Research, News and Market Data ALVOF

Mar 21, 2023

CALGARY, AB, March 21, 2023 /CNW/ – Alvopetro Energy Ltd. (TSXV: ALV) (OTCQX: ALVOF) is pleased to announce a 17% increase in our quarterly dividend, to US$0.14 per common share, our financial results for the year ended December 31, 2022, filing of our annual information form, an automatic share repurchase plan, and an operational update.

All references herein to $ refer to United States dollars, unless otherwise stated and all tabular amounts are in thousands of United States dollars, except as otherwise noted.

President & CEO, Corey C. Ruttan commented:

“We are very pleased with our 2022 results, from revenues of $63.5 million we generated $49.9 million of funds flow from operations and net income of $31.7 million, increases of 82%, 102% and 467% respectively, year over year. This represents industry leading operating netback margins underpinning our disciplined capital allocation model that balances organic growth and stakeholder returns. Since commencing production from our Caburé project in 2020, we have repaid all outstanding debt and today’s announcement represents the third increase in our quarterly dividend since Q1 2022. With this, we will have already returned $22 million ($0.62/share) to shareholders in the form of dividends. We are also firmly focused on our next phase of growth and are looking forward to an exciting 2023 capital program.”

Quarterly Dividend Increased 17% to $0.14 per Share

Alvopetro is pleased to announce that our Board of Directors has approved a 17% increase in our quarterly dividend, to $0.14 per common share, payable in cash on April 14, 2023, to shareholders of record on March 31, 2023. This dividend is designated as an “eligible dividend” for Canadian income tax purposes.

Dividend payments to non-residents of Canada will be subject to withholding taxes at the Canadian statutory rate of 25%. Shareholders may be entitled to a reduced withholding tax rate under a tax treaty between their country of residence and Canada. For further information, see Alvopetro’s website at https://alvopetro.com/Dividends-Non-resident-Shareholders.

Operational Update

Our average daily sales have continued at strong rates in 2023, averaging 2,754 boepd in January and a new daily record of 2,866 boepd in February. Effective February 1, 2023, our natural gas price increased to BRL2.00/m3 and is effective for all natural gas sales from February 1 to July 31, 2023. Including recently approved and enhanced sales tax credits, our realized gas price, net of sales taxes, for the month of February was approximately $12.23/Mcf (based on our average heat content to date and the average February 2023 BRL/USD foreign exchange rate of 5.17).

On February 6, 2023, we announced our 2023 capital program, focused on lower risk development opportunities on our Murucututu natural gas project and our Bom Lugar oil field. We have commenced stimulation operations at our 197(1) well on Murucututu. The 197(1) well location has already been tied in to our 183(1) facility and we expect to commence production from the well in the second quarter. Following this stimulation, we plan to drill two follow-up wells at Murucututu, with one well having additional uphole exploration potential. We have budgeted total capital expenditures of $16 million for our Murucututu project in 2023.

On our Bom Lugar field, we plan to drill up to two development wells in 2023, targeting the Caruaçu Formation with additional potential in the deeper Gomo and Agua Grande Formations, the first of which is planned for the second quarter. Total capital expenditures of up to $11 million are budgeted at Bom Lugar.

Additional capital spending budgeted for 2023 includes $3 million on our Caburé field for the expansion of unit facilities and drilling two additional wells, $0.5 million at our Mãe-da-lua field for stimulation of the existing well and $0.4 million in capital expenditures at our 182-C2 and 183-B2 wells.

Automatic Share Repurchase Plan

In January 2023, we received approval from the TSX Venture Exchange (“TSXV”) for a normal course issuer bid (the “NCIB”) as more particularly described in our news release dated January 3, 2023. The terms of the NCIB permit Alvopetro to repurchase up to 2,876,414 common shares from January 6, 2023 to the earlier of January 5, 2024 or when the NCIB is completed or terminated by Alvopetro. No repurchases have been made under the NCIB to date.

Alvopetro intends to enter into an automatic share purchase plan (“ASPP”) with our designated broker, subject to the approval of the TSXV. The ASPP is intended to allow for the purchase of common shares under the NCIB at times when the Corporation may not ordinarily be permitted to purchase common shares due to regulatory restrictions and customary self-imposed blackout periods.

The ASPP is to be implemented upon TSXV approval and would allow the designated broker to purchase common shares pursuant to the proposed ASPP until the expiry of the NCIB on January 5, 2024. Such purchases will be determined by the broker at its sole discretion based on the purchasing parameters set out by the Corporation in accordance with the rules of the TSXV, applicable securities laws and the terms of the ASPP. The ASPP will terminate on the earlier of the date on which: (i) the NCIB expires; (ii) the maximum number of common shares have been purchased under the ASPP; and (iii) the Corporation terminates the ASPP in accordance with its terms.

Outside of the ASPP and outside of pre-determined blackout periods, common shares may continue to be purchased under the NCIB based on management’s discretion, in compliance with the rules of the TSXV and applicable securities laws. All purchases made under the ASPP will be included in the number of common shares available for purchase under the NCIB.

December 31, 2022 Reserves and Net Asset Value

On February 28, 2023, Alvopetro announced its December 31, 2022 reserves based upon the independent reserve assessment and evaluation prepared by GLJ Ltd. (“GLJ”) dated February 27, 2023 with an effective date of December 31, 2022 (the “GLJ Reserves and Resources Report”).

Key highlights from the GLJ Reserves and Resources Report1:

- 2P net present value before tax discounted at 10% (“NPV10”) increased 17% to $348.2 million.

- Proved reserves (“1P”) decreased 12% to 3.9 MMboe and 2P reserves increased 3% to 9.0 MMboe after 0.9 MMboe of production in 2022.

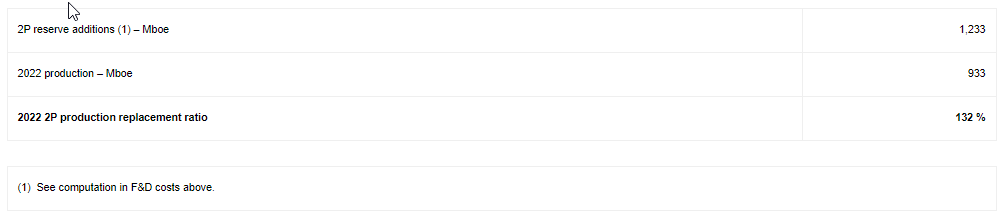

- 2P production replacement ratio of 132%.

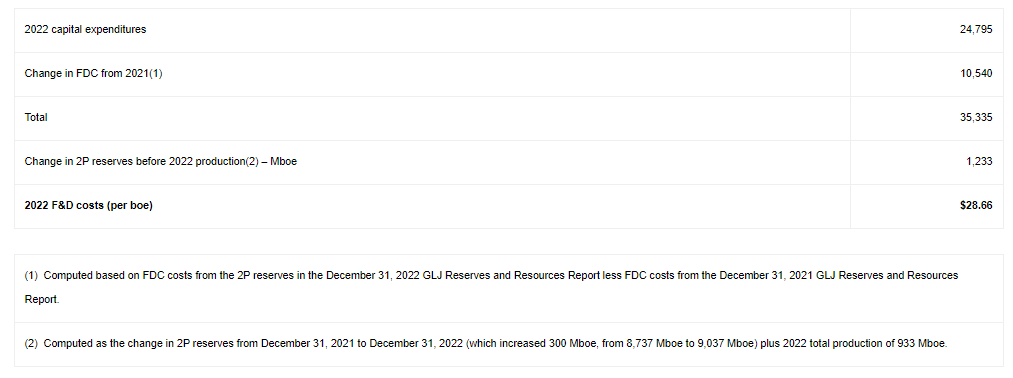

- 2P F&D costs of $28.66/boe.

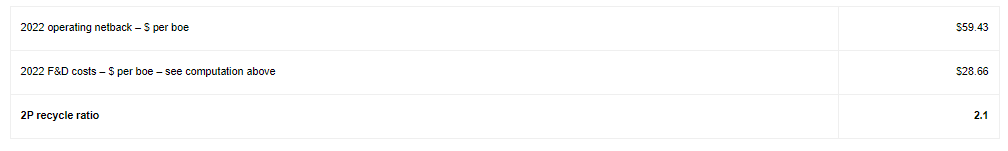

- 2P recycle ratio of 2.1 times.

- 2P Net Asset Value of CAD$13.70/share ($9.99/share) before any potential from contingent or prospective resources.

- Risked best estimate contingent resource of 2.9 MMboe (NPV10 $62.2 million) and risked best estimate prospective resource of 12.5 MMboe (NPV10 $259.1 million).

| 1 Refer to the section entitled “Oil and Natural Gas Advisories” for additional disclosures regarding oil and natural gas reserves, contingent resources and prospective resources. In addition refer to “Oil and – Natural Gas Advisories – Other Metrics” and “Non-GAAP and Other Financial Measures” for additional disclosures and assumptions used in calculating production replacement ratio, F&D costs, recycle ratio, net asset value and net asset value per share. |

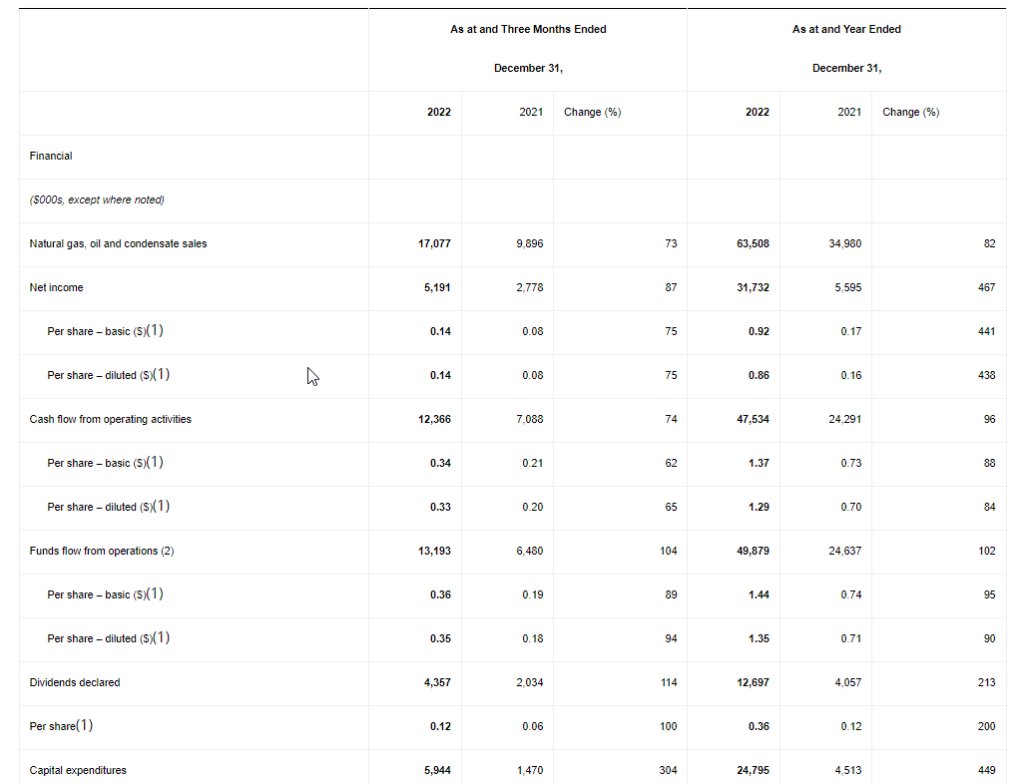

Financial and Operating Highlights – Fourth Quarter of 2022

- Our average daily sales increased to a new quarterly record of 2,724 boepd (+3% from Q3 2022 and +12% from Q4 2021).

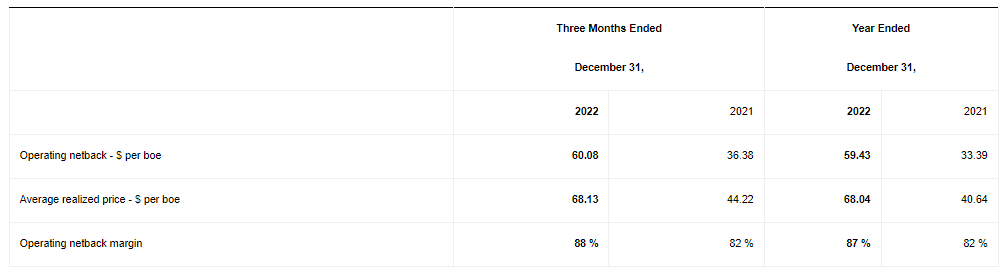

- With natural gas sales in Q4 2022 continuing at the ceiling price in our contract, our average realized natural gas price was $11.18/Mcf (+58% from Q4 2021) and our average realized price per boe was $68.13 (+54% from Q4 2021). Higher realized prices and record daily sales volumes resulted in a 73% increase in our natural gas, condensate and oil revenue compared to Q4 2021.

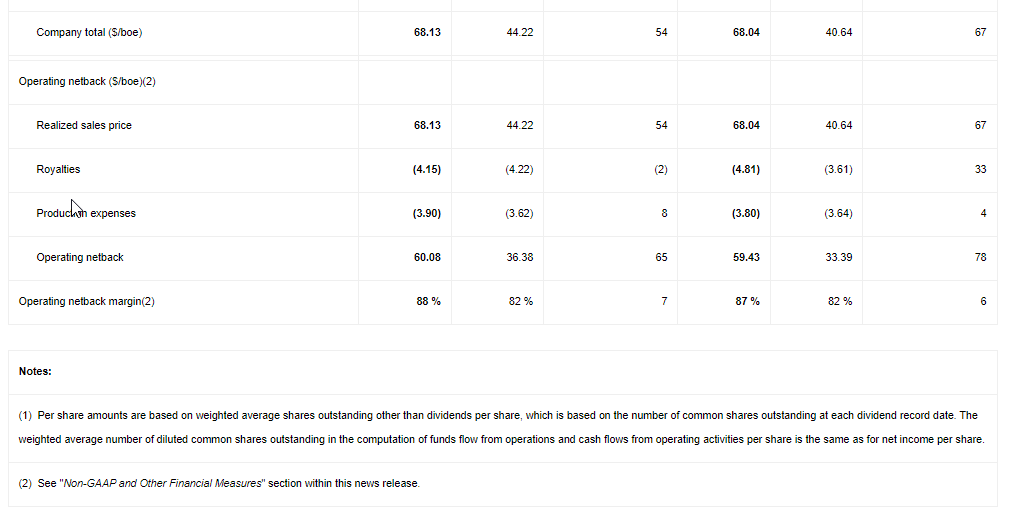

- Our operating netback was $60.08 per boe in Q4 2022, an improvement of $23.70 per boe from Q4 2021 (+65%) and $0.25 per boe from Q3 2022.

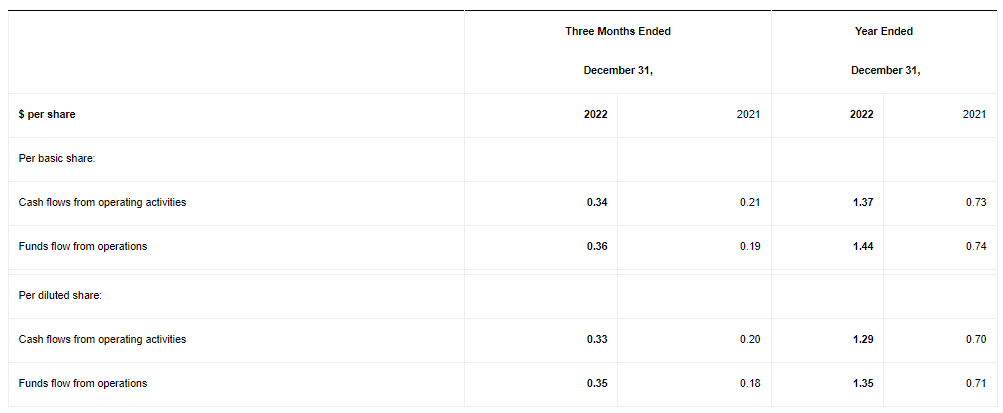

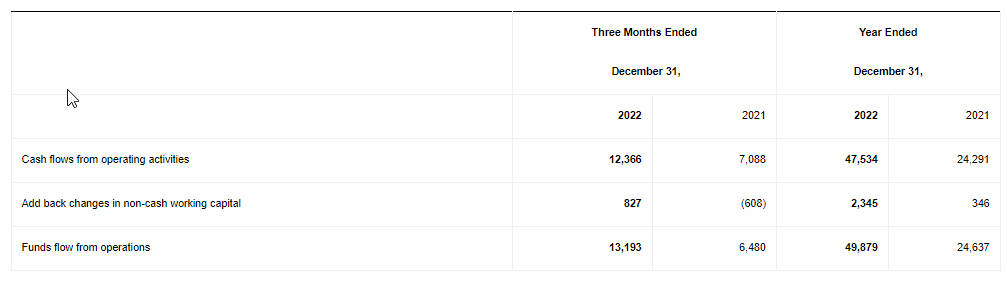

- We generated funds flows from operations of $13.2 million ($0.36 per basic share and $0.35 per diluted share), an increase of $6.7 million compared to Q4 2021 and a decrease of $0.2 million compared to Q3 2022.

- We reported net income of $5.2 million in Q4 2022, an increase of $2.4 million (+87%) compared to Q4 2021. Net income was impacted by impairment expense of $6.3 million recognized on exploration assets.

- Capital expenditures totaled $5.9 million, including drilling and testing costs for our 182-C2 well, testing of the Unit-C well and facilities expenditures at the Caburé unit, testing costs for our 183-B1 well, development costs on our Murucututu project and long-lead purchases.

- Our Q4 2022 dividend increased 50% to $0.12 per share. The Q4 2022 dividend was paid on January 13, 2023 to shareholders of record on December 30, 2022.

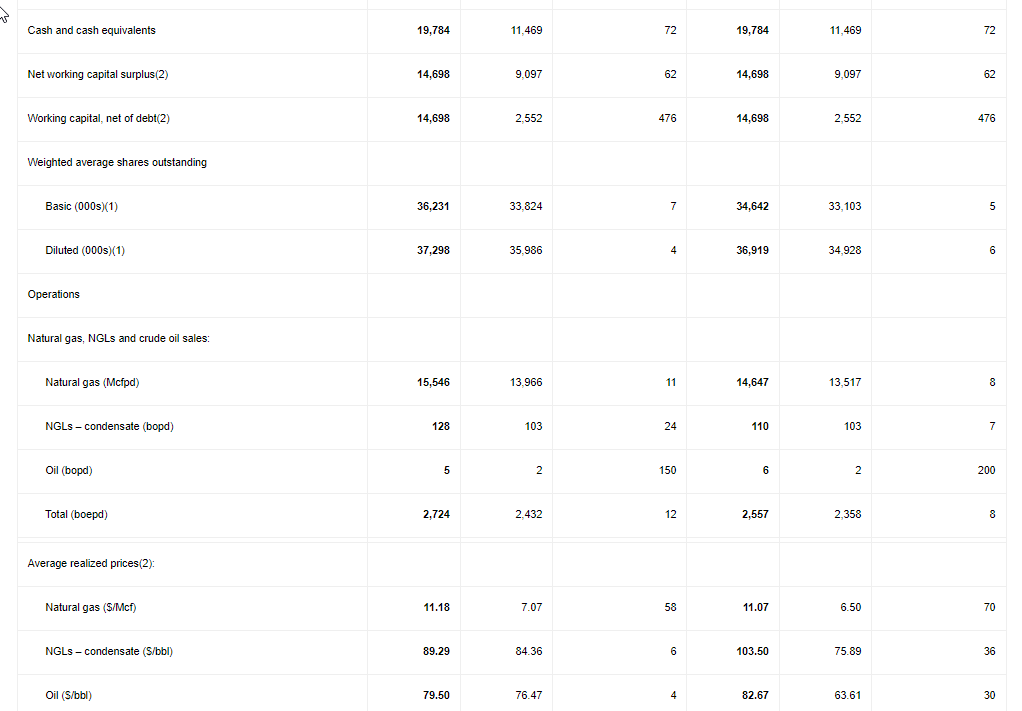

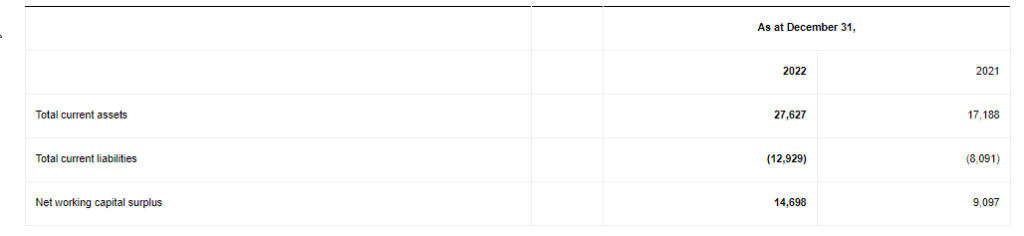

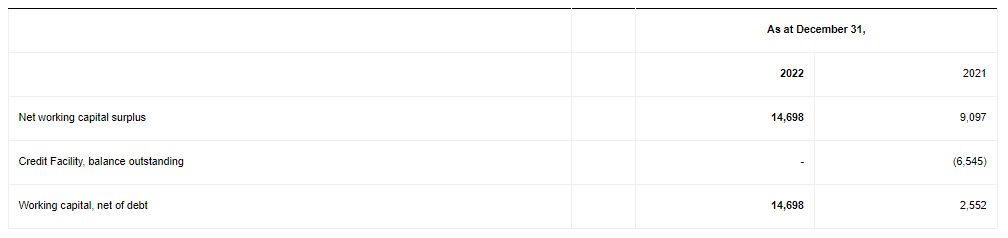

- Our cash and working capital increased to $14.7 million, an improvement of $2.5 million compared to September 30, 2022 and an increase of $12.1 million compared to December 31, 2021 working capital net of debt of $2.6 million.

Financial and Operating Highlights – Year Ended December 31, 2022

- Our annual sales averaged 2,557 boepd (95% natural gas, 4% NGLs from condensate and marginal crude oil production), an increase of 8% compared to 2021.

- We reported net income of $31.7 million, compared to $5.6 million in 2021 (+467%).

- We generated funds flow from operations of $49.9 million ($1.44 per basic share on $1.35 per diluted share) compared to $24.6 million in 2021 ($0.74 per basic share and $0.71 per diluted share).

- Capital expenditures totaled $24.8 million in 2022.

- In the third quarter of 2022, all outstanding warrants were exercised. Alvopetro received cash proceeds of $2.4 million and issued a total of 2,081,616 common shares on the exercise.

- The credit facility was fully repaid in September 2022 and has been cancelled.

- Dividends totaled $0.36 per share in 2022 compared to $0.12 per share in 2021 (+200%).

The following table provides a summary of Alvopetro’s financial and operating results for periods noted. The consolidated financial statements with the Management’s Discussion and Analysis (“MD&A”) are available on our website at www.alvopetro.com and will be available on the System for Electronic Document Analysis and Retrieval (SEDAR) website at www.sedar.com.

2022 Results Webcast

Alvopetro will host a live webcast to discuss 2022 financial results at 9:00 am Mountain time on Wednesday March 22, 2023. Details for joining the event are as follows:

DATE: March 22, 2023TIME: 9:00 AM Mountain/11:00 AM EasternLINK: https://us06web.zoom.us/j/83279531812 DIAL-IN NUMBERS: https://us06web.zoom.us/u/kcfqlsznWWEBINAR ID: 832 7953 1812

The webcast will include a question and answer period. Online participants will be able to ask questions through the Zoom portal. Dial-in participants can email questions directly to [email protected].

Annual Information Form

Alvopetro has filed its annual information form (“AIF”) with the Canadian securities regulators on SEDAR. The AIF includes the disclosure and reports relating to oil and gas reserves data and other oil and gas information required pursuant to National Instrument 51-101 of the Canadian Securities Administrators. The AIF may be accessed electronically at www.sedar.com.

Corporate Presentation

Alvopetro’s updated corporate presentation is available on our website at:

http://www.alvopetro.com/corporate-presentation.

Social Media

Follow Alvopetro on our social media channels at the following links:

Twitter – https://twitter.com/AlvopetroEnergyInstagram – https://www.instagram.com/alvopetro/LinkedIn – https://www.linkedin.com/company/alvopetro-energy-ltd

Alvopetro Energy Ltd.’s vision is to become a leading independent upstream and midstream operator in Brazil. Our strategy is to unlock the on-shore natural gas potential in the state of Bahia in Brazil, building off the development of our Caburé natural gas field and our strategic midstream infrastructure.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

Oil and Natural Gas Advisories

Oil and Natural Gas Reserves

The disclosure in this news release summarizes certain information contained in the GLJ Reserves and Resources Report but represents only a portion of the disclosure required under National Instrument 51-101 (“NI 51-101”). For additional details, see our news release dated February 28, 2023. Full disclosure with respect to the Company’s reserves as at December 31, 2022 is contained in the Company’s annual information form for the year ended December 31, 2022 which has been filed on SEDAR (www.sedar.com). All net present values in this press release are based on estimates of future operating and capital costs and GLJ’s forecast prices as of December 31, 2022. The reserves definitions used in this evaluation are the standards defined by the Canadian Oil and Gas Evaluation Handbook (COGEH) reserve definitions, are consistent with NI 51-101 and are used by GLJ. The net present values of future net revenue attributable to the Alvopetro’s reserves estimated by GLJ do not represent the fair market value of those reserves. Other assumptions and qualifications relating to costs, prices for future production and other matters are summarized herein. The recovery and reserve estimates of the Company’s reserves provided herein are estimates only and there is no guarantee that the estimated reserves will be recovered. Actual reserves may be greater than or less than the estimates provided herein. Possible reserves are those additional reserves that are less certain to be recovered than probable reserves. There is a 10% probability that the quantities actually recovered will equal or exceed the sum of proved plus probable plus possible reserves.

Contingent Resources

This news release discloses estimates of Alvopetro’s contingent resources and the net present value associated with net revenues associated with the production of such contingent resources as included in the GLJ Reserves and Resources Report. There is no certainty that it will be commercially viable to produce any portion of such contingent resources and the estimated future net revenues do not necessarily represent the fair market value of such contingent resources. Estimates of contingent resources involve additional risks over estimates of reserves. For additional details with respect to Alvopetro’s contingent resources evaluated as at December 31, 2022, see our news release dated February 28, 2023 and additional details contained in the Company’s annual information form for the year ended December 31, 2022 which has been filed on SEDAR (www.sedar.com).

Prospective Resources

This news release discloses estimates of Alvopetro’s prospective resources included in the GLJ Reserves and Resources Report. There is no certainty that any portion of the prospective resources will be discovered and even if discovered, there is no certainty that it will be commercially viable to produce any portion. Estimates of prospective resources involve additional risks over estimates of reserves. The accuracy of any resources estimate is a function of the quality and quantity of available data and of engineering interpretation and judgment. While resources presented herein are considered reasonable, the estimates should be accepted with the understanding that reservoir performance subsequent to the date of the estimate may justify revision, either upward or downward. For additional details with respect to Alvopetro’s prospective resources evaluated as at December 31, 2022, see our news release dated February 28, 2023 and additional details contained in the Company’s annual information form for the year ended December 31, 2022 which has been filed on SEDAR (www.sedar.com).

Other Metrics

This press release contains metrics commonly used in the oil and natural gas industry, which have been prepared by management, including “F&D costs”, “net asset value”, “net asset value per share”, “production replacement ratio” and “recycle ratio”. These terms do not have a standardized meaning and may not be comparable to similar measures presented by other companies, and therefore should not be used to make such comparisons.

“F&D costs” are reflected on a per barrel of oil equivalent and are calculated as the sum of capital expenditures in the current year plus the change in FDC for the period, divided by the change in reserves in the period, before current year production. The 2022 F&D costs are computed as follows:

“Net asset value” is based on the before tax net present value of the Company’s reserves as at December 31, 2022, discounted at 10% plus the Company’s net working capital balance as of December 31, 2022. Net working capital is a capital management measure. See “Non-GAAP and Other Financial Measures” below for further details.

“Net asset value per share” is based on the computation of net asset value divided by basic shares outstanding of 36,311,579 adjusted to Canadian dollars based on the foreign exchange rate on March 21, 2023.

“Production replacement ratio” is calculated as total reserve additions divided by current year production. Alvopetro’s 2P production replacement ratio in 2022 is calculated as:

“Recycle ratio” is calculated by dividing the 2022 operating netback by F&D costs per boe for the year. The Company’s 2022 recycle ratio is calculated as follows:

Management uses these oil and gas metrics for its own performance measurements and to provide shareholders with measures to compare our operations over time. Readers are cautioned that the information provided by these metrics, or that can be derived from the metrics presented in this press release, should not be relied upon for investment or other purposes.

Non-GAAP and Other Financial Measures

This news release contains references to various non-GAAP financial measures, non-GAAP ratios, capital management measures and supplementary financial measures as such terms are defined in National Instrument 52-112 Non-GAAP and Other Financial Measures Disclosure. Such measures are not recognized measures under GAAP and do not have a standardized meaning prescribed by IFRS and might not be comparable to similar financial measures disclosed by other issuers. While these measures may be common in the oil and gas industry, the Company’s use of these terms may not be comparable to similarly defined measures presented by other companies. The non-GAAP and other financial measures referred to in this report should not be considered an alternative to, or more meaningful than measures prescribed by IFRS and they are not meant to enhance the Company’s reported financial performance or position. These are complementary measures that are used by management in assessing the Company’s financial performance, efficiency and liquidity and they may be used by investors or other users of this document for the same purpose. Below is a description of the non-GAAP financial measures, non-GAAP ratios, capital management measures and supplementary financial measures used in this news release. For more information with respect to financial measures which have not been defined by GAAP, including reconciliations to the closest comparable GAAP measure, see the “Non-GAAP Measures and Other Financial Measures” section of the Company’s MD&A which may be accessed through the SEDAR website at www.sedar.com.

Non-GAAP Financial Measures

Operating netback

Operating netback is calculated as natural gas, oil and condensate revenues less royalties and production expenses. This calculation is provided in the “Operating Netback” section of the Company’s MD&A using our IFRS measures. The Company’s MD&A may be accessed through the SEDAR website at www.sedar.com. Operating netback is a common metric used in the oil and gas industry used to demonstrate profitability from operations.

Non-GAAP Financial Ratios

Operating netback per boe

Operating netback is calculated on a per unit basis, which is per barrel of oil equivalent (“boe”). It is a common non-GAAP measure used in the oil and gas industry and management believes this measurement assists in evaluating the operating performance of the Company. It is a measure of the economic quality of the Company’s producing assets and is useful for evaluating variable costs as it provides a reliable measure regardless of fluctuations in production. Alvopetro calculated operating netback per boe as operating netback divided by total sales volumes (barrels of oil equivalent). This calculation is provided in the “Operating Netback” section of the Company’s MD&A using our IFRS measures. The Company’s MD&A may be accessed through the SEDAR website at www.sedar.com. Operating netback is a common metric used in the oil and gas industry used to demonstrate profitability from operations on a per unit basis (boe).

Operating netback margin

Operating netback margin is calculated as operating netback per boe divided by the realized sales price per boe. Operating netback margin is a measure of the profitability per boe relative to natural gas, oil and condensate sales revenues per boe and is calculated as follows:

Funds Flow from Operations Per Share

Funds flow from operations per share is a non-GAAP ratio that includes all cash generated from operating activities and is calculated before changes in non-cash working capital, divided by the weighted the weighted average shares outstanding for the respective period. For the periods reported in this news release the cash flows from operating activities per share and funds flow from operations per share is as follows:

Capital Management Measures

Funds Flow from Operations

Funds flow from operations is a non-GAAP capital management measure that includes all cash generated from operating activities and is calculated before changes in non-cash working capital. The most comparable GAAP measure to funds flow from operations is cash flows from operating activities. Management considers funds flow from operations important as it helps evaluate financial performance and demonstrates the Company’s ability to generate sufficient cash to fund future growth opportunities. Funds flow from operations should not be considered an alternative to, or more meaningful than, cash flows from operating activities however management finds that the impact of working capital items on the cash flows reduces the comparability of the metric from period to period. A reconciliation of funds flow from operations to cash flows from operating activities is as follows:

Net Working Capital

Net working capital is computed as current assets less current liabilities. Net working capital is a measure of liquidity, is used to evaluate financial resources, and is calculated as follows:

Working Capital Net of Debt

Working capital net of debt is computed as net working capital surplus decreased by the carrying amount of the Credit Facility. Working capital net of debt is used by management to assess the Company’s overall financial position.

Supplementary Financial Measures

“Average realized natural gas price – $/Mcf” is comprised of natural gas sales as determined in accordance with IFRS, divided by the Company’s natural gas sales volumes.

“Average realized NGL – condensate price – $/bbl” is comprised of condensate sales as determined in accordance with IFRS, divided by the Company’s NGL sales volumes from condensate.

“Average realized oil price – $/bbl” is comprised of oil sales as determined in accordance with IFRS, divided by the Company’s oil sales volumes.

“Average realized price – $/boe” is comprised of natural gas, condensate and oil sales as determined in accordance with IFRS, divided by the Company’s total natural gas, condensate and oil sales volumes (barrels of oil equivalent).

“Royalties per boe” is comprised of royalties, as determined in accordance with IFRS, divided by the total natural gas, condensate and oil sales volumes (barrels of oil equivalent).

“Production expenses per boe” is comprised of production expenses, as determined in accordance with IFRS, divided by the total natural gas, condensate and oil sales volumes (barrels of oil equivalent).

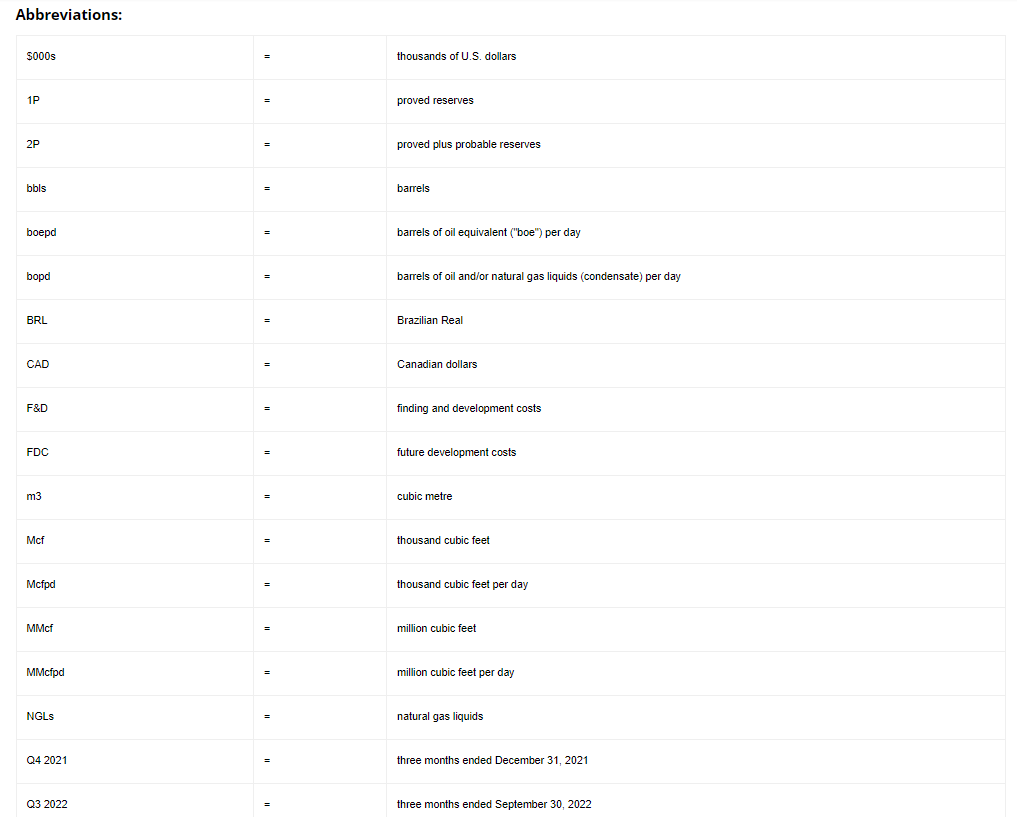

BOE Disclosure

The term barrels of oil equivalent (“boe”) may be misleading, particularly if used in isolation. A boe conversion ratio of six thousand cubic feet per barrel (6 Mcf/bbl) of natural gas to barrels of oil equivalence is based on an energy equivalency conversion method primarily applicable at the burner tip and does not represent a value equivalency at the wellhead. All boe conversions in this news release are derived from converting gas to oil in the ratio mix of six thousand cubic feet of gas to one barrel of oil.

Forward-Looking Statements and Cautionary Language

This news release contains forward-looking information within the meaning of applicable securities laws. The use of any of the words “will”, “expect”, “intend” and other similar words or expressions are intended to identify forward-looking information. Forward–looking statements involve significant risks and uncertainties, should not be read as guarantees of future performance or results, and will not necessarily be accurate indications of whether or not such results will be achieved. A number of factors could cause actual results to vary significantly from the expectations discussed in the forward-looking statements. These forward-looking statements reflect current assumptions and expectations regarding future events. Accordingly, when relying on forward-looking statements to make decisions, Alvopetro cautions readers not to place undue reliance on these statements, as forward-looking statements involve significant risks and uncertainties. More particularly and without limitation, this news release contains forward-looking statements concerning plans relating to the Company’s operational activities, proposed exploration development activities and the timing for such activities, exploration and development prospects of Alvopetro, capital spending levels, future capital and operating costs, timing and taxation of dividends and plans for dividends in the future, plans for share repurchases under the NCIB and the duration of the NCIB, future production and sales volumes, the expected natural gas price, gas sales and gas deliveries under Alvopetro’s long-term gas sales agreement, the expected timing of production commencement from the 197(1) well, the proposed automatic share purchase plan, and projected financial results. Forward-looking statements are necessarily based upon assumptions and judgments with respect to the future including, but not limited to, expectations and assumptions concerning the timing of regulatory licenses and approvals, equipment availability, the success of future drilling, completion, testing, recompletion and development activities and the timing of such activities, the performance of producing wells and reservoirs, well development and operating performance, expectations regarding Alvopetro’s working interest and the outcome of any redeterminations, environmental regulation, including regulation relating to hydraulic fracturing and stimulation, the ability to monetize hydrocarbons discovered, the outlook for commodity markets and ability to access capital markets, foreign exchange rates, general economic and business conditions, forecasted demand for oil and natural gas, the impact of the COVID-19 pandemic, weather and access to drilling locations, the availability and cost of labour and services, the regulatory and legal environment and other risks associated with oil and gas operations. The reader is cautioned that assumptions used in the preparation of such information, although considered reasonable at the time of preparation, may prove to be incorrect. Actual results achieved during the forecast period will vary from the information provided herein as a result of numerous known and unknown risks and uncertainties and other factors. In addition, the declaration, timing, amount and payment of future dividends remain at the discretion of the Board of Directors. Although we believe that the expectations and assumptions on which the forward-looking statements are based are reasonable, undue reliance should not be placed on the forward-looking statements because we can give no assurance that they will prove to be correct. Since forward looking statements address future events and conditions, by their very nature they involve inherent risks and uncertainties. Actual results could differ materially from those currently anticipated due to a number of factors and risks. These include, but are not limited to, risks associated with the oil and gas industry in general (e.g., operational risks in development, exploration and production; delays or changes in plans with respect to exploration or development projects or capital expenditures; the uncertainty of reserve estimates; the uncertainty of estimates and projections relating to production, costs and expenses, reliance on industry partners, availability of equipment and personnel, uncertainty surrounding timing for drilling and completion activities resulting from weather and other factors, changes in applicable regulatory regimes and health, safety and environmental risks), commodity price and foreign exchange rate fluctuations, market uncertainty associated with financial institution instability, and general economic conditions. The reader is cautioned that assumptions used in the preparation of such information, although considered reasonable at the time of preparation, may prove to be incorrect. Although Alvopetro believes that the expectations and assumptions on which such forward-looking information is based are reasonable, undue reliance should not be placed on the forward-looking information because Alvopetro can give no assurance that it will prove to be correct. Readers are cautioned that the foregoing list of factors is not exhaustive. Additional information on factors that could affect the operations or financial results of Alvopetro are included in our annual information form which may be accessed on Alvopetro’s SEDAR profile at www.sedar.com. The forward-looking information contained in this news release is made as of the date hereof and Alvopetro undertakes no obligation to update publicly or revise any forward-looking information, whether as a result of new information, future events or otherwise, unless so required by applicable securities laws.

SOURCE Alvopetro Energy Ltd.