investors’ tolerance or support for ESG measures, including a willingness to have poorer returns, varied by their age, current wealth, as well as the specific ESG issue.

Looking at Return vs. Alternative Objectives

Investors closest to retirement age, 58 years old and over, were the least likely to support ESG objectives. Those farthest from retirement age, 18 to 41 were the most likely. The data showed more than one-third of the younger investors said they would be willing to lose 11% to 15% of their retirement savings to encourage companies to have gender and racial diversity mirroring the general population. Of the more experienced older grouping, only 3% said they would risk or be willing to lose that amount for an ESG priority. A full 66% of the older investors said they were unwilling to lose any money to support ESG principles.

“Older investors want fund managers to generate financial returns to support their spending needs during retirement and don’t have a lot of time to recoup big losses,” says David Larcker, a professor at Stanford’s Graduate School of Business and one of the researchers.

The survey further confirmed that those where a loss was less troubling were more inclined to support and allow a large firm like Blackrock to decide what to support. The results showed wealthier young investors tended to be the largest group of ESG positive investors. For example, young investors with at least $250,000 under management said on average that they would be willing to lose about 14% of their retirement savings to have companies reduce carbon emissions to net zero by 2050. Alternatively, young investors with savings of less than $50,000 they would be willing to lose 6% on average to accomplish that goal.

Not all ESG initiatives rank the same for investors. Those surveyed held a higher level of support for those involving environmental issues. Social issues came next, and they were concerned the least about governance.

Vote Preferences

The investors surveyed also said they wanted the investment managers’ vote to reflect their own individual personal views related to ESG initiatives. In a related inquiry, 79% of the survey’s respondents with money at BlackRock managed assets said they approved of the firm’s use of its voting power to promote diversity on corporate boards.

Fully reflecting their clients’ views on ESG initiatives would be a high hurdle for investment managers, given the range of investors’ positions on so many issues. One potentiality is Investment managers could split their votes to weight individual investors’ views, Prof. Larcker says. For instance, that could mean voting 70% of their shares in a company in favor of a specific ESG proposal and 30% of their shares against the proposal.

Return Expectations

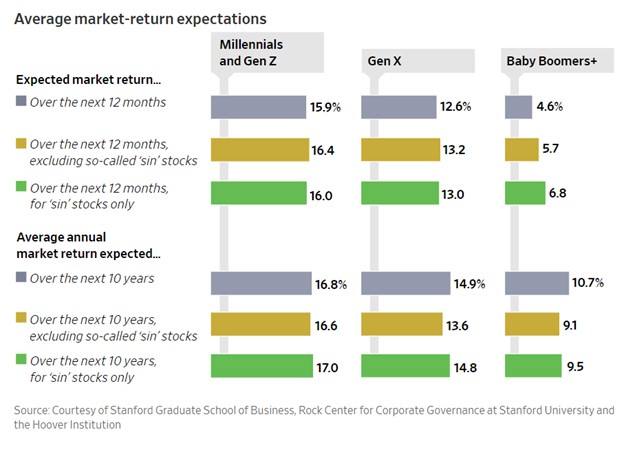

The older, more experienced respondents also had a significantly different view of expectations of return on investments.

Investment managers may want to provide data to try to improve fund participants’ understanding of the extent to which they have increased their risk to support the plans of an ESG-managed fund. Prof. Larcker suggests this could entail making it clear how returns of voting choices differed financially and from an ESG perspective, he says: “Did a vote improve or hurt the company’s financial performance in the short or long term? Was there a tangible effect on the environment or on employee diversity?”

“Fund managers need to acknowledge that there is likely to be some trade-off between ESG and financial returns,” he says, “and that trade-off may matter to individual investors.”

Take Away

Investing for the social good is not a new concept. The latest incarnation, ESG, has gained much more traction than the socially responsible investing initiatives of the past. The performance data, both financial and goal satisfaction, are difficult to measure. The survey done this past summer demonstrates the differences between demographic groups, a difference of expectations, and the weight of importance of, say, environmental issues over others.

As ESG-based investments evolve, Channelchek will keep you up to date on how others are looking at this category, what is new within the category, and other news that can keep you aware of the changing face of ESG. Sign up for Channelchek emails and information here.

Managing Editor, Channelchek

Sources