Do the Most Current Economic Measurements Suggest a Trend Toward Recession or Growth?

How is the US Economy Doing?

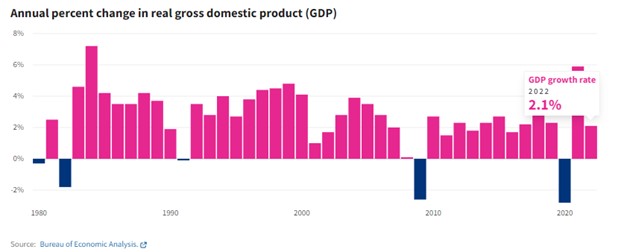

- US GDP increased 2.1% in 2022 after increasing 5.9% in 2021.

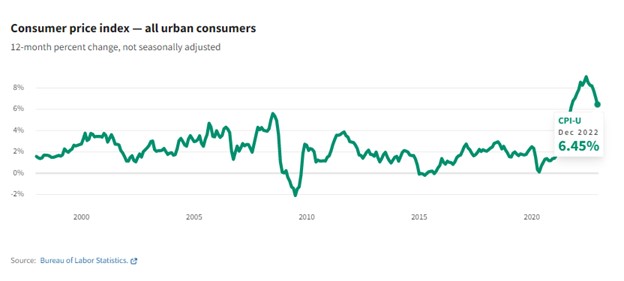

- Year-over-year inflation, the rate at which consumer prices increase, was 6.5% in December 2022.

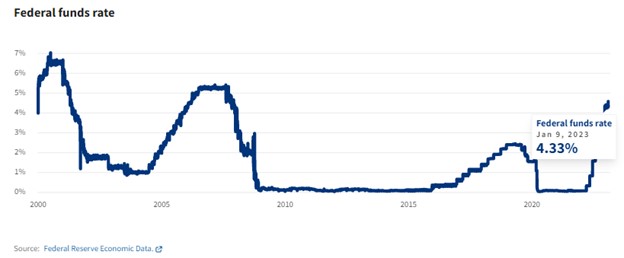

- The Federal Reserve raised interest rates seven times in 2022 and again on February 1, 2023 to curb inflation, increasing the target rate from near zero to 4.5-4.75%.

- When accounting for inflation, workers’ average hourly earnings were down 1.7% in December 2022 compared to a year prior.

- The ratio of unemployed people to job openings remained at or near record lows throughout 2022.

- The unemployment rate was 4.0% at the beginning of 2022 and ended the year at 3.5%.

- The labor force participation rate remains almost one percentage point below February 2020.

- From January to November 2022, the US imported $889.9 billion more in goods and services than it exported. This is 7% higher than the trade deficit in 2021 for the same months.

US GDP increased 2.1% in 2022 after increasing 5.9% in 2021

Gross domestic product (GDP) fell in the first half of 2022 but grew in the second half. GDP reached $25.5 trillion in 2022.

Year-over-year inflation, the rate at which consumer prices increase, was 6.5% in December 2022

That’s down from June 2022’s rate of 9.1%, the largest 12-month increase in 40 years. Inflation grew at the beginning of the year partly due to rising food and energy prices, while housing costs contributed throughout 2022.

The Federal Reserve raised interest rates seven times in 2022 and again on February 1, 2023 to curb inflation, increasing the target rate from near zero to 4.5-4.75%

Rate increases make it more expensive for banks to borrow from each other. Banks pass these costs on to consumers through increased interest rates. Read more about how the Federal Reserve tries to control inflation here.

When accounting for inflation, workers’ average hourly earnings were down 1.7% in December 2022 compared to a year prior

Inflation-adjusted average hourly earnings fell in all industries except information and leisure and hospitality, where earnings were flat.

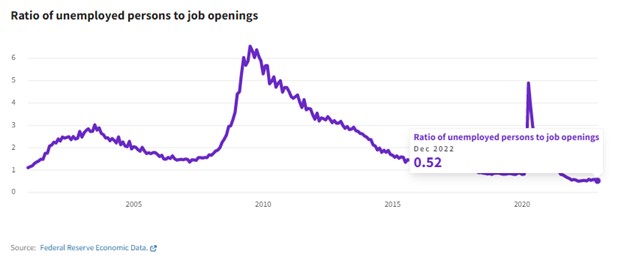

The ratio of unemployed people to job openings remained at or near record lows throughout 2022

In a typical month from March 2018 and February 2020, there were between 0.8 and 0.9 unemployed people per job opening. But after more than quadrupling in April 2020 at the onset of the pandemic, the ratio fell and settled from December 2021 to December 2022 to between 0.5 and 0.6 unemployed people per job opening, the lowest since data first became available in 2000.

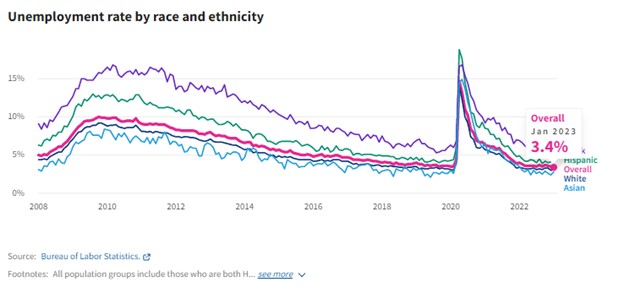

The unemployment rate was 4.0% at the beginning of 2022 and ended the year at 3.5%

It decreased most for Black and Asian people, 1.2 and 1.1 percentage points, respectively. Black people still have unemployment rates higher than the rest of the nation.

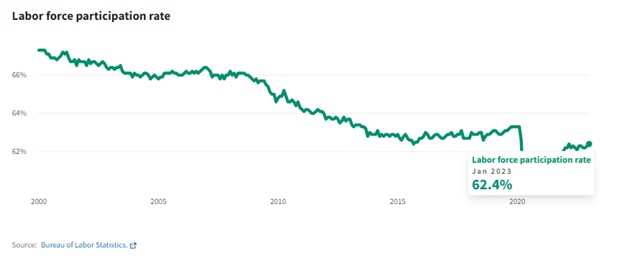

The labor force participation rate remains almost one percentage point below February 2020

An additional 2.5 million workers would need to be in the labor force for the participation rate to reach its pre-pandemic level.

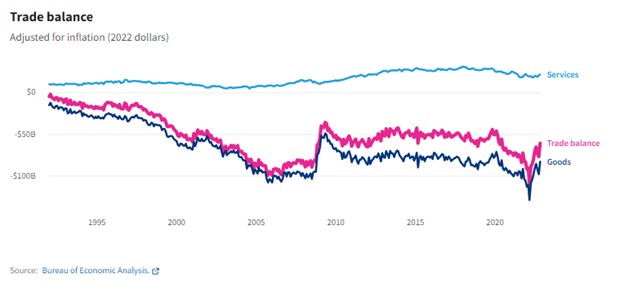

From January to November 2022, the US imported $889.9 billion more in goods and services than it exported. This is 7% higher than the trade deficit in 2021 for the same months

During this time, the goods trade deficit reached $1.1 trillion. Complete 2022 data is expected on February 7, 2023.

This content was republished from USAFacts. USAFacts is a not-for-profit, nonpartisan civic initiative making government data easy for all Americans to access and understand. It provides accessible analysis on US spending and outcomes in order to ground public debates in facts.