Which Way is Oil Going, and What it Could Mean for Investors in Related Sectors

Whether the sudden and severe decline in oil prices is an opportunity to invest in sectors that will benefit from cheaper fuel, a sign of further problems in the economy, or transitory, remains to be seen. It may depend on two overriding factors – and there are strong arguments supporting each. Below we look at the different scenarios and the sectors that are impacted.

Background

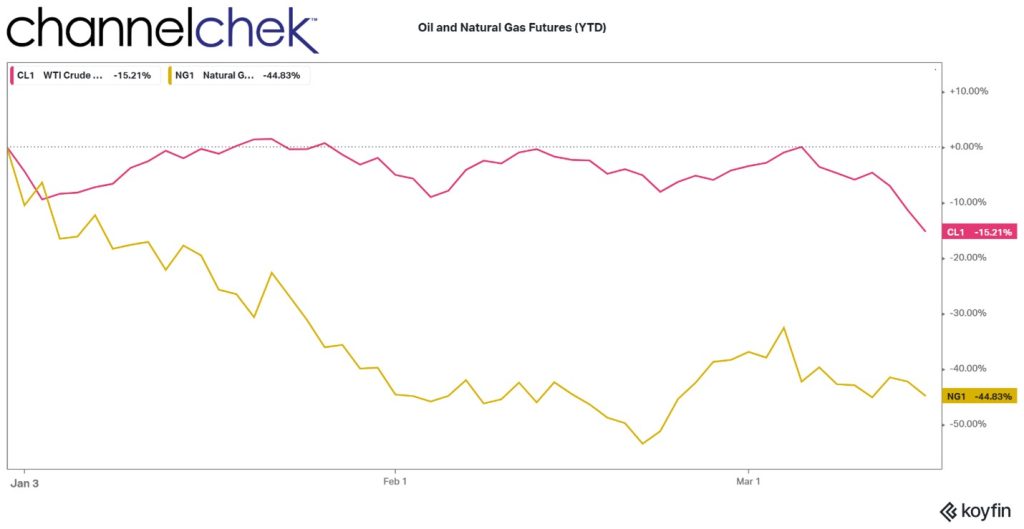

Energy futures and oil-related stocks like Chevron (CVX) and Exxon (XOM) gapped down at the open two days this week as concern about the overall health of the financial sector as two banks were closed and a major rating agency downgraded the banking sector Since Friday. U.S. oil futures remained below $70 per barrel midweek, as prices of WTI have now dipped 13% to levels not seen since December 2021.

These downward price moves are a reaction to thinking that demand will wane in a slowing U.S. economy. Also that it may take longer for the Chinese economy to rise to expected levels. Although far less impactful, approval of the Willow oil drilling project by the White House demonstrates a reversal of the ‘no more drilling’ policy by this administration.

A report by the International Energy Agency (IEA) this morning suggests the price decline may be temporary. The IEA anticipates that the oil markets will switch from a supply overhang in the first half of 2023 to a deficit later in the year. This is expected as OPEC continues its plan to cut production, and that the increased air traffic, along with an economic rebound in China will push global oil demand to a record high, according to the IEA.

Oil remains one of the most crucial commodities to the modern world. Its price has a significant impact on various industries and investment sectors. Below are the sectors that stand to benefit if the recent decline in prices remains intact or declines further:

Transportation Industry is a significant beneficiary of lower oil prices. The reason of course is because fuel costs are a significant expense for airlines, trucking, and shipping companies. When the cost of fuel follows the decline, the transportation industry enjoys a reduction in operating costs. This can result in wider margins on tickets sold for air travel, lower shipping costs for businesses including retailers, and lower prices for cruise lines.

The Chemical Industry is another sector that benefits from declining oil prices. Many chemicals are derived from crude oil, and a decrease in oil prices means a decrease in the cost of raw materials. This, in turn, can lead to lower prices for chemical products such as fertilizers, plastics, and other materials.

The Consumer Goods Industry is also a significant beneficiary of declining oil prices. This is because many consumer goods are made from oil-based materials such as plastics, rubber, and synthetic fabrics. When oil prices decline, the cost of these materials decreases, resulting in lower production costs and, ultimately, lower prices for consumers.

The Renewable Energy Industry is not directly related to oil prices, a decline in oil prices can benefit this sector indirectly. Renewable energy sources such as wind and solar power are becoming increasingly competitive with traditional fossil fuels, and a decrease in the price of oil can make it more challenging for the fossil fuel industry to compete. This can result in increased investment in renewable energy and a shift toward cleaner, more sustainable sources of energy.

Emerging Markets, particularly those that are oil-importing countries, can benefit significantly from declining oil prices. These countries rely heavily on imported oil, and a decrease in oil prices can result in significant cost savings for these countries. This can lead to increased economic growth, as businesses have more money to invest in other areas and consumers have more disposable income to spend.

Take Away

Oil has dropped considerably this year. This is in part because economic activity is expected to become lower, and problems in the banking sector. This may not last through the year as indicated by the IEA. Others believe this is the start of further declines. Should oil prices not track higher, stock market investors could look at the transportation, chemical, and consumer goods industries, as well as the renewable energy sector and emerging markets. As with any economic change, it is essential to carefully analyze the potential effects on different industries and sectors to make informed investment decisions.

Managing Editor, Channelchek

Sources