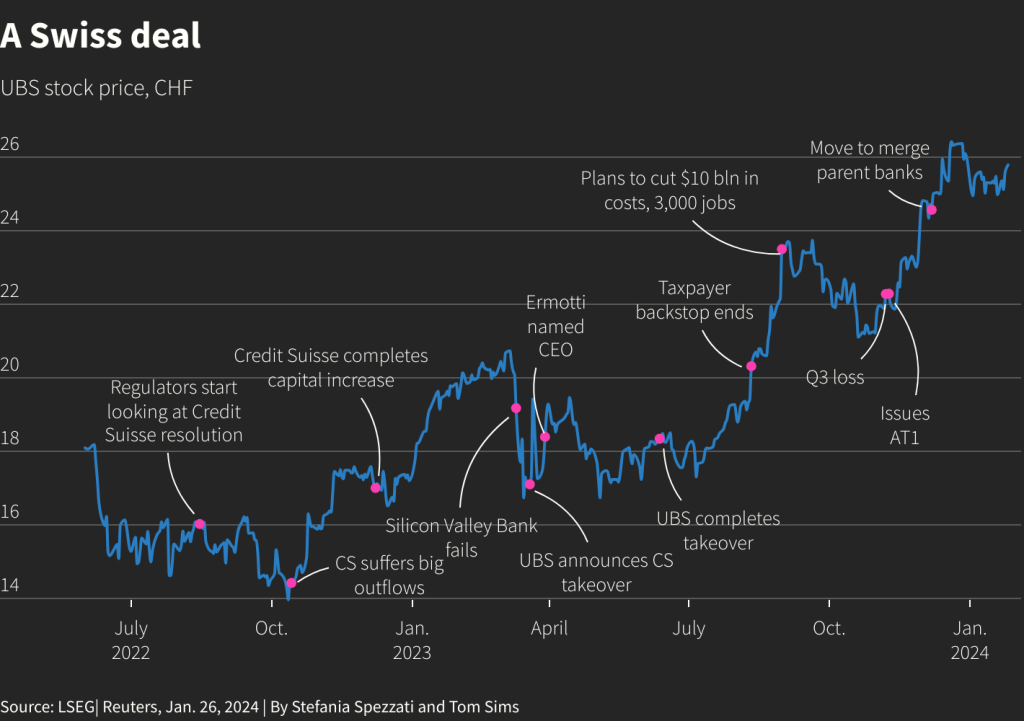

Swiss banking giant UBS announced several major strategic updates on Tuesday, including resuming share buybacks and increasing cost-cutting targets related to its takeover of Credit Suisse last year. The bank’s shares fell nearly 4% as investors reacted to financial results and the roadmap ahead.

UBS said it plans up to $1 billion in share repurchases in 2024, restarting its buyback program which was halted during the acquisition of Credit Suisse in March 2023. The deal, valued at nearly $16 billion, was the first ever merger between two global systemically important banks. It significantly expanded UBS’s wealth management operations and investment banking capabilities.

Integrating Credit Suisse is expected to generate major cost synergies over the next several years. UBS now estimates total savings of $13 billion by the end of 2026, up from the previous target of over $10 billion. Around half of the savings will come from headcount reductions, according to CFO Todd Tuckner.

While UBS said the initial phase of integration is complete, CEO Sergio Ermotti warned there is still significant restructuring ahead. The next few years will involve job cuts, combining IT systems, and optimizing operations. Ermotti cautioned that progress “will not be measured in a straight line” and the trickier parts of integration have yet to occur.

The bank reaffirmed its key financial targets, including for return on capital and cost-income ratios. It also set new ambitions, such as growing assets under management in its wealth management division to $5 trillion by 2028, up from $3.85 trillion currently.

For 2024, UBS proposed boosting its dividend by 27% compared to 2023. This comes as many European banks have been rewarding shareholders through dividends and buybacks.

UBS posted a small net loss of $279 million in the fourth quarter of 2023. The loss was attributed to Credit Suisse integration costs. However, the bank sees profitability improving in early 2024 amid better market activity and progress on merging operations.

The wealth management unit reported $22 billion in net new money growth during the quarter. However, a change in metrics makes the figure not directly comparable to previous periods. The investment bank posted a pre-tax loss of $169 million but is expected to return to profitability soon.

Shares fell due to concerns around UBS’s near-term profitability as integration costs weigh on performance. While cost savings are substantial over the long run, analysts pointed out revenue will likely drop in the next couple years before synergies are fully realized.

There are also lingering concerns around integrating such large banking operations smoothly. Regulators are keeping a close eye given the combined balance sheet is nearly twice the size of Switzerland’s GDP. However, UBS maintains only around one-third of assets are illiquid.

Overall, UBS remains confident in achieving strategic goals from its takeover of Credit Suisse, even if the next few years involve headaches from combining staff, technology, and business lines. Execution risks remain but cost cuts could significantly boost profitability down the line. Tuesday’s announcements provided investors more clarity around buybacks, dividends, and the path forward.