Ark Invest’s Cathie Wood Finds the Federal Reserve Quixotic

On Wall Street, staying with the herd guarantees average gains or losses. Wandering far from the herd adds two more possibilities. You may still have average performance, you may exceed the averages, or you may get slaughtered. ARK Invest’s Cathie Wood likes to explore her own field in which to graze, far from the herd. This preference shows in her funds performance. At times her returns have far exceeded competing hedge funds, and at other times they fall well below the pack.

In October of 2021, before Fed Chairman Powell changed his thinking that inflation may not be transitory, the renowned hedge fund manager, and market guru, Cathie Wood began sounding alarm bells about her fear of deflationary pressures. At the same time, she warned of job losses due to displacement as technology would reduce costs and the need for the current skill sets in the labor force.

For months renowned investor Cathie Wood has said that the Federal Reserve should stop raising interest rates, that the economy is seeing deflation rather than inflation, and that it is in a recession.

Even as others in the”transitory” camp have come more in line with the official position of the Fed on inflation, she has remained steadfast to her idea that new technology will solve supply issues. Supply is an important inflation input, and that innovation may oversupply to a point where the economy may struggle with falling prices.

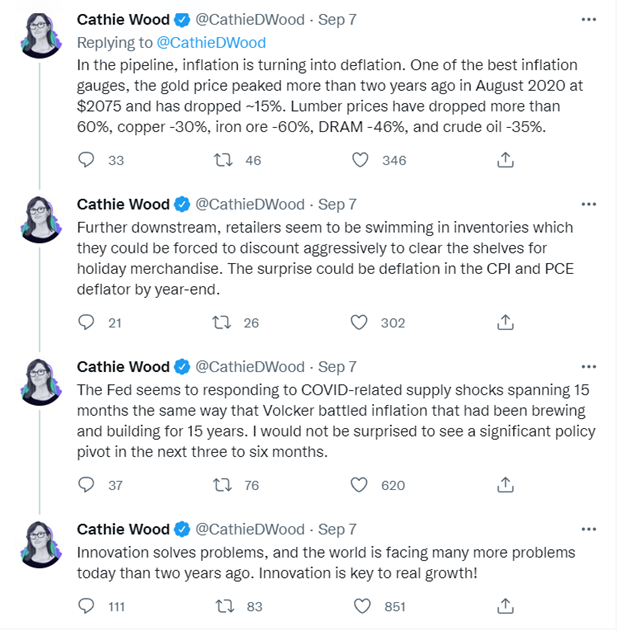

This week she tweeted a few reasons for her forecast and shared her thoughts on Jerome Powell’s address at the Jackson Hole Economic Symposium.

Her view is that the Fed has overshot the target. Wood, who was already working on Wall Street during the high inflation 1970’s, tweeted her reasons for this belief. High on her list is the price of gold (expressed in dollars) which she says is one of the best inflation gauges. Gold, she tweeted, “peaked more than two years ago.”

She also reminded followers of the price movements of other commodities, all down. These include lumber’s price decrease of 60%, iron ore 60%, oil 35%, and copper 30%. Much closer to final consumer prices, she highlighted that retailers are flush with inventories that don’t match the selling season. They’re discounting to clear shelves which could result in a deflation print in one of the more popular inflation gauges.

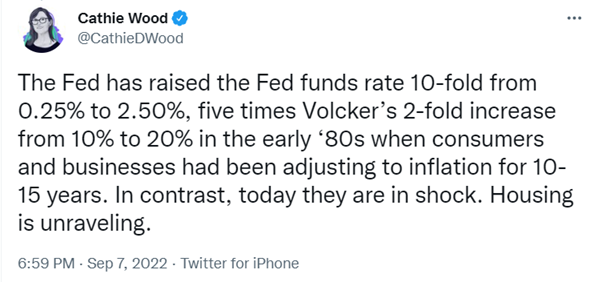

The Fed chairman who last fought inflation with unblinking resolve is Paul Volcker. Ms. Wood reminded her Twitter followers that the inflation he was battling had been “brewing and building for 15 years.” In comparison, she said inflation under Jay Powell’s watch is only 15 months old and Covid-related. She thinks the current Fed Chair has gone too far, and “I wouldn’t be surprised to see a significant policy pivot over the next three to six months,” Wood said.

A Quixotic Fed?

Powell and his colleagues are looking at the wrong data, Wood tweeted. “The Fed is basing monetary policy decisions on backward indicators: employment and core inflation,” she tweeted. “Inflation is turning into deflation,” she said in another tweet.

Wood said, comparing the two Fed chairpersons, Powell invoked Volcker’s name four times in the Jackson Hole speech. Her tweets explained inflation was much higher in Volker’s era. “Until Volker took over [of the Fed] In 1979, 15 years after the start of the Vietnam War and the Great Society, did the Fed launch a decisive attack on inflation,” Wood detailed.

“Conversely, in the face of two-year supply-related inflationary shocks, Powell is using Volker’s sledgehammer and, I believe, is making a mistake.”

Take Away

Without different opinions and different investment holding periods, there would be no market. We’d all speculate on the same things, and they’d continue upward until the last dollar was invested.

Ark Invest’s flagship Arc Innovation ETF (arkk) has fallen 55% this year, more than double the fall-off of the indexes. When discussing current performance Wood has defended her strategy by reminding others that she has an investment horizon of five years. As of Sept. 7, Arc Innovation’s five-year annualized return was 5.81%.

Cathie Wood has continued an almost year-long campaign warning of deflation and saying the Federal Reserve should stop raising interest rates, and that the economy is in a recession. If she is right and has selected the investments that benefit from being correct, then those invested in her funds will be glad they placed some of their investment funds away from the herd.

Managing Editor, Channelchek

Sources