Ark Invest’s New Disruptive Technology Fund has a Unique Value Proposition

Not all companies worth owning are publicly traded. Yet, many still need capital, and some could serve smaller investors well. Cathie Wood’s latest fund, which launched on September 27, is intended to bring venture investing to those with $500 or more to invest. The focus is on private companies.

The fund’s launch is on a platform provided by Titan which itself is a young disruptive company, providing advantages to many investors and potentially disrupting the old methods.

About the Fund

The Ark Venture fund will be an interval fund. This means it is a closed-end fund that doesn’t trade on a stock exchange. Interval fund restrictions are most often used when many of the holdings in a fund are illiquid (i.e., don’t trade on the open market). The restrictions make it easier for the fund to focus on return without worrying about managing inflows and outflows.

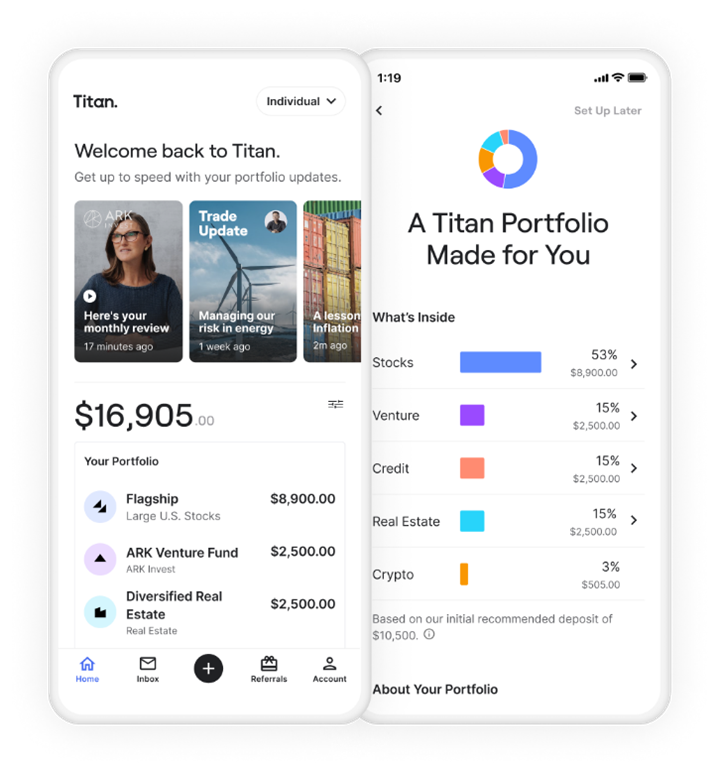

The ARK Venture Fund will invest in early to late-stage private tech companies and venture capital funds. Public tech companies are also permitted. Access to the fund investments will occur on Titan. Titan is a disruptive platform on phone apps and tablets that allows investors to curate strategies created and managed by popular investors.

As with other Ark Invest funds, the fund’s investment theme is disruptive innovation. ARK defines “disruptive innovation” as the introduction of a technologically enabled new product or service that potentially changes the way the world works. The platform Titan itself is an example of disruptive technology.

About Titan

The first thing you see on Titan’s home page is a line that reads, “Investment management, made modern.” It invites you to use its platform to, “Build a portfolio of managed stocks, crypto, real estate, private credit, venture capital & more.”

The innovative idea behind Titan is it uses technology to provide an investment platform that enables individuals to orchestrate a portfolio made up of “titans”: a set of curated investment strategies, spanning public equities to real estate to credit to crypto, each created and managed by professionals or “titans” like the CIO of ARK Invest.

The overriding purpose of Titan is to provide access to investments retail investors had been held away from.

About Venture Capital

Venture capital is a form of non-public capital provided to companies by investors that have enough confidence in management and the company’s business model to expect above-average earnings. Because these companies don’t trade on public exchanges, investments, usually from family offices, well-off investors, and investment banks, have been the traditional sources of capital.

Though it is deemed risky for investors to commit funds to VC, the potential for above-average returns is an attractive inducement for investors. For new companies or ventures that have a limited operating history, this is the market they often turn to.

Take Away

ARK’s step into less-liquid assets departs from Wood’s earlier strategies, the success of which elevated her to all-star investor status as the value of ARK ETFs like the ARK Innovation ETF (ARKK) soared last year. ARKK has plummeted 60% so far in 2022, a much steeper decline than the 21% decline in the S&P-500-tracking ETF, the SPDR S&P 500 ETF Trust (SPY).

ARK has struggled on offerings this year. The firm announced the closure of its Transparency ETF (CTRU) at the end of July, and its eight remaining ETFs, including the ARK Innovation ETF (ARKK) have dramatically underperformed broader markets.

Related Information

Information on private offerings available through Noble Capital Markets may be available to you. Are you a qualified investor? Learn more by going here and discovering the various qualifiers and what may be obtainable by you.

Managing Editor, Channelchek

Sources

https://www.sec.gov/Archives/edgar/data/1905088/000110465922011382/tm225314d1_n2.htm

https://www.etf.com/sections/features-and-news/woods-ark-ventures-low-cost-private-equity-investing?

https://apps.apple.com/us/app/titan-modern-investing/id1322024184