Company Stock Repurchases Have Reached Record Levels

Stock buybacks often boom when borrowing costs are down. However, interest rates are currently as high as they have been in a while, yet buybacks are still surging. The rampant pace also flies in the face of new corporate taxes on the practice. US companies grabbing their own shares is one part of why the market has started the year very strong. The S&P 500 was up for a third week in a row to end January and kick off February. The pace shows no sign of slowing and may even pick up as earnings season and the related blackout periods are lifted. What’s involved in stock buybacks, and what has been the impact now, so early in 2023.

How is a Stock Buyback Executed?

Last week Meta Platforms (META) followed a few logistics companies, oil businesses, and even aerospace contractors by announcing an increase in management’s authorization to purchase its own shares. There are simple but important rules Meta and the others will have to abide by to conduct these purchases. The rules are to provide orderly markets, they fall under the Securities and Exchange Commission’s “Safe Harbor” for Issuer Repurchase, SEC 10b-18 protections.

The head trader at Noble Capital Markets, David Lean is a veteran equity trader whose desk has been involved in many stock repurchases. He explained the critical areas a broker has to follow. They are, Manner of Purchase, Timing, Price, and Volume.

“The company must purchase shares through a single broker or dealer during a single day,” Mr. Lean said, explaining that one day a company may choose a broker like Noble and provide instructions and criteria, it then is the only broker allowed to trade on behalf of the buyback plans that day. Another day a different single broker or dealer may be selected for the trading day.

As far as timing, the SEC has laid out the following guidelines: A company with an average trading volume less than $1 million per day or a public float value below $150 million is unable to trade within the last 30 minutes of trading. Companies with higher average-trading-volume and public float value can trade up until the last 10 minutes.

David Lean explained the trading price restrictions on behalf of the company, “The company must repurchase at a price that does not exceed the highest independent bid or the last transaction price quoted.” While a stock repurchase does put upward pressure on share prices, the act of repurchasing shares should not be allowed to bid up the price directly.

The rules on volume also help prevent the repurchase from being overly disruptive. “The company cannot purchase more than 25% of the average daily volume as measured over the previous four weeks,” according to Lean. He was also was quick to point out that there is an exclusion whereby “The company may make one ‘block’ purchase per week and not be subject to the 25% volume limitation, provided the ‘block’ purchase is the only Rule 10b-18 purchase made on that day.”

The SEC provides these “Safe Harbor” rules as a guide for all parties involved to understand the boundaries of acceptance in the eyes of the SEC.

Buybacks 2023

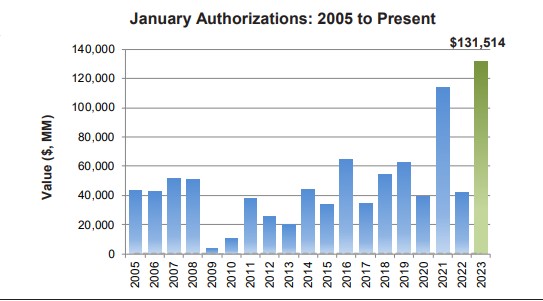

During the first month of 2023, announced corporate buybacks more than tripled to $132 billion from a year ago. Then, February kicked off with META immediately adding another $40 billion to the annual tally. According to data compiled by Birinyi Associates, January broke, by 15%, the previous record for a January set in 2021.

There has been no slowdown. According to Bloomberg, Morgan Stanley’s desk that executes buybacks saw orders increase 5%. This feeds into the market strength that thus far has characterized 2023, along increased buying interest from retail accounts, and quant funds.

This increase in stock buybacks in 2023 coes at the same tome a new tax levy on repurchases comes into play by the Inflation Reduction Act of 2022. According to the IRS the new code imposes a 1% excise tax on the aggregate fair market value of stock repurchased by certain corporations during the taxable year. The 1% levy is not deductible. The new tax indicates that the government doesn’t encourage companies repurchasing their own stock. In fact in the case of Chevron (CVX), they had been criticized by the White House for using their cash in this way rather than to try to increase output.

Take Away

Each company has its own reason to repurchase its own stock. However, in each case it could represent confidence in the future. There are rules put in place by the SEC that help provide orderly trading in the names, but the announcements themselves tend to create upward spikes in the names.

A new tax on the practice that came into effect on January 1 is going to cost the companies buying their shares 1%. This has not prevented the record levels of stock buybacks in January.

Managing Editor, Channelchek

Sources:

https://www.rttnews.com/corpinfo/stockbuybacks.aspx

https://finance.yahoo.com/news/7-big-stock-buybacks-meta-065244274.html